Ride-hailing service provider Uber Technologies (NYSE:UBER) is set to report its third-quarter results on November 7, before the market opens. The Street expects Uber to post diluted earnings of $0.07 per share on revenues of $9.54 billion. The consensus reflects a significant improvement over Uber’s comparative period performance. In Q3 2022, the company reported a diluted loss of $0.61 per share on revenues of $8.34 billion.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

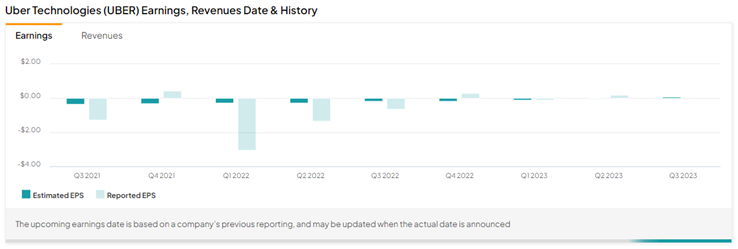

Unfortunately for Uber, the company missed earnings expectations in four of the past eight quarters. Even so, various factors contribute to the optimism surrounding Uber’s upcoming results.

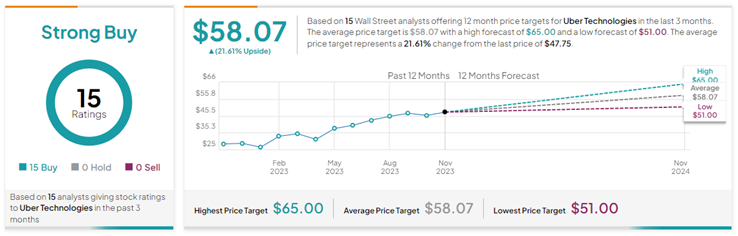

Ahead of the Q3 print, KeyBanc analyst Justin Patterson upgraded UBER to a Buy from Hold and maintained a price target of $60 (25.7% upside potential). Patterson even lifted the EPS forecast for 2024 and 2025.

The analyst cited tailwinds such as UBER’s inclusion in the S&P 500 index (SPX), emerging advertising business, and expansion into hailables, ride-sharing, and grocery delivery as the reasons for his upgraded rating. Another positive news for Uber and rival Lyft (NASDAQ:LYFT) is that they settled a multi-year investigation by the New York Attorney General alleging they had cheated drivers of their earnings. Both companies agreed to jointly pay $328 million to settle the claims.

Is UBER a Buy or Hold?

With 15 unanimous Buys, UBER commands a Strong Buy consensus rating on TipRanks. Also, the average Uber Technologies price target of $58.07 implies 21.6% upside potential from current levels. Year-to-date, UBER stock has zoomed 88.3%.

Insights from Options Trading Activity

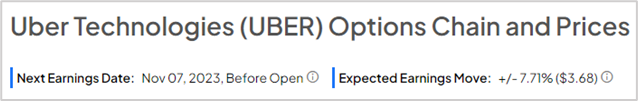

TipRanks now presents options activity to help investors plan their trades ahead of earnings releases. Options traders are pricing in a +/- 7.71% move on Uber’s earnings. UBER shares have averaged a 4.47% move in the last eight quarters. In particular, the stock lost 5.68% in reaction to Q2 2023 results.

The anticipated move is determined by computing the at-the-money straddle of the options closest to the expiration after the earnings announcement.

Learn more about TipRanks’ Options tool here.

Ending Thoughts

Uber is expected to outperform analysts’ expectations in the to-be-reported quarter. A slew of tailwinds are poised to benefit Uber’s performance going forward.