As an investment, financial services giant Visa (NYSE:V) – best known for issuing debit and credit cards – seems to be a reasonable wager. Almost acting as a universal blow-off valve, the company seemingly offers relevance no matter which way the economy turns. Nevertheless, major options traders appear to be broadcasting a different message. Therefore, I am neutral on V stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

V Stock Presents an Enticing Narrative amid the Ambiguity

Since the start of the year, the benchmark S&P 500 Index (SPX) has gained about 14%. However, since the close of the July 31 session, the index has slipped 5%. Therefore, investors face an ambiguous environment. Under this context, though, V stock may present an enticing narrative. No matter where the market heads next, the underlying financial services firm offers a relevant solution.

For the optimists, recent historical data suggests resilience for the economy and consumer sentiment. At the highest level, U.S. GDP growth came in hotter than expected, as TipRanks reporter Yulia Vaiman mentioned. Unsurprisingly, this dynamic resulted in a very favorable tailwind for V stock.

Also, late last month, Visa disclosed its report for the fourth quarter of Fiscal Year 2023. Per TipRanks reporter Sheryl Sheth, adjusted earnings per share landed at $2.33, swinging past analysts’ consensus target of $2.25 per share. This figure beat Q4-2022’s print of $1.93 per share as well. On the top line, Visa rang up sales of $8.61 billion, up 11% year-over-year and exceeding the consensus view of $8.56 billion.

On the not-so-pleasant side, even market pessimists recognize that V stock may rise on certain relevancies. Even with the most recent data suggesting a decline in travel sentiment, many households can’t make ends meet merely by cutting discretionary spending. Instead, they must use credit cards to stay in the game.

Notably, Americans’ collective plastic debt soared to just over $1 trillion in August, a dubious record. On many levels, that’s a bad sign. However, it also indicates consumers’ trust in the U.S. financial system. Thus, that might be a win for V stock.

Major Options Traders Cast Doubt on Visa

Given the above analysis, while applying traditional fundamental research, investors may come away with the impression that V stock is a clear Buy. After all, Visa offers an important service that millions of people use. Also, its quarterly print has been impressive. Still, one glaring factor doesn’t match up cleanly — options sentiment.

Specifically, two options stick out: the Jan 19 ’24 260.00 call and the Jun 21 ’24 245.00 call. Currently, the former option features an open interest reading of 8,473 contracts, while the latter comes in at 618 contracts. Compared to the other calls within the respective expiration dates, the open interest is relatively high, especially regarding the $260 option.

At first glance, the elevated open interest in these two calls seems to be a bullish signal; calls give the holders the right but not the obligation to buy the underlying security at the listed strike price. However, options require two parties. For the call writer (or seller), the entity has the obligation but not the right to fulfill terms upon exercise.

Moreover, options flow data – which screens exclusively for big block trades likely made by institutions – reveals that much of the volume for the two previously mentioned calls stems from major traders selling these options.

For instance, on October 3, major traders sold 666 contracts of the Jan 19 ’24 260.00 call. On October 20, big block traders sold 500 contracts of the Jun 21 ’24 245.00 call. In other words, the smart money – the entities that have the most resources and best information – are likely betting that V stock won’t reach the aforementioned strike prices at the listed expiration dates.

What’s Not Being Said

Another element tied to V stock that warrants closer examination is the activity that’s not occurring. So far, institutional investors haven’t bought far out-the-money (OTM) calls. Rather, the OTM calls that they do buy feature realistic price targets such as $250. Currently, Visa stock trades at around $243.

Stated differently, major options traders are predominantly underwriting the risk that V stock will not reach certain price thresholds rather than underwriting the risk that it will hit specified price milestones. To be fair, that’s not decisively bearish. On the other hand, it’s not particularly encouraging.

Is V Stock a Buy, According to Analysts?

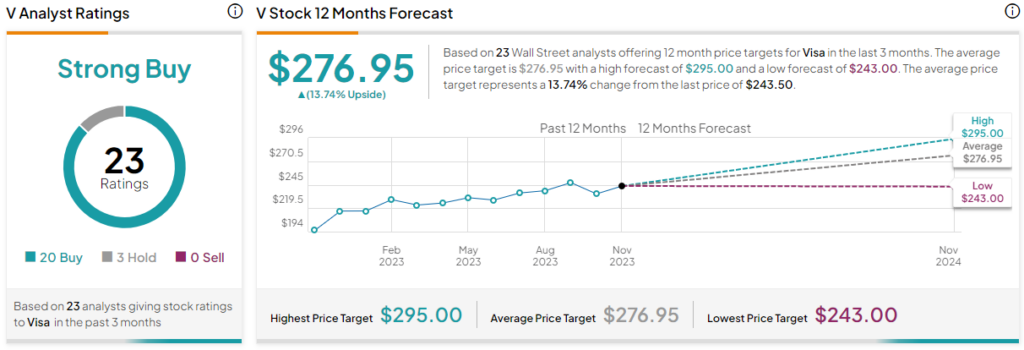

Turning to Wall Street, V stock has a Strong Buy consensus rating based on 20 buys, three Holds, and zero Sell ratings. The average V stock price target is $276.95, implying 13.7% upside potential.

The Takeaway: Don’t Rush Into V Stock Just Yet

Based on the realities of the economy, Visa offers a relevant backdrop, even if circumstances turn negative. However, looking at how the smart money is trading V stock in the options market, caution may be warranted. The biggest investors aren’t necessarily signaling that Visa is a Sell. However, they’re also not saying that it’s a resounding Buy.