The TipRanks database follows over 9,600 publicly traded stocks. It’s a treasure trove of data, making it possible for investors to track and follow their favorite equities, or get the lowdown before they put their money down. And now, as 2021 turned into 2022, we can step back, get a wider look at the market, and take a deep dive into 3 stocks with Strong Buy ratings and a ‘Perfect 10’ from the Smart Score.

These are quick data points that can show investors a stock’s likely path forward. A Strong Buy is obvious – it’s derived from the aggregate of the Wall Street’s analyst’s ratings, and shows that sentiment on the stock is clearly upbeat.

The Smart Score is a bit different. It’s a score derived from a wide range of data sources. The composite data sets have all been shown to correlate strongly with stock performance, and the Smart Score shows, at a glance, how a stock measures up. A perfect score, of 10, might not indicate strength in every area – but will indicate a stock that is generally very strong.

So let’s dive in. From the TipRanks data, these are 3 stocks that investors should look at in the new year. They bring together a series of positive attributes: the Strong Buy rating, the Smart Score of 10, and a one-year double-digit upside potential.

General Motors (GM)

First up is GM, a company that most of us are familiar with. This staple of the Detroit auto scene has been in the business for well over a century and its Renaissance Center headquarters are an iconic marker of Detroit’s downtown. GM owns some of Detroit’s most famous automotive brands and nameplates, including GMC, Cadillac, Chevy, and Buick.

Like much of the auto industry, GM has faced serious headwinds in the form of the COVID pandemic, supply chain disruptions, semiconductor chip shortages, and rising inflation. All of this has impacted sales, revenues, earnings, and market share. A look at the Q3 results, reported back in October, will tell the story.

The top line, total revenues, showed $26.7 billion, down 24% year-over-year, and the EPS, at $1.52 was the lowest print since 2Q20. These declines walked hand-in-hand with a drop in vehicle sales; at 446,997, the quarter’s total sales were down 33% yoy. GM reported a strong gain in market share, however, which at 13.3% was up almost 7% yoy.

Along with these results, GM has shown volatile stock activity in course of 2021 – but at the end, the company’s shares are up an impressive 41% for the past 12 months. This outpaces the S&P’s 29% gain over the same period.

The gains could be partly attributed to the auto giant’s positioning in the burgeoning electric vehicle (EV) space. Looking ahead, GM is making a major investment in the segment. The company has introduced the Ultium Platform, a flexible EV chassis that can support a variety of vehicle models – and bodes well for GM’s overall plan, of introducing up to 30 new EVs by 2025. These will include everything from commuter vehicles to pickup trucks to delivery vans and commercial vehicles.

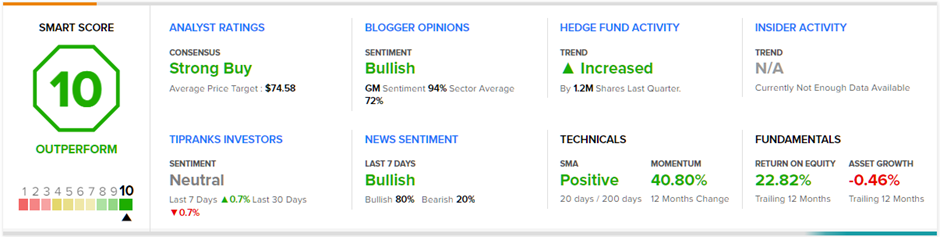

Turning to the Smart Score, we see that the Perfect 10 here is supported by strong performances on 7 out of 8 metrics. Pay particular attention to the hedge activity, which is up some 1.2 million shares in the past quarter, and the news sentiment, which is 82% bullish.

The EV story forms the core of Wedbush analyst Daniel Ives’ positive view on GM. He writes, “With the software and services business complementing the advancing battery technology, we believe GM is in a great position to monetize its EV vision over the coming years. With the conversion accelerating, GM will be able to realize top-line growth from better product margins on each vehicle sold and will benefit significantly as profit margins from the subscription services will grow to record levels.”

Ives rates GM shares as Outperform (a Buy), and his $85 price target indicates potential for 45% upside in the year ahead. (To watch Ives’ track record, click here)

It’s clear from the consensus that Wall Street agrees. GM has 13 reviews on record, with an 11 to 2 breakdown of Buy over Hold to support the Strong Buy rating. Shares are priced at $58.13 and their $74.58 average target implies an upside of 27% from that level. (See GM’s stock analysis at TipRanks)

DigitalBridge Group (DBRG)

Next up is DigitalBridge Group, a company that mixes tech and real estate. DigitalBridge is a REIT, a real estate investment trust, with a focus on properties in the digital economy. The company buys, builds, owns, and operates a variety of holdings, including data centers, fiberoptic cable systems, small cell networking infrastructure, and wireless transmission towers.

Digital Bridge has been moving to expand its footprint. This past October, the company bought a controlling stake in Vertical Bridge Holdings. The US-based, privately-held Vertical Bridge owns and master-leases wireless telecom assets, and counts over 8,000 towers in its networks. This was added to the 20+ companies in DigitalBridge’s portfolio, and the more than $40 billion in assets which DigitalBridge manages.

