The Walt Disney Co. (NYSE:DIS) is scheduled to report its Q3 Fiscal 2023 results on August 9 after the market closes. A number of known challenges are expected to hinder Disney’s performance. Wall Street expects Disney to post adjusted earnings of $0.98 per share, lower than last year’s figure of $1.09 per share. Meanwhile, the analyst consensus for revenue is pegged at $22.49 billion, 4.6% higher than the comparative period last year.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Factors Impacting Disney’s Results

Factors that could have impacted Disney’s quarterly results include the loss of subscribers in the Direct-to-Consumer segment, weak TV advertising revenues, declining attendance at the Disney theme parks, and the ongoing Hollywood actors’ and writers’ strike. Although Disney has undertaken strategic steps to curb costs and streamline operations, they may not be enough to outweigh the current headwinds.

One of the biggest questions for Disney remains about its cable sports network ESPN, which has failed to garner enough viewership post-pandemic. Recently, CEO Bob Iger announced that Disney is looking for a strategic partner and is willing to sell an equity stake in ESPN.

What’s more, Disney is even contemplating selling its broadcast network, including ABC Broadcast, FX, and National Geographic. The only silver lining for Disney currently is Bob Iger’s contract extension of two years. Analysts and investors alike hope that Iger is the one person who can bring about a drastic transformation for the House of the Mouse entertainment company.

Is Disney a Good Stock to Buy Right Now?

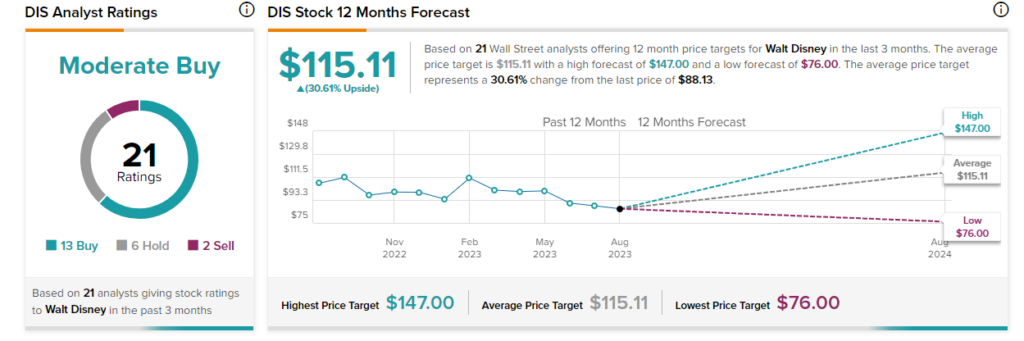

Analysts remain split on Disney’s stock trajectory while troubles continue to haunt the entertainment company. On TipRanks, Disney stock has a Moderate Buy consensus rating based on 13 Buys, six Holds, and two Sell ratings. The average Walt Disney stock price target of $115.11 implies 30.6% upside potential from current levels. Meanwhile, DIS stock has lost .94% so far this year.

Insights from Options Trading Activity

TipRanks now presents options activity to help investors plan their trades ahead of earnings releases. Options traders are pricing in DIS stock to move by +/-5.70% after reporting earnings. Last quarter, the stock declined by 8.73% following the Q2-2023 results despite the company reporting in-line revenue and earnings numbers.

The anticipated earnings move is determined by computing the at-the-money straddle of the options closest to the expiration after the earnings announcement.