Card payment network provider Visa (NYSE:V) registered a healthy Q4 Fiscal 2023 beat on both the top and bottom lines. Further, the board of directors hiked Visa’s quarterly cash common dividend on its Class A shares by 15.5% to $0.52 per share and authorized a new $25 billion multi-year Class A share repurchase program. Visa’s quarterly performance was driven by robust cross-border volumes coupled with steady growth in payments volume and processed transactions.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Visa’s adjusted earnings of $2.33 per share easily outpaced the Street’s estimates of $2.25 per share and came in much stronger than the prior year’s figure of $1.93 per share. Similarly, net revenues grew 11% year-over-year to $8.61 billion and exceeded analysts’ estimates of $8.56 billion.

For the full year Fiscal 2023, Visa reported adjusted earnings of $8.77 per share on net revenues of $32.65 billion. Visa attributed the solid financial performance to the continued momentum in consumer spending and an uptick in cross-border travel post-pandemic. Year-to-date, Visa stock has gained 13.8%.

Is Visa a Buy, Sell, or Hold?

Following the Q4 print, research firm KBW assigned a Buy rating to Visa stock with a price target of $285, implying 21.5% upside potential from current levels.

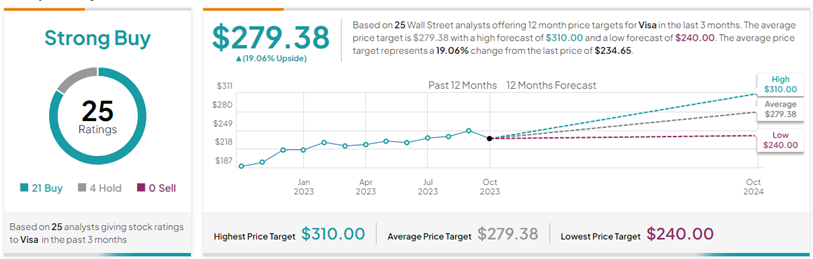

On TipRanks, Visa stock commands a Strong Buy consensus rating. This is based on 21 Buys versus four Hold ratings received during the past three months. The average Visa price target of $279.38 implies 19.1% upside potential from current levels.