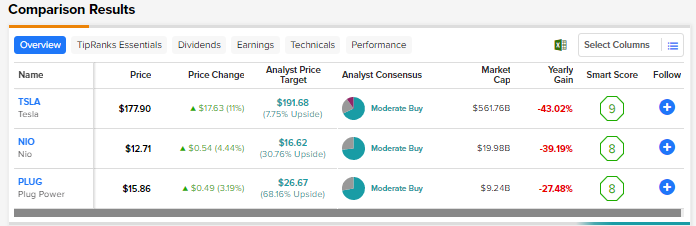

Several electric vehicle (EV) stocks have been trending higher since the start of 2023 after plunging massively last year. Investor sentiment has improved due to softer inflation reports and in anticipation that the Fed’s interest rate hikes would be less aggressive this year. Nonetheless, the stock market might be volatile in the days ahead due to macro uncertainty. Using TipRanks’ Stock Comparison Tool, we stacked Tesla (NASDAQ:TSLA), Nio (NYSE:NIO), and Plug Power (NASDAQ: PLUG) up against each other to pick the most attractive EV stock.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Tesla (NASDAQ:TSLA)

Tesla stock rallied 33% last week, thanks to the company’s upbeat Q4 2022 results. Despite supply chain disruptions and macro pressures, the company’s revenue grew 37% to $24.3 billion and adjusted EPS increased 40% to $1.19.

Moreover, Tesla expects to produce 1.8 million vehicles in 2023, with a potential to manufacture 2 million vehicles. Tesla’s Q4 performance and Elon Musk’s statement that the company is currently seeing orders “at almost twice the rate of production,” addressed investors’ concerns that Musk’s Twitter acquisition has diverted his focus from Tesla.

What is the Price Target for Tesla Stock?

Berenberg analyst Adrian Yanoshik upgraded Tesla to Buy from Hold but lowered the price target to $200 from $255. While Tesla’s recent price cuts are expected to impact profitability, Yanoshik expects margins to improve through 2023 as production increases and lower prices boost demand.

“Longer term, we expect Tesla’s cost structure and product momentum to retain high-teens operating margins, even while it grows output from higher-cost plant locations,” said Yanoshik.

Wall Street is cautiously optimistic about Tesla, with a Moderate Buy consensus rating based on 21 Buys, seven Holds, and three Sells. The average TSLA stock price target of $191.68 implies 7.8% upside potential. Shares have risen over 44% since the beginning of 2023.

Nio (NYSE:NIO) Stock

2022 was a very challenging year for Nio and other Chinese EV makers due to persistent supply chain issues and COVID-induced production disruptions. Despite multiple headwinds, Nio ended Q4 2022 with 40,052 deliveries, marking a 60% year-over-year growth. Overall, deliveries increased 34% to 122,486 vehicles in 2022.

Looking ahead, the company is optimistic about capturing further market share by launching five models in the first half of 2023. The company is also expanding its presence in the lucrative European market.

Is Nio a Good Stock to Buy?

After hosting a business update call with Nio earlier this month, Citigroup analyst Jeff Chung reiterated a Buy rating on the stock, with a target price of $23.30. Chung noted that management showed confidence in doubling its sales in 2023, backed by the release of five new models. Management guided for estimated sales of 80,000 to 90,000 units in the first half of 2023 and sales of 150,000 to 160,000 units in the second half.

Overall, the Street’s Moderate Buy consensus rating for Nio stock is based on 11 Buys and four Holds. At $16.62, the average NIO stock price target suggests nearly 31% upside potential. Shares have advanced over 30% since the start of this year.

Plug Power (PLUG) Stock

Plug Power is a leading hydrogen fuel cell technology provider. Last week, the company slashed its Q4 2022 and full-year outlook due to new product launch delays. It now expects revenue growth of 45% to 50% in 2022, down from the previous forecast of over 80% growth. The lower outlook reflects some larger projects being completed in 2023 instead of 2022 due to customer timing and supply chain bottlenecks.

For 2023, the company projects revenue of $1.4 billion, ahead of analysts’ estimate of $1.37 billion. Moreover, it expects to deliver revenues of $5 billion by 2026 and $20 billion by 2030.

What is the Forecast for Plug Power Stock?

Recently, J.P. Morgan analyst Bill Peterson reiterated that Plug Power, ChargePoint Holdings (CHPT), and Enovix Corp. (ENVX) were his top picks. The analyst feels that expectations for these companies have been largely reset, and he sees the potential for relative outperformance as the year progresses. “From a sector view, we continue to prefer infrastructure enablers in hydrogen and charging over vehicle makers/component suppliers,” said Peterson.

Peterson lowered his price target for Plug Power shares to $24 from $28 but reiterated a Buy rating, saying “From a bigger picture perspective, Plug Power remains well-positioned.”

The Moderate Buy consensus rating for Plug Power is based on 13 Buys and five Holds. The average PLUG stock price target of $26.67 implies over 68% upside potential from current levels. Shares have advanced 28% since the start of this year.

Conclusion

Wall Street is cautiously optimistic about Tesla, Nio, and Plug Power due to macro uncertainty. Nonetheless, analysts remain confident about the long-term growth prospects of the EV market and these three stocks. Currently, they estimate higher upside in Plug Power stock compared to Tesla and Nio.

Aside from Wall Street analysts, hedge funds are also bullish about Plug Power. As per TipRanks’ Hedge Fund Trading Activity Tool, the Hedge Fund Confidence Signal is Very Positive for Plug Power. Hedge funds increased their holdings in Plug Power stock by 1.5 million shares last quarter.