Shares of Uber (NYSE:UBER) and Lyft (NASDAQ:LYFT) gained yesterday after these ride-hailing giants jointly committed to disbursing a total of $328 million to settle the accusations made by the New York Attorney General that they had cheated drivers of their earnings. Uber stock closed about 6% higher on November 2. At the same time, Lyft stock jumped 8.4%.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Let’s delve deeper.

The Settlement Details

The settlement concludes the investigations that spanned multiple years into both Uber and Lyft. Notably, Uber deducted sales taxes and Black Car Fund fees from drivers’ earnings between 2014 and 2017, intended to be paid by passengers. Similarly, Lyft employed a comparable approach to undercompensate drivers from 2015 to 2017. Investors should note that both Uber and Lyft denied any wrongdoing.

Nonetheless, as part of the settlement, Uber has agreed to pay $290 million, while Lyft will contribute $38 million to address allegations. Further, according to the Attorney General’s office, the resolution includes provisions for a minimum driver “earnings floor.” Additionally, it involves the implementation of paid sick leave, proper hiring and earnings notifications, and other enhancements to improve driver working conditions.

While Uber and Lyft settle the multi-year investigation, let’s turn to analysts to understand what the future holds for these companies.

What is the Prediction for Uber Stock?

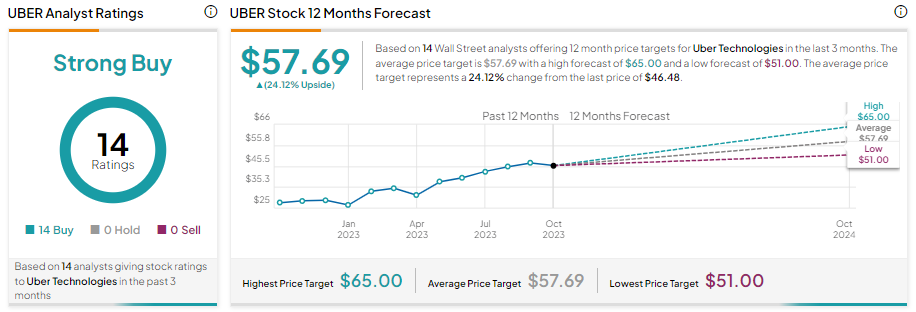

Wall Street analysts are bullish about Uber’s prospects. It has received 14 unanimous Buy recommendations for a Strong Buy consensus rating. Further, the average UBER stock price target of $57.69 implies 24.12% upside potential from current levels.

What is the Forecast for LYFT Stock?

Analysts remain sidelined on Lyft stock. With three Buy, 19 Hold, and one Sell recommendations, Lyft stock has a Hold consensus rating. Further, the average LYFT stock price target of $11.57 implies 16.40% upside potential from current levels.