Shares of healthcare technology provider Tabula Rasa Healthcare (TRHC) surged last week after its preliminary second-quarter numbers impressed investors. The stock is up around 68% over the past five days but is still down around 72% so far in 2022.

Last week, Indaba Capital urged TRHC’s Independent Directors for a reshuffle at the top and a Board rejig in an open letter. Indaba’s ownership in TRHC outstrips that of its board by nearly five times and is seeking to fix “TRHC’s abysmal corporate governance, dysfunctional boardroom, and sustained underperformance.”

Add to this, Indaba Capital, which owns more than a 10% stake in the company, scooped up TRHC shares worth $5.13 million yesterday at $3.97 per share.

Indaba Urges Action

Dr. Calvin Knowlton is the Founder, Chairman, and CEO of TRHC, while Dr. Orsula Knowlton is the Co-Founder, President, and Marketing Head of the company. Indaba is also seeking the resignation of Knowltons, de-staggering of the Board and a revamp of the company’s governance.

Indaba has flagged anti-investor governance, cronyism, and nepotism in the hiring of family members and associates of the Knowltons; insider share selling; value destruction; and deterioration of financials along with pledging of stake by the Knowltons in the company.

TRHC, on its part, has noted the Board and the management have spoken with Indaba multiple times since its initial stake acquisition in April 2022 and anticipate remaining in talks with Indaba as well as other shareholders.

TRHC’s Changing Fortunes

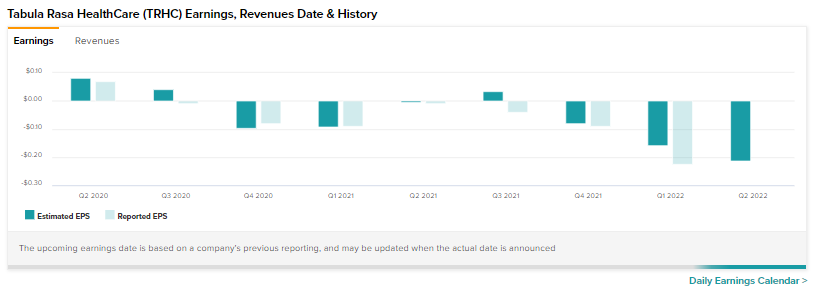

From an $84 peak in 2018, TRHC’s shares are now languishing at $4.4 levels. Short interest in the stock is running high at nearly 10.3%. Despite a gradually rising top line, the company has turned loss-making since 2020. The net loss per share is further expected to worsen from $0.01 in 2020 to $0.64 in 2023. The loss of value for investors is also visible in the company’s beta of 3 and a price to sales ratio of 0.47, meaning investors can buy a dollar of TRHC’s sales for only 47 cents.

Closing Note

Indaba has brought up significant issues at TRHC, and all eyes will be on the company’s second-quarter conference call on August 5, when the Street expects the company to report a net loss per share of $0.21. In the year-ago period, TRHC reported a net loss per share of $0.01, in line with estimates.

Read the full Disclosure