Exxon Mobil Corporation (NYSE:XOM), Chevron Corporation (NYSE:CVX), and Hess Corporation (NYSE:HES) are the three offshore oil and gas drilling companies that have been traded (bought and sold) by U.S. politicians in the past three months.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The offshore oil and gas drillers are in the limelight as the U.S. regulators, the Department of the Interior and the Bureau of Safety and Environmental Enforcement (BSEE), have proposed new regulations to upgrade safety standards at offshore drilling properties.

The proposed changes are related to maintaining drilling well integrity and technological upgrades of blowout preventer systems (BOPs) at offshore drilling properties. Notably, the new standards will partially change the provisions of the 2019 Well Control Rule.

Deb Haaland, a United States Secretary of the Interior, said, “The Biden-Harris administration is committed to the highest standards of worker safety and environmental protections. This proposed rulemaking will help ensure that offshore energy development utilizes the latest science and technology to keep people safe.”

The Director of BSEE, Kevin M. Sligh Sr., opined that the proposed regulations “will protect workers’ lives and the environment from the potentially devastating effects of blowouts and offshore oil spills.”

Amid such a scenario, risks of non-compliance with the new rules and regulations might increase for offshore oil and gas drilling companies. A brief discussion on some U.S. politicians’ trading activities and analysts’ take on Exxon, Chevron, and Hess is provided below.

A consolidated chart, designed using TipRanks’ Stock Comparison tool, for the abovementioned players is as follows.

Exxon Mobil Corporation (NYSE:XOM)

A Representative from New York, Chris Jacobs, and a Representative from North Carolina, Kathy Manning, have bought shares of this $406.8-billion oil & gas exploration and production company in the past 90 days. While Republican Chris Jacobs bought 12 to 175 XOM shares for $1,000-$15,000, Democrat Kathy Manning’s Buy trade, of the same value, involved 12 to 178 shares.

Meanwhile, a Representative from North Carolina, Virginia Foxx, has sold 1,174 to 2,934 shares of Exxon, valuing within the $100,000-$250,000 range, in the past three months.

Is XOM Stock a Buy, Sell, or Hold?

With solid prospects and low exposure to the Legal & Regulatory and Tech & Innovation risk categories (both limited to just four risks), Exxon could be of interest to prospective investors interested in the oil and gas industry.

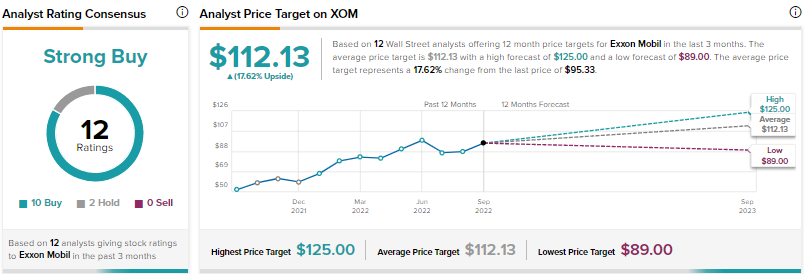

On TipRanks, analysts are optimistic about the prospects of XOM, which warrants a Strong Buy consensus rating based on 10 Buys and two Holds. XOM’s average price target of $112.13 reflects 17.62% upside potential from the current level. Shares of XOM have grown 3.93% in the past three months.

Chevron Corporation (NYSE:CVX)

Shares of Chevron, a $318.08 billion oil & gas exploration and production and chemicals company, have been purchased twice in the past three months by Representatives Chris Jacobs and Kathy Manning.

While Jacobs’ Buy trade of eight to 108 CVX shares was valued within the range of $1,000-$15,000, Manning bought eight to 109 shares of the company for $1,000 to $15,000.

Meanwhile, a Representative of Kansas and Republican, Ron Estes, sold seven to 104 shares of Chevron valued within the $1,000-$15,000 range. Also, a Senator from Alabama and a Republican, Tommy Tuberville, conducted a Sell trade of seven to 102 CVX shares for $1,000 to $15,000.

Is Chevron a Good Stock to Buy Now?

Analysts are cautious but optimistic about the prospects of Chevron. The cautious tone could mirror concerns over the company’s exposure to five risks related to the Legal & Regulatory category and two risks related to the Tech & Innovations category. Considering this, the stock could interest long-term investors for now.

On TipRanks, the company has a Moderate Buy consensus rating based on 11 Buys and five Holds. CVX’s average price forecast of $179.81 implies upside potential of 12.8% from the current level. Shares of CVX have inched up 0.30% in the past three months.

Hess Corporation (NYSE:HES)

The $39.3-billion oil & gas exploration and production company has been in the good books of Republican Virginia Foxx. In the last three months, the Representative from North Carolina purchased 142-474 shares of HES for $15,000-$50,000 and conducted another Buy trade worth $1,000-$15,000 in August.

Is Hess Stock a Buy?

In addition to Virginia Foxx’s optimism, analysts’ confidence in the company raises the stock’s investment appeal. Also, a low-risk profile, with exposure limited to just three risks in the Legal & Regulatory category and two risks in the Tech & Innovation category, works in the company’s favor. Considering these, the stock could be an attractive investment option for prospective investors.

On TipRanks, the company commands a Strong Buy consensus rating based on eight Buys and one Hold. HES’ average price prediction of $139.50 mirrors 12.77% upside potential from the current level. Shares of HES have climbed 9.33% in the past three months.

Concluding Remarks

The prospects of the offshore oil and gas drilling industry seem to be bright amid high fuel demand in the United States and globally. Well-rooted industry players, like Exxon, Chevron, and Hess, should be well-equipped to abide by changing regulations and deal with associated risks.

Read full Disclosure