More recently, DigitalBridge announced that a number of its assets in Latin America will be benefiting from an International Finance Corporation (IFC) investment in that region’s wireless connectivity networks and infrastructure. The IFC will put $25 million into companies which DigitalBridge holds in its portfolio.

And finally, in a move that helped to streamline operations, DigitalBridge announced in December that it had sold off a section of its portfolio. The Other Equity & Debt segment (OED) was sold to Fortress Investment Group. The sale brought DigitalBridge a total of $506.8 million in realized value. That includes $443.4 million in direct cash, $31.2 million in cash which has already been received, and another $32.2 million in future payments, expected in 2022.

The high Smart Score here demonstrates that a stock doesn’t need every metric to show perfection. Technical aspects and blogger opinions form the basis of DBRG’s bullish Smart Score. The company has an impressive 100% positive sentiment from the financial bloggers.

B. Riley’s 5-star analyst Daniel Day looks ahead to a “catalyst-filled 2022.” He says, “…we see DBRG at an inflection point in not only earnings, but business simplification as well. In 2022, we expect the following to occur, each of which is not only a potential catalyst but should also make the transformed DBRG easier to understand for new investors: 1) redeployment of proceeds from recently announced asset sales into digital infrastructure assets, 2) resumption of dividend, 3) initial AFFO guidance, and 4) updated 2023/2025 guidance for Digital IM FRE and Digital Operating EBITDA (we believe guidance is conservative).”

Day sets a Buy rating here, with a $13 price target that suggests the stock has room to run another 56% this coming year. (To watch Day’s track record, click here.)

This digital-economy real-property company boasts a unanimous Strong Buy conviction rating from the Wall Street analysts; there are only 3 reviews here, but they all agree that it’s a Buy. The stock is selling for $8.33 and the average price target, at $11, indicates a potential 32% gain in the next 12 months. (See DigitalBridge’s stock analysis at TipRanks)

Matador Resources Company (MTDR)

Last on our list is Matador Resources Company, an energy development company in the US, engaged in exploration, development, and production of unconventional oil and natural gas plays. The company’s current operations include oil and liquids-rich regions in the Delaware Basin on the Texas-New Mexico border, the Eagle Ford shale play in South Texas, and, in Louisiana, the Haynesville shale and Cotton Valley plays.

The New Mexico-Texas-Louisiana region has been at the center of the US oil boom in recent years, and with the Biden Administration’s de-emphasis on fossil fuels, the region is still a major producer. The quality of Matador’s holdings can be seen from the pattern of recent earnings reports. For the past five consecutive quarters, the company has registered sequential gains in both revenues and earnings. In the most recent quarter, 3Q21, Matador showed over $472 million at the top line, up 132% from the year-ago quarter, along with a diluted EPS of $1.71, up sharply from the $2.38 loss recorded in 3Q20. This was driven by oil and natural gas production that beat expectations, at an average of 90,000 barrels of oil equivalent per day through the quarter.

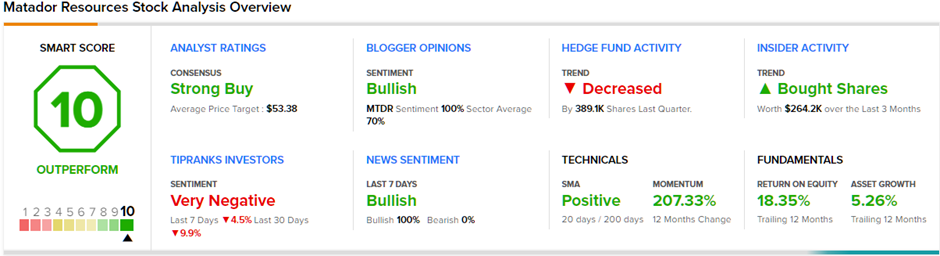

Matador is another company whose perfect Smart Score is based on several strongly positive metrics outweighing the negatives. While hedge activity in the recent quarter decreased, corporate officers – the insiders – increased their buying activity to the tune of $264,200 worth of shares. Both the financial bloggers and the news outlets were also positive, showing 100% bullish sentiment on MTDR shares.

Matador’s recent success induced the company to increase its dividend policy, doubling the common share payment to 5 cents per share. While the yield is low, the key point is the increase – and strong cash flow behind it. Matador showed $291.2 million in cash from operations during Q3, up 13% sequentially.

All of this has RBC’s 5-star analyst Scott Hanold bullish on Matador. He writes, “MTDR is positioned to get a strong start in early 2022 aided by completions of the next Voni wells located in the prolific Stateline area during mid-February 2022. This also positions midstream EBITDA expansion from MTDR and third-party volume increases. The focus on its core areas and pre-loading some CAPEX should allow 20% YoY production growth while generating a 17% FCF yield.”

These comments support an Outperform (Buy) rating on the stock, and Hanold’s $53 price target implies a 12-month gain ahead of 43%. (To watch Hanold’s track record, click here)

Matador has 9 reviews on record, including 7 Buys vs. just a pair of Holds, supporting a Strong Buy consensus from the Street. The stock’s average price target is $53.38, suggesting an upside potential of 44% in the year ahead. (See Matador’s stock analysis at TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.