Biotech is big business, no doubt about that. The healthcare sector takes up almost 1 in 5 dollars of the US gross domestic product, 18.3%, or approximately $13,000 per capita, according to data from the American Medical Association. The total sum is staggering – some $4.3 trillion.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The US is the world leader in biomedical research, including innovation on new prescription drugs, medical devices, and other healthcare advances. The health sector R&D spend in the US comes to $250 billion annually.

The high spending, on both services and research, is fueled by two factors: healthcare’s essential nature, and an aging population that finds it needs more such care as it gets older. Over the past few years, the biomedical industry has been expanding at a compound annual growth rate of 7%, and is predicted to reach $725 billion by 2025. That sort of growth is sure to open up plenty of opportunities for savvy investors.

Deutsche Bank analyst and biopharma sector expert Neena Bitritto-Garg is following that line, locating biotech stocks that are showing strong upside potential given the bullish healthcare background.

We’ve opened up the TipRanks databanks, and found that her choices all share features that should attract investor attention: ‘Strong Buy’ ratings from the Street’s analysts, and average targets that call for triple-digit upside over the coming year. Here’s a closer look at these 3 biotech stocks.

Don’t miss

- ‘Time to Hit Buy,’ Says Wells Fargo About These 2 Energy Stocks

- These 3 stocks are Cowen’s best ideas for 2024 including Amazon and Biogen

- Goldman Sachs Says These 3 Healthcare Giants Look Very Attractive Right Now

Amylyx Pharmaceuticals (AMLX)

The first stock on our list is Amylyx, a small-cap biotech research firm focused on the development of novel therapies for neurodegenerative diseases. The Massachusetts-based company is best known for AMX0035, an experimental drug with wide-ranging applications – it is undergoing clinical trials for the treatment of Alzheimer’s disease, Wolfram syndrome, and progressive supranuclear palsy. Most importantly, however, AMX0035 last year received regulatory approval in both the US and Canada as a treatment for amyotrophic lateral sclerosis, ALS or Lou Gehrig’s disease.

That last could be a long-term game changer for Amylyx. The company has launched the drug commercially in both countries, and is currently conducting the PHOENIX Phase 3 study of AMX0035 in the treatment of ALS as a precursor to seeking EU approval. The European Medicines Agency (EMA) has already released a negative opinion from the Committee for Medicinal Products for Human Use (CHMP) on AMX0035, but company management is optimistic that a positive result from PHOENIX will support future approval. Results from the PHOENIX trial are expected in 2Q24.

In the meantime, Amylyx earlier this month released additional data from the previously completed Phase 2 CENTAUR study of AMX0035 in ALS, showing clinically significant positive results in study participants. Amylyx is also pursuing the TUDCA IIS study of tauroursodeoxycholic acid (also known as ursodoxicoltaurine), one of the compounds used to make up the AMX0035 combination drug.

On the commercialization side, Amylyx has been reporting some mixed results since the approval of this ALS drug. Branded as Albrioza in Canada and as Relyvrio in the US, sales of the drug have brought in $272.3 million in the first three full quarters since the US approval and launch. Product revenue in 3Q23, the last reported, came to $102.7 million. That quarterly total, however, missed the forecast by $10.96 million.

Shares in AMLX fell by 32% after that revenue miss. The financial release showed that Amylyx is struggling to gain traction with Relyvrio, even though the drug has been on the market for nearly one year. Management remains optimistic, however, as product sales pushed Amylyx into net-profitability starting in Q1 of this year, and as noted, there is a solid chance to gain EU acceptance later next year on positive results from the PHOENIX trial.

The company’s turn to net-profits and the potential of current trials of AMX0035 form the core of Neena Bitritto-Garg’s analysis of Amylyx shares. The analyst starts out writing, “Though we do see risk to success in both the ongoing Ph3 PHOENIX study for AMX0035 and the TUDCA IIS, we’re buyers at current levels and on any volatility around the TUDCA IIS data around YE23; we see risk/reward on PHOENIX topline data in 2Q24 as highly favorable, with downside to cash/share (~$6-$7/share, or -50% from here) and upside to $40+ (+$30 / +200% or more).”

Looking ahead, she outlines likely scenarios for the company, and comes down on the Buy-side: “Even in a PHOENIX failure scenario, Relyvrio is highly likely to remain on market in the US (it has full, not accelerated approval; the one exception is if a new safety signal arises) and continues to sell given unmet need in ALS; our modeling scenario analysis suggests that at the current share price, the market is pricing in either full market withdrawal, or sales erosion post PHOENIX topline in 2Q24 of 5%-10% per year through LoE, which seems extreme to us given the unmet need in ALS and lack of near-term commercial competition, in the absence of adverse payer action.”

