Michigan-based Ford Motor Co. (NYSE: F) designs, manufactures and sells automobiles and commercial vehicles under the Ford brand and luxury cars under the Lincoln brand.

Its Ford family includes Fusion sedan, Ecosport compact SUV, Bronco SUV, Explorer SUV, Mustang sports car, Mach-E SUV, F-150 pickup truck, and Ranger, a midsize pickup truck. Under the Lincoln brand, the company’s models include three SUVs — Navigator, Aviator, and Nautilus.

Further, Ford has joint ventures in China (Changan Ford), Taiwan (Ford Lio Ho), Thailand (AutoAlliance Thailand), Turkey (Ford Otosan), and Russia (Ford Sollers).

The carmaker is scheduled to announce its first-quarter results on April 27 after the market closes.

Q4 Results

Ford reported mixed results in the fourth quarter of 2021. Revenues increased 5% year-over-year to $37.7 billion, beating the Street’s estimate of $35.77 billion.

However, adjusted EPS came in at $0.26, lower than analysts’ expectations of $0.42 and the year-ago figure of $0.34 per share.

Q1 Expectations

For the first quarter, analysts expect the company to report earnings and revenues of $0.38 per share and $31.09 billion, respectively.

Website Traffic

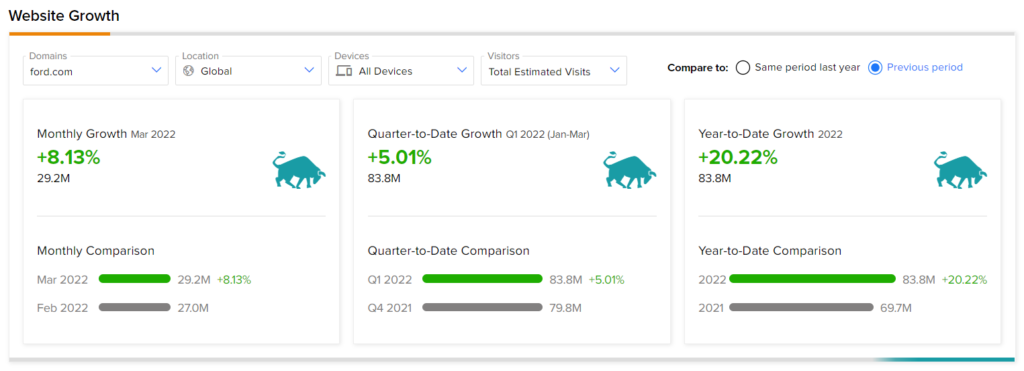

In March, Ford’s U.S. retail sales declined 30.1% year-over-year but remained up 23.2% month-on-month. A similar monthly trend can be seen on TipRanks’ Website Traffic Tool. This new tool measures and analyzes a company’s website visits over a specified time period.

According to the tool, Ford’s website traffic registered an 8.1% rise in global visits in March, compared to February. Moreover, the footfall on the company’s website has grown 5% quarter-over-quarter.

All-Electric F-150s in Production

Meanwhile, Ford has commenced the production of its all-electric F-150 pickup truck, Lightning, a report published by The Wall Street Journal said.

Ford’s CEO Jim Farley said that the EV’s price will start from $40,000. The company said it has already received 200,000 orders for the e-truck. It aims to manufacture 150,000 units per year.

Analyst’s Take

Ahead of the first-quarter results, J.P. Morgan (NYSE: JPM) analyst Ryan Brinkman maintained a Buy rating on the stock and lowered the price target to $21 from $22 (42.8% upside potential).

The analyst has cut his estimates for Ford for the second time this quarter on account of “a reduced outlook for global light vehicle sales and production.”

Overall, the stock has a Moderate Buy consensus rating based on six Buys, six Holds and two Sells. Ford’s average price target of $20.62 implies 40.2% upside potential.

Conclusion

Shares of Ford have declined 31.6% year-to-date and almost 24% in the last three months due to additional challenges that the Russia-Ukraine war has created for the auto industry, which is already struggling with the shortage of semiconductor chips.

The conflict has resulted in increased inflation and interest rates that are having an indirect impact on the industry. Investors should wait and watch how Ford plans to deal with these issues as it works towards boosting its EV production capacity.

Learn more about the Website Traffic tool in this video by Youtube sensation Tom Nash.

Read full Disclaimer & Disclosure