According to several reports, Walt Disney (NYSE:DIS) could delay the release of some of its movies. The media and entertainment giant is reviewing its movie slate and might hold up a few titles as striking actors will not be promoting the films. While it is unclear whether Disney will postpone releases and how the ongoing Hollywood strikes will impact its financials, prolonged strikes add uncertainty over release timings and earnings, which could hurt its stock price.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Goldman Sachs analyst Brett Feldman expects the WGA (Writers Guild of America) and SAG-AFTRA (Screen Actors Guild – American Federation of Television and Radio Artists) strikes to generate near-term cash benefits for media companies. However, he also warns that prolonged strikes could inject a degree of unpredictability into the earnings outlook for these companies, including DIS.

Nonetheless, the analyst reiterated a Buy rating on DIS stock on July 18.

On the contrary, Hamilton Faber of Atlantic Equities downgraded DIS stock to a Sell on July 25, citing multiple headwinds, including lower linear TV advertising revenues, the declining popularity of its popular franchises, and a pullback in content spend.

While the company faces significant challenges, it is scheduled to announce its Q3 financials on Wednesday, August 9, 2023. Let’s understand analysts’ expectations from Disney’s Q3.

Disney’s Q3 Earnings are Expected to Decline

Wall Street analysts expect Disney to report revenues of $22.51 billion in Q3 compared to $21.5 billion in the prior-year quarter. However, DIS’ earnings will likely decline year-over-year, reflecting the reduction in linear TV advertising revenues and inflationary cost pressure.

Analysts expect DIS to report earnings of $1.01 per share in Q3 compared to $1.09 per share in the prior-year period.

What is the Target Price for DIS Stock?

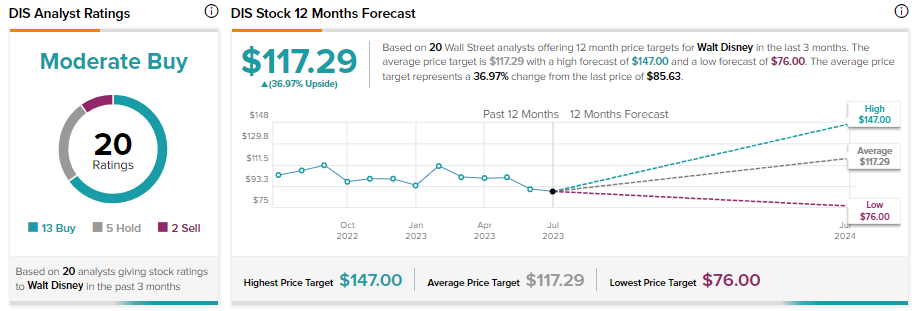

Given the ongoing headwinds, analysts are cautiously optimistic about DIS stock. It has received 13 Buy, five Hold, and two Sell recommendations for a Moderate Buy consensus rating. The average DIS stock price target of $117.29 implies 36.97% upside potential from current levels.