These comments support the DB Buy rating on AMLX stock, and the $36 price target points toward a one-year upside potential of 153%. (To watch Bitritto-Garg’s track record, click here)

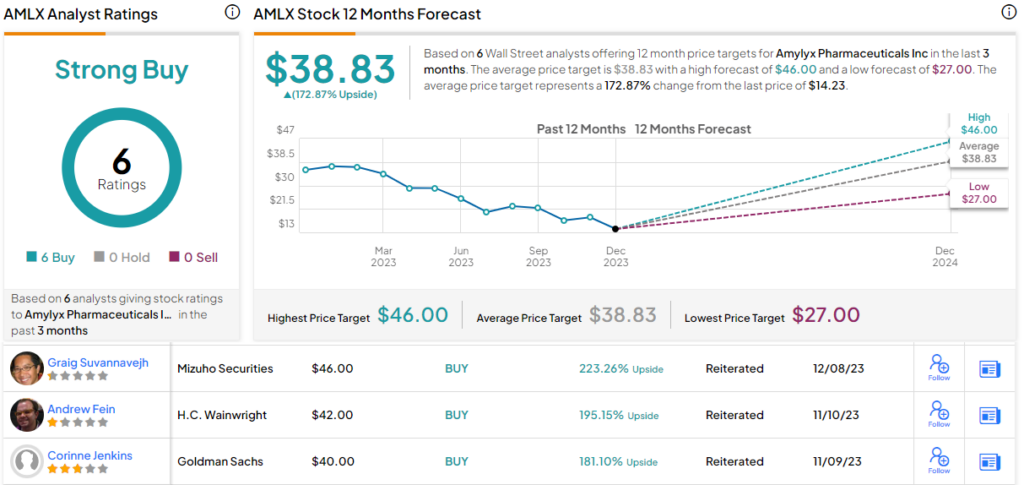

This stock has earned a Strong Buy consensus rating from the Street, based on 6 unanimously positive analyst reviews. The shares are trading for $14.23 and the $38.83 average target price suggests a robust gain of 173% on the one-year horizon. (See AMLX stock forecast)

Prothena Corporation (PRTA)

Next up is Prothena, a biotech company with a portfolio of new therapeutic agents designed to target protein dysregulation, or misfolded proteins, as an approach to treating rare, devastating neurodegenerative diseases.

The company has an extensive research pipeline, with 9 separate tracks. These include 2 in early discovery stages, 2 in preclinical studies, and 5 that are ‘in the clinic,’ undergoing human clinical trials. Of these, 2 each are at Phase 1 and Phase 2, and the last has advanced to Phase 3.

The company is studying treatments for a variety of disease conditions, including Parkinson’s and Alzheimer’s, AL and ATTR amyloidosis, and ALS. The company’s drug candidates directly target improperly folded proteins, with the design being to alter the course of the disease at the most basic level possible.

The leading program in Prothena’s pipeline is birtamimab, a novel drug candidate designed to target AL amyloidosis, a serious disease in which light chain proteins are overproduced in clonal plasma cells and then misfold, aggregate, and form amyloid deposits in vital organs – including in the heart. Cardiac failure is the chief cause of death in this condition, and current treatments target plasma cells in order to reduce protein overproduction. Birtamimab is a monoclonal antibody designed to target and clear away the amyloid deposits that cause the organ dysfunction and eventual death.

Birtamimab, which has been granted the FDA’s Fast Track designation, showed positive results in the Phase 3 VITAL trial, which were published this past June. The drug candidate is currently undergoing the Phase 3 AFFIRM-AL clinical trial, under a special protocol agreement with the FDA, and topline results are expected next year.

Also of note in the pipeline is PRX012, a potential new treatment for Alzheimer’s. This is a wholly-owned drug candidate, and potentially best-in-class. It targets the brain amyloid plaque that has been connected to the damage caused by Alzheimer’s. Data from the Phase 1 single ascending dose and multiple ascending dose trials are expected in the next few weeks. Like birtamimab, PRX012 has been granted Fast Track status by the FDA.

The stock has been on a downward trend over recent months, but given the catalysts ahead, even should it drop further, Bitritto-Garg thinks investors should be paying attention here. She writes, “Heading into very first data for PRX012 in Alzheimer’s disease around YE23, given current bearish sentiment that’s driven a gradual sell off over the last few months, we see the bar for shares to work as very high (i.e., safety and amyloid PET data comparable to lecanemab), which means additional incremental downside is possible from here. However, the bar to show initial target engagement is much lower, in our view, and thus, we’d be buyers on any incremental downside on first data, assuming safety data are acceptable and some target engagement is shown, as data from additional cohorts, and from other programs (i.e., prasinezumab, birtamimab) should make for a catalyst-rich 2024.”

Looking ahead, the analyst puts a Buy rating on PRTA shares, along with a $62 price target that suggests a one-year gain of 55% for the shares.

