Aircraft manufacturer Boeing (NYSE:BA) faces yet another challenge with its best-selling jet, the 737 Max. This time, the company has recognized that the fastener holes on the aft pressure bulkhead of some planes have been inaccurately drilled. Boeing noted that the newly found flaw could pressurize the company’s deliveries this year. However, it’s crucial to emphasize that this concern does not pertain to flight safety. BA stock fell 2.8% in extended trading on the news.

The manufacturing problem has been identified in components provided by Spirit AeroSystems (NYSE:SPR). The parts of the fuselages supplied by SPR are often sourced from multiple suppliers. Thus, the company concluded that “only some units are affected.”

The count of affected jets is unknown at the moment, as the company is still inspecting the airplanes and carrying out rework on the affected ones. Boeing said the new issue will only impact short-term deliveries, and the jet maker will continue delivering the unaffected 737 Maxes.

Boeing Maintains Solid Performance in 2023

In Q2, Boeing delivered 136 commercial airplanes and 266 jets in the first six months of 2023. Boeing even reported better-than-anticipated results for Q2FY23 and reiterated its FY23 outlook. Buoyed by robust travel demand, Boeing has announced its intention to increase production of the 737 Max aircraft to 38 units per month, a notable rise from the current output of 31 jets.

At the same time, Boeing continues to bag multiple billion-dollar orders for its 787 Dreamliner from air carriers worldwide. The post-pandemic bump in demand for traveling and aerospace jets overall will surely bode well for Boeing in the long run.

Is BA a Good Buy Right Now, as per Analysts?

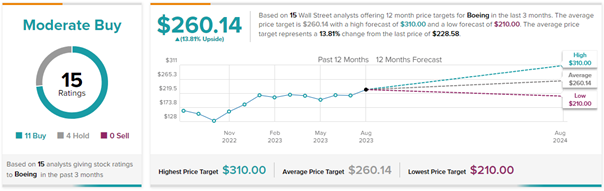

Yesterday, two analysts rated BA stock with contrasting views. Analyst Ronald Epstein of Bank of America Securities reiterated his Buy view on BA stock with a price target of $300 (31.3% upside).

Conversely, Barclays analyst David E. Strauss reiterated his Hold rating on Boeing stock with a price target of $210 (8.1% downside potential).

Overall, Wall Street remains cautiously optimistic about Boeing’s stock trajectory. On TipRanks, BA has a Moderate Buy consensus rating based on 11 Buys and four Hold ratings. The average Boeing stock prediction of $260.14 implies 13.8% upside potential from current levels. Meanwhile, BA stock has gained 17% year to date.