Baker Hughes (NASDAQ:BKR) is an undervalued S&P 500 (SPX) stock that analysts believe has high growth potential in the long term. BKR trades at a P/E (price-to-adjusted earnings per share) multiple of 21.37x, well below its five-year average of 31.35x.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Texas-based Baker Hughes is an energy technology company that helps companies with more efficient, reliable, and cleaner solutions.

BKR’s Improving Financial Position

In the past year, BKR stock has gained 18.6%. In FY23, BKR’s total revenue jumped 20.6%, backed by a 14% increase in the order book. Furthermore, adjusted EBITDA (earnings before interest, tax, deprecation, and amortization) grew 26%, while adjusted earnings per share (EPS) jumped to $1.60 from $0.91 in FY22.

For Fiscal 2024, BKR projects revenue in the range of $26.50 to $28.50 billion and adjusted EBITDA to be between $4.10 and $4.50 billion.

Interestingly, BKR pays a healthy quarterly dividend of $0.21 per share, reflecting a yield of 2.33%. In the full year 2023, BKR returned $1.32 billion (65% of its free cash flow) to shareholders, including dividends of $786 million and share buybacks worth $538 million.

Analysts Believe BKR Stock is Underappreciated

Baker Hughes is scheduled to release its Q1 FY24 results on April 24. Ahead of the print, some analysts reiterated their Buy rating on the stock, as they think it is undervalued at current levels.

Recently, Jefferies analyst Lloyd Byrne gave a Q1 preview of BKR, stating that he expects revenue in line and EPS marginally below the consensus. Byrne is encouraged by BKR’s oilfield services and LNG portfolio, expansion in digital offerings, and growing focus on new energy markets. The analyst has a $43 (25.8% upside) price target on BKR.

Similarly, Citi analyst Scott Gruber is upbeat about BKR’s aftermarket services in the IET (Industrial and Energy Technology) segment. The analyst believes that the aftermarket services have the potential to outperform and boost EBITDA, despite weakness in core equipment orders. Gruber noted that this favorable aspect is not fully accounted for in BKR’s current valuation.

Likewise, Goldman Sachs analyst Neil Mehta noted that BKR stock has an underappreciated growth potential. BKR has underperformed the broader energy sector so far in 2024 due to demand concerns in the LNG space. Nevertheless, Mehta is optimistic about BKR’s aftermarket services and growth in the non-LNG-related businesses, mainly Industrial Products and New Energy sectors.

Is BKR a Good Investment?

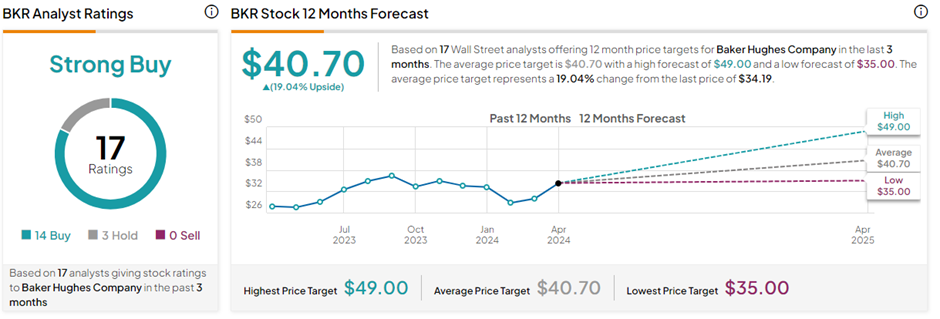

With 14 Buys and three Hold ratings, BKR stock commands a Strong Buy consensus rating on TipRanks. The average Baker Hughes price target of $40.70 implies 19% upside potential from current levels.

Ending Thoughts

Baker Hughes currently trades at a cheaper P/E ratio compared to its five-year average. Analysts believe the stock is underappreciated and has the potential to deliver solid growth in the long term.