The Cyberspace Administration of China (CAC) is banning operators of key infrastructure in the country from buying products of Micron Technology (NASDAQ:MU), a leading U.S.-based manufacturer of memory chips, citing significant network security risks. The move is being seen as China’s retaliation to the massive restrictions by the Biden administration on the sale of advanced chip technology to China last year.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The CAC announced a review of Micron’s products in late March, saying that there is a need to safeguard the supply chain for critical information infrastructure. Based on China’s broad definition of critical information infrastructure, the ban could include sectors like telecom, transport, and finance.

“The review found that Micron’s products have serious network security risks, which pose significant security risks to China’s critical information infrastructure supply chain, affecting China’s national security,” the CAC said in a statement.

Reacting to the ban, Micron said the company is evaluating the review’s conclusion and assessing its next steps. The company added that it is looking forward to continuing to engage in talks with Chinese authorities. Last year, Micron derived $3.3 billion or around 11% of its overall revenue from customers based in Mainland China (excluding Hong Kong).

Growing Political Crisis

Micron’s South Korean rivals Samsung Electronics (GB:SMSN) and SK Hynix are expected to benefit from China’s ban. Last month, the Biden administration asked South Korea to urge its companies not to fill chip shortfalls in China if Beijing bans Micron.

China’s announcement of a ban on Micron comes a day after the leaders at the G7 summit vowed to counter the country’s “malign” practices, like illegitimate technology transfer or data disclosure. The leaders from Japan, Britain, Canada, France, Germany, Italy, and the U.S. said that they were not “decoupling” from China but trying to “derisk” the relationship. The leaders explained that they intend to diversify supply chains to ensure that they are not dependent on any one country for a vital product.

Meanwhile, the Biden administration reacted strongly to China’s ban on Micron’s products. The U.S. Commerce Department said that the country firmly opposes China’s restrictions that have “no basis in fact.”

“This action, along with recent raids and targeting of other American firms, is inconsistent with (China’s) assertions that it is opening its markets and committed to a transparent regulatory framework,” said a spokesperson of the U.S. Commerce Department.

Further, the U.S. intends to work with its key allies and partners to address “distortions” of the memory chip market caused by China’s actions. The Commerce Department also said it will directly engage with Chinese authorities to detail its position.

Is Micron a Buy, Sell, or Hold?

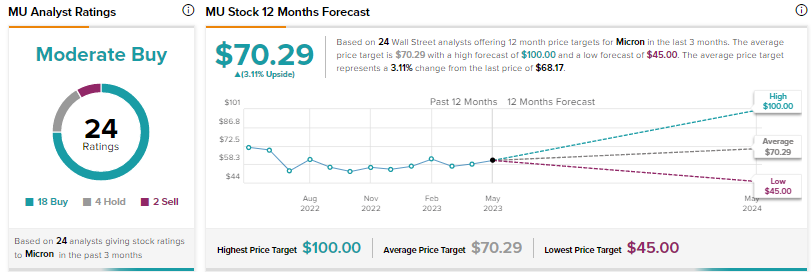

Wall Street’s Moderate Buy consensus rating on Micron stock is based on 18 Buys, four Holds, and two Sells. The average price target of $70.29 suggests 3.1% upside potential. Shares have risen over 36% so far in 2023.