When most people think of electric vehicles, Tesla (TSLA) often comes to mind first, with BYD Co. (BYDDF) emerging as a significant global competitor. While BYD led in overall vehicle deliveries last year with over four million units, I remain optimistic about Tesla’s long-term potential.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

I believe the market continues to undervalue Tesla’s strategic advantages, particularly in artificial intelligence, software monetization, and its positioning within a potentially favorable regulatory environment under a second Trump administration.

I am prepared to navigate market fluctuations with the expectation of strong returns beginning in late 2026 and continuing into 2027. If Tesla realizes its goals in autonomous technology, I believe its stock could surpass previous record highs.

Tesla and BYD’s Converging Roads to Success

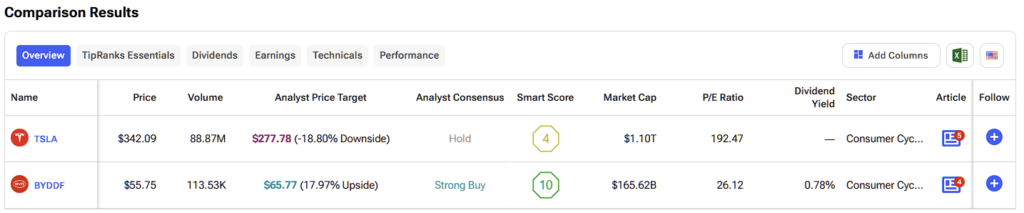

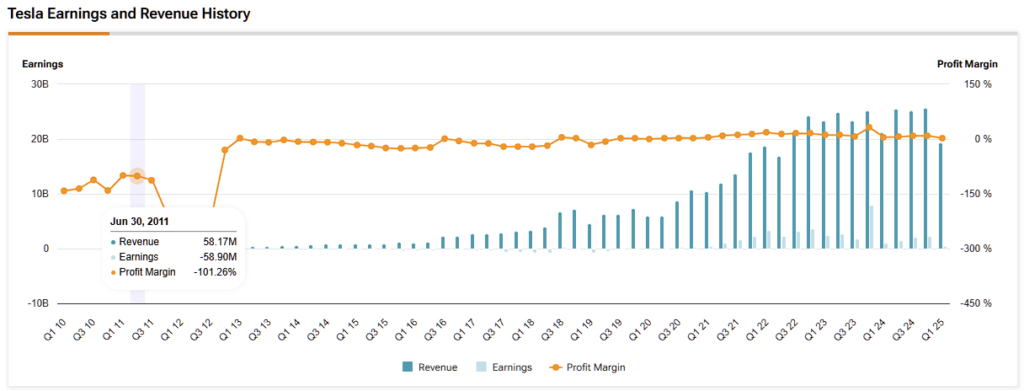

In Q1 2025, Tesla delivered around 336,681 units, with revenues of around $19.3 billion and net income of $409 million. While Tesla’s gross margin at 16.3% was weaker than that of BYD, Tesla’s excellent overall profitability is underpinned by more expensive models, foreign brand premium, and high-margin software sales, particularly its Full Self-Driving (FSD) subscriptions. Unlike BYD’s lower-profit, high-volume business model, Tesla focuses more on net profitability from forward-looking and diversified sources.

On the other hand, BYD’s strength is impossible to ignore. In 2024, it sold nearly 4.27 million vehicles worldwide, reflecting an impressive 41% year-over-year growth. Its revenues were $107 billion, much higher than Tesla’s $97.7 billion in the same period. Such numbers reflect BYD’s dominance in China, supported by better vertical integration and low-cost manufacturing operations. BYD also recorded a decent gross margin of 19.4%, reflecting profitability supported by relentless competition.

But BYD has real-world problems. It has very little presence in North America and Europe’s premium markets, the segments where brand prestige and pricing leverage are paramount. BYD also has no cutting-edge AI or robotics strategy. Its “God’s Eye” driver aid system, as impressive as it seems to be, simply provides commodity features wrapped with software upselling.

Tesla’s AI Edge Creates a Competitive Advantage

Tesla’s long-term strategic emphasis on artificial intelligence provides it with a significant competitive advantage. The company has invested over $5 billion in AI infrastructure—more than any other mass-market automaker. In contrast, BYD and other peers have yet to develop comparable AI training capabilities. This strategic investment positions Tesla not only to lead in autonomous driving but also to expand into broader AI services across industries.

Tesla’s Full Self-Driving (FSD) product remains a substantial potential revenue stream, currently priced at $8,000 upfront or $99 per month. Once development costs are amortized, this offering could become a strong profit center. Looking ahead, the growth of autonomous taxi networks and AI-powered subscription services may significantly enhance Tesla’s margins, aligning its financial profile more closely with that of a software company.

From an investment perspective, Tesla represents a high-risk, high-reward opportunity centered on software-driven AI autonomy. Elon Musk’s leadership strongly influences the company’s direction, whose track record, regardless of political context, is underscored by his results, including holding the position of the world’s highest net worth.

Trump Era Regulatory Climate Assists TSLA

On the political front, far from being a headwind, President Trump’s friendly regulatory climate supports Tesla. In April 2025, the Department of Transportation, headed by Secretary Sean P. Duffy, unveiled a new Automated Vehicle (AV) Framework that aims to promote innovation and local production while providing safety guarantees. The policy aims to achieve harmonized autonomous car regulations nationwide, which could significantly speed up Tesla’s autonomy rollout timeline.

In addition, Trump’s tariffs on Chinese-made electric cars effectively prevent BYD from selling into the U.S. market due to prohibitively expensive import costs. Taking advantage of multiple U.S. Gigafactories, Tesla will benefit most from such protectionism. Moreover, further reducing production costs and speeding up growth (through lax automotive and autonomy regulations brought in by Trump) will also maximize Tesla’s profitability.

Valuation Warranted by Premium Growth Potential

Tesla’s valuation multiples remain relatively high, reflecting investors’ belief in breathtaking growth based on aggressive innovation strategies. Tesla’s forward P/E multiple is over 150, and its EV/EBITDA multiple is approximately 80. These multiples, though high, are uniquely sustainable due to Tesla’s revolutionary software-driven revenue model and projected explosive earnings expansion from AI.

In spite of the inherent risks, like earnings volatility or late achievement of autonomy milestones, Tesla’s enormous cash reserves of $37 billion provide a financial buffer and room for continued aggressive investment in future technologies. For risk-hungry investors with long-term horizons, Tesla’s lofty valuation remains justified.

Is Tesla a Buy or Sell?

On Wall Street, Tesla has a Hold consensus rating based on 16 Buys, 10 Holds, and 11 Sell ratings. The average TSLA stock price target of $277.78 indicates ~ 19% downside over the next 12 months. Despite the potential for near-term declines and volatility, TSLA stock remains a worthy addition to investor portfolios seeking to capture explosive AI and autonomous robotics market growth in and around 2027.

Tesla Remains a Strategic Play on AI-Driven Mobility

My bullish outlook on Tesla is anchored in its unique integration of advanced AI and software capabilities with electric vehicle manufacturing. While BYD will likely maintain its dominance in the budget-friendly, mass-market EV segment, Tesla’s strength lies in its high-margin AI offerings and alignment with regulatory trends supporting innovation.

For investors aiming to gain exposure to the emerging era of intelligent mobility, Tesla represents a compelling portfolio position. It is well-positioned to capitalize on AI’s transformative impact on the global transportation market.