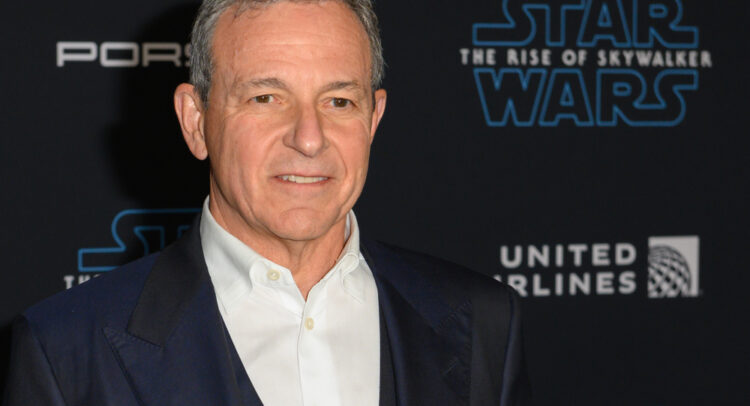

The Walt Disney Company (NYSE:DIS) is poised to undergo notable transformations under CEO Robert Iger’s extended leadership. On July 12, Disney’s board unanimously extended Iger’s contract for two years, until the end of 2026. In an interview with CNBC’s David Faber after the news, Iger shared his vision for a potentially leaner and more profitable Disney. DIS stock is up by a marginal 1.7% so far in 2023.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

CEO Iger’s Dreams for Disney

To start with, Iger is mulling over selling the traditional TV business, which includes FX and National Geographic, and its broadcast group, ABC Networks. Iger noted that the state of traditional TV channels has deteriorated more than he had expected owing to the stiff competition from online streaming channels. Iger termed these businesses “non-core” and decided that they could be sold to pump cash into the business.

Further, Iger said Disney is looking for strategic partners for its ESPN sports channel, of which it currently owns 80%. An equity stake sale or a joint venture is what Iger is looking at alongside the transformation of ESPN from a sports network to streaming. Iger also mentioned in the context that the company has held early-stage discussions with a few partners who could assist with ESPN’s “distribution or content.”

Additionally, Iger confirmed that the pending full equity ownership of Hulu will take place as planned. Disney currently owns 66% of Hulu, while the rest is owned by media giant Comcast (NASDAQ:CMCSA). Iger believes a combination of Hulu and Disney+ offerings would improve the profitability of the streaming business. The combined offering would be available for viewing by the end of 2023.

Meanwhile, Iger noted that Disney will also be cutting back on making new movies or series in the Marvel and Star Wars franchises. This step is part of Disney’s major cost-cutting plan, which includes cutting $3 billion in non-sports content costs. Not just that, Disney has experienced a slump in box office hits recently, which is also forcing Iger to rethink releasing new sequels for the franchises.

Concurrently, Disney is also exploring various alternatives for its Star India business after experiencing a slowdown due to the loss of streaming rights for a renowned cricket league in India. As a result, DIS is expected to witness a loss of 8 million to 10 million subscribers to its Disney+ Hotstar streaming service in the fiscal third quarter.

Is Disney Stock Good to Buy?

Following Iger’s comments on selling Disney’s linear TV assets, Wells Fargo analyst Steven Cahall maintained his Buy rating on DIS stock. Cahall believes the divestitures will result in a potential accretion to the bottom line of 10%, or $10 per share. The analyst is encouraged by Iger’s bold actions, which could ultimately bring cash to the company and improve its earnings prospects. Cahall has set a price target of $147 on Disney stock, implying an impressive 62.5% upside potential.

Overall, Wall Street remains cautiously optimistic about Disney. On TipRanks, the stock has a Moderate Buy consensus rating based on 12 Buys and five Hold ratings. Also, the average Walt Disney price target of $120.53 implies 33.2% upside potential from current levels.