Major U.S. airlines are optimistic about continued recovery this year due to pent-up travel demand and easing of COVID-19 travel restrictions. However, soaring fuel costs and labor challenges could hurt profitability to some extent even as airlines are charging higher ticket prices.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

According to Adobe Analytics’ recent report, online spending for domestic flight bookings in April 2022 declined 13% to $7.8 billion compared to March. That said, demand continued to be above pre-pandemic levels, with online spending up 23% compared to April 2019. Adobe’s report is based on direct consumer transactions from six of the top 10 U.S. airlines and over 150 billion web visits.

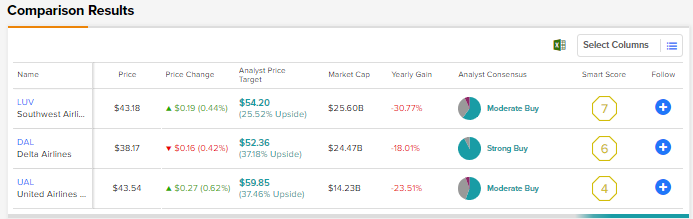

Bearing these dynamics in mind, using the TipRanks stock comparison tool we will pit Southwest Airlines, Delta Air Lines and United Airlines against each other and discuss Wall Street pros’ opinions about these airline stocks.

Southwest Airlines (NYSE: LUV)

Despite reporting a worse-than-anticipated adjusted loss per share of $0.32 in Q1’22 due to the impact of Omicron, Southwest assured its investors last month of being “solidly profitable” for the remaining three quarters of 2022 and for the full-year. Southwest’s Q1’22 revenue declined 8.8% to $4.69 billion compared to Q1’19 (pre-pandemic levels) but was slightly ahead of expectations.

Southwest predicts its operating revenue to grow in the range of 8% to 12% in Q2’22 compared to Q2’19, even as it expects its capacity (as measured by ASM or Available Seat Miles) to be down 7%.

Amid improving travel demand, Southwest announced a $2 billion plan to enhance customers’ travel experience. It also intends to launch a new fare category with additional flexibility and value called “Wanna Get Away Plus.”

Earlier this month, Morgan Stanley named Southwest as one of its “Conviction Picks.” The investment firm stated, “As a largely US domestic medium haul airline, we believe its network is in a sweet spot for a COVID rebound and it has one of the attractive loyalty programs with a loyal customer base.”

J.P. Morgan analyst Jamie Baker raised his price target on Southwest to $72 from $62 and maintained a Buy rating following the Q1 results. Baker believes that the company’s consensus-topping outlook “may potentially begin restoring the margin confidence many investors forfeited last December.”

Overall, the Street is cautiously optimistic on Southwest, with a Moderate Buy consensus rating based on nine Buys, five Holds and one Sell. The average Southwest price target of $54.20 implies 25.52% upside potential from current levels. Shares are flat on a year-to-date basis.

Delta Air Lines (NYSE: DAL)

With over 4,000 flights, Delta covers more than 275 destinations on six continents. Delta’s Q1’22 results beat analysts’ expectations even as the carrier’s revenue declined nearly 11% compared to pre-pandemic levels to $9.35 billion. Q1 adjusted loss per share came in at $1.23.

For Q2’22, Delta expects to operate at about 84% of its Q2’19 capacity and forecast its revenue to recover up to 93% to 97% of Q2’19 levels.

Delta is “greatly encouraged” by the momentum in travel demand and continues to be confident about delivering “meaningful” full-year profit in 2022.

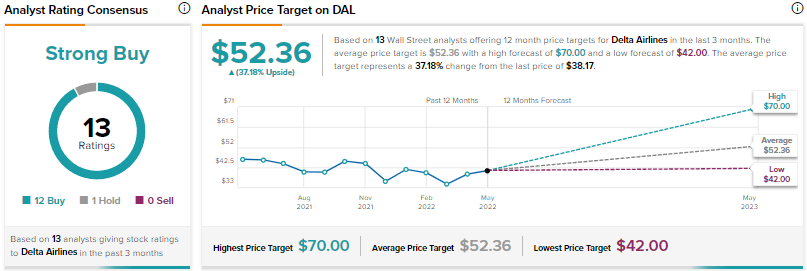

Following the Q1 print, Barclays analyst Brandon Oglenski upgraded Delta to Buy from Hold with a price target of $60. The analyst feels that investors’ sentiment for Delta and other peers should turn more favorable as the rapid recovery in travel demand following Omicron more than offsets increased fuel prices and “drives a near-recovery to pre-pandemic profitability levels.”

Oglenski believes “Delta’s focus on brand, premium products and prudent balance sheet management has favorably positioned the carrier to meaningfully profit from the current strong rebound in US travel demand.”

Delta scores a Strong Buy consensus rating backed by 12 Buys and one Hold. The average Delta price target of $52.36 indicates 37.18% upside potential over the next 12 months. Shares are down 2.3% so far this year.

United Airlines Holdings (NASDAQ: UAL)

On Monday, May 16, United Airlines upgraded its Q2’22 unit revenue outlook based on continued improvement in demand, even as the carrier trimmed its capacity estimate. United expects total revenue per available seat mile (or TRASM) to increase by 23% to 25% compared to 2019 levels, while the previous guidance indicated a 17% growth.

United now expects its Q2 capacity to be down 14% compared to 2019 levels, reflecting a deterioration compared to the previous guidance of a 13% decline.

The company kept its Q2 adjusted operating margin guidance intact at nearly 10% despite raising its average aircraft fuel price estimate to $4.02 per gallon from $3.43 per gallon.

Last month, United missed Q1’22 analysts’ estimates but impressed investors with its outlook as it guided the “highest quarterly revenue in our history in 2Q.” The company’s Q1 revenue declined 21.1% to $7.57 billion compared to Q1’19.

The company posted an adjusted loss per share of $4.24 in the first quarter. However, it reassured investors about returning to profitability in Q2’22 and generating a pretax profit for the full-year 2022.

In reaction to Q1 results and an upbeat outlook, Baker double upgraded United Airlines to Buy from Sell and lifted the price target to $76 from $60.

Explaining his bullish stance, Baker stated “Despite recent volatility in the space, we believe that UAL has endured the pandemic better than most and is emerging amid favorable trends.”

All in all, the Street has a Moderate Buy consensus rating that breaks down into 10 Buys, seven Holds and one Sell. At $59.85, the average United Airlines price target suggests 37.46% upside potential from current levels. Shares are nearly flat on a year-to-date basis.

Conclusion

Despite inflation worries, higher fuel costs and labor challenges, all three airlines are confident about continued recovery this year backed by robust leisure travel demand, improvement in business travel and easing of travel restrictions.

Following the Q2 revenue upgrade by United Airlines, investors will be awaiting similar updates from other carriers to get more clarity on air travel demand trends.

While the upside potential based on the Street’s average price target is comparable for Delta and United Airlines, analysts currently seem highly bullish on Delta.

Discover new investment ideas with data you can trust

Read full Disclaimer & Disclosure