Although the COVID-19 pandemic imposed a disproportionate impact on United Airlines (NASDAQ:UAL) and the underlying industry, forward-looking investors banked on the pent-up demand theory to eventually lift sentiment. However, this so-called “revenge travel” catalyst may be diminishing as economic pressures crimp discretionary spending. Therefore, it’s probably time to ground United stock. I am bearish on UAL stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

UAL Stock Suffers Badly in the Market

A major clue as to the dangers facing UAL stock at this juncture centers on its recent market volatility. Last week, UAL incurred a steep drop of over 9%. With this bleeding of red ink, United is now down about 5% since the beginning of the year. Of course, much of the downfall stemmed from its earnings report.

On paper, United actually delivered a robust print for the third quarter of Fiscal Year 2023. As the TipRanks Team pointed out, earnings per share clocked in at $3.65, beating analysts’ consensus EPS target of $3.38. On the top line, the airliner posted sales of $14.48 billion, up 12.5% on a year-over-year basis. As well, this tally beat covering experts’ estimate by $70 million.

Specifically, management stated that a boost in passenger volume contributed to the revenue spike. Here, sales landed at $13.35 billion, above the consensus view of $13.25 billion. To be fair, Cargo revenue dipped by 33% to $333 million, falling below the estimate of $347.6 million. However, with the broader narrative focused on sustained revenge travel, United delivered the goods.

Unfortunately, the market responds to forward-looking implications. Regarding Q4, management offered a bleaker picture. If flights to Tel Aviv, Israel, are suspended through October, the airliner believes EPS will slip to $1.80. However, if such flights are suspended through the end of the year, EPS may only come in at $1.50.

Worryingly, Wall Street anticipated Q4 EPS to hit $2.09; hence, the severe volatility.

Revenge Travel May No Longer be Relevant

At the beginning of the COVID-19 crisis, revenue passenger miles for U.S. carriers plunged by nearly 97% between February and April 2020. However, the most intrepid contrarians bought up shares of UAL stock during the downcycle in anticipation of a travel-sector rebound. Unfortunately, headwinds impacting the consumer economy – such as stubbornly-high inflation – may finally be catching up to UAL stock.

For one thing, revenue passenger miles have been flat to declining since February 2023. Also, this metric has gotten close to (but not quite reached) levels seen during the final months of 2019. That means air travel demand may be peaking prior to a full recovery in the sector, which is obviously worrisome.

Second, outside data indicates that revenge travel sentiment may be fading. That’s according to a CNBC report, which cited a Morning Consult study that shows that while travel intentions are rising in many countries, they’re also flatlining or fading in other nations. Particularly, the European region has suffered diminished travel plans among its consumers.

To be clear, Morning Consult is not projecting that travel demand will drop off a cliff. However, the thesis is that those who wanted to engage in revenge travel have already done so. And while the research firm might not want to give a downbeat forecast, investors are voting with their actions.

In particular, close peers such as Delta Air Lines (NYSE:DAL) and American Air Lines (NASDAQ:AAL) suffered conspicuous losses last week, as they both lost almost 6% of their equity value.

Of course, the Hamas attack on Israel imposes a horrific and completely unnecessary obstacle to the airline industry. However, even with stability in that region, UAL stock and its peers may still face pressure from the hurting consumer economy.

Is UAL Stock a Buy, According to Analysts?

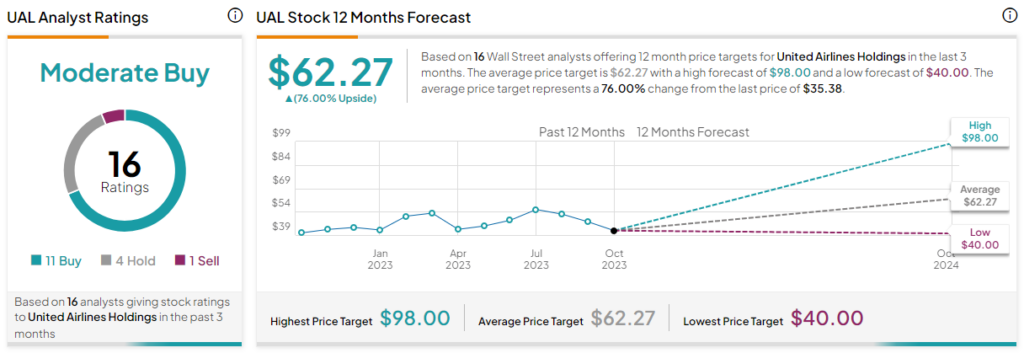

Turning to Wall Street, UAL stock has a Moderate Buy consensus rating based on 11 Buys, four Holds, and one Sell rating. The average UAL stock price target is $62.27, implying 76% upside potential.

The Takeaway: UAL Stock May Lose a Key Catalyst

With the world’s attention rightfully turning to Israel as it responds to the Hamas terrorist attack, United Airlines has become an unwitting victim. Because of the violence, it must downgrade its profitability expectations. Still, even if peace and stability were to materialize, fading revenge travel sentiment is the bigger story, at least as far as UAL stock is concerned. Losing this key catalyst spells big trouble for the entire industry.