Prothena’s Strong Buy consensus rating comes from 8 recent reviews that break down 7 to 1 in favor of the Buys over the Holds. The shares are priced at $39.99 and their $81.13 average target price implies a 12-month upside potential of 103%. (See PRTA stock forecast)

COMPASS Pathways (CMPS)

Wrapping up this list, we’ll turn to COMPASS Pathways, a biopharmaceutical firm working on new psychedelic drugs for the treatment of mental health disorders. The company’s research work focuses on using psilocybin in the treatment of several psychiatric disorders, including treatment-resistant depression, post-traumatic stress disorder, and anorexia nervosa. Psilocybin is a naturally occurring chemical compound, and is perhaps best known outside the psychiatric world as the effective ‘ingredient’ in the so-called ‘magic mushrooms.’

COMPASS has taken psilocybin and developed a therapeutic formulation from it, an investigational, synthesized form of the compound called COMP360, which is being investigated as a treatment administered in conjunction with psychological support for the patient. In the treatment model, the patient and therapist – a psychologist – first use several sessions to become acquainted. During the drug treatment session, the patient is administered psilocybin in a controlled environment and allowed to progress through the ‘trip’ under supervision. Afterwards, the patient and therapist can discuss the experience and the patient’s feelings on it.

Patients receiving COMP360 under this investigational study receive the drug while in a capsule. During the experience, the patient wears an eye mask, and listens to music from a playlist that is specially designed before the session. The procedures are discussed with the patient in advance. The session typically takes between 6 and 8 hours to complete.

Under this model, COMP360 has been designated as a Breakthrough Therapy by the FDA. This designation is acknowledgement by the regulatory agency that the drug has high potential to show a substantial improvement over existing therapies. The Breakthrough Therapy designation allows for an expedited review process of the drug treatment.

The use of psilocybin in the treatment of treatment-resistant depression is the most advanced of COMPASS’s research lines. The company is also adapting the drug therapy for the treatment of bipolar type II disorder, and in November initiated a UK component of the global Phase 3 study of the therapy against treatment-resistant depression.

Against this background, Bitritto-Garg’s comments on COMPASS stock makes sense. She is upbeat, seeing the stock as a potential gainer as more and more positive data come in from the clinical trials, writing, “Based on results of a Phase 2b study for COMP360 in TRD, we think PoS in the ongoing Ph3s is very high (i.e., 75%+), and see potential for the Ph3 data (two studies, data summer 2024 and mid-2025, respectively) to be some of the best registrational data in the depression space historically; however, questions around COMP360 commercial infrastructure, competitive landscape, IP, and commercial / peak sales opportunity have capped enthusiasm around COMP360 and other psychedelic compounds in rigorous clinical trials since COMP360’s Ph2b topline data in 2021.”

However, Bitritto-Garg believes “many of these concerns are overdone.” “Thus,” she goes on to add, “with shares still trading near all-time lows, we like the setup into data mid-2024; we think shares could run towards the double digits into topline data as investors start looking at key 2024 events and turning attention back to COMP360.”

This adds up to a Buy rating, and the analyst’s $16 price target implies the shares will double in value over the course of the next year. (To watch Bitritto-Garg’s track record, click here)

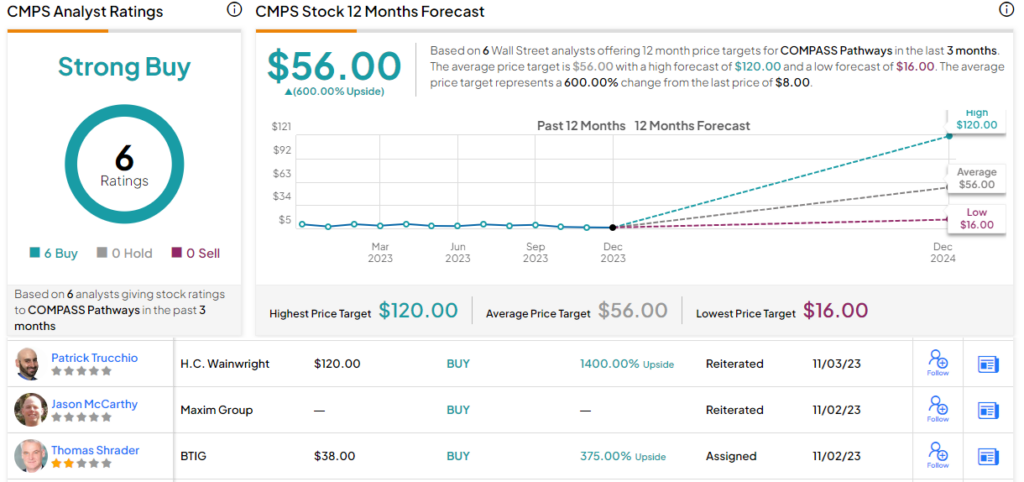

This stock is another with a unanimously positive Strong Buy analyst consensus view, based on 6 recent stock recommendations on file. The shares are currently trading for $8 and their average price target, at $56, suggests a very impressive 600% upside in 2024. (See CMPS stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.