The New Year is only five weeks away, and looking ahead to 2024 some noted market experts are predicting a modestly positive investing environment. Notable among them is David Kostin, chief US equity strategist from Goldman Sachs, who has expressed some cautious optimism about the coming year.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Kostin believes that, like this year, the next will present a volatile stock market background and toss up opportunities for investors to score profits. Kostin’s rosy upside scenario sees the S&P 500 hitting 5,000, while his more downbeat bearish scenario sees it dropping to 3,700; the mostly likely case, in Kostin’s view, is for the index to grow a modest 3.2% from current levels and finish 2024 at or near 4,700.

Although reaching 4,700 is not overly optimistic, Kostin emphasized that there are numerous opportunities for savvy investors to still improve on the market’s overall performance next year. So, what should investors specifically be looking for? “Stocks with ‘quality’ attributes such as high profitability, strong balance sheets, stable sales and earnings growth, and low historical drawdown risk,” Kostin said.

With that info as the backdrop, the stock analysts at Goldman are following Kostin’s lead, and picking out stocks with opportunities brewing. We’ve opened up the TipRanks databanks to pull up the details on 3 of them; here they are, along with the Goldman Sachs comments.

Don’t miss

- Buy These 2 Beaten-Down Stocks Before They Rebound, Says UBS

- Morgan Stanley Says These 3 Stocks Are Top Picks for 2024

- RBC Sees S&P 500 Reaching 5,000 in 2024; Here Are 2 Stocks to Play the Bounce

Vale SA (VALE)

First up is a mining company, Vale SA, based in Brazil. This firm is a leader on the Latin American mining scene, and in recent years has consistently ranked among the world’s largest producers of both iron ore and nickel. Last year, Vale brought in over $43 billion in net operating revenues, and the company currently has a market cap in excess of $64 billion.

At the core of Vale’s success is its operations in the Carajas mine in northern Brazil. This mine boasts a particularly rich ore, containing some 67% iron content – the world’s highest known iron-content ore, and the most valuable iron mine in operation. Vale’s iron mining operations can supply iron ore and pellets – the basic raw materials for steel – as well as nickel and copper to global industries. The company has active operations in Brazil, Canada, China, Japan, Indonesia, Malaysia, Oman, and the UK.

While iron is the foundation that Vale works from, the company is deeply involved in the production of copper and nickel. Iron is the most-used metal in the world’s industries, copper takes third place – and nickel is used in alloying processes and battery production, and so is essential in everything from steel production to building laptop computers and electric vehicles.

Turning to the quarterly results for 3Q23, the last on record, we find that Vale had a top line of $10.62 billion, up nearly 7% year-over-year, and reported a bottom line of 66 cents per diluted share by non-GAAP measures. The EPS figure was down from the 98 cents reported in the year-ago period but was more than triple the 20 cents reported in the previous quarter, 2Q23. The company also announced a share buyback program authorizing the repurchase of up to 150 million common shares.

For Goldman’s Marcio Farid, this all paints a picture of a company with places to go. Farid is especially impressed by Vale’s operations, and the support it finds there; he writes of the stock, “We believe the current setup that supports Vale’s investment thesis is unique due to a combination of tailwinds that has not been in place since at least 2014. They include: 1) a balanced iron ore market in support of prices at $110/t for 2024 (GSe); 2) positive operational momentum (although the pace is a bit disappointing); 3) relatively low investor exposure (mainly from local Brazilian investors); 4) attractive valuation (at 12% FCF yield and 4.8x EV/EBITDA in 2024, cheapest among majors) and 5) GS expectation of ongoing China policy support (with iron ore being the most China-centric commodity).”

Getting to his own bottom line, Farid outlines his reasons for taking a bullish stance here: “Vale is now our preferred name within LatAm Materials. We believe the story is now too attractive to ignore and investors will slowly increase exposure as confidence around iron ore supply/demand balance in 2024 increases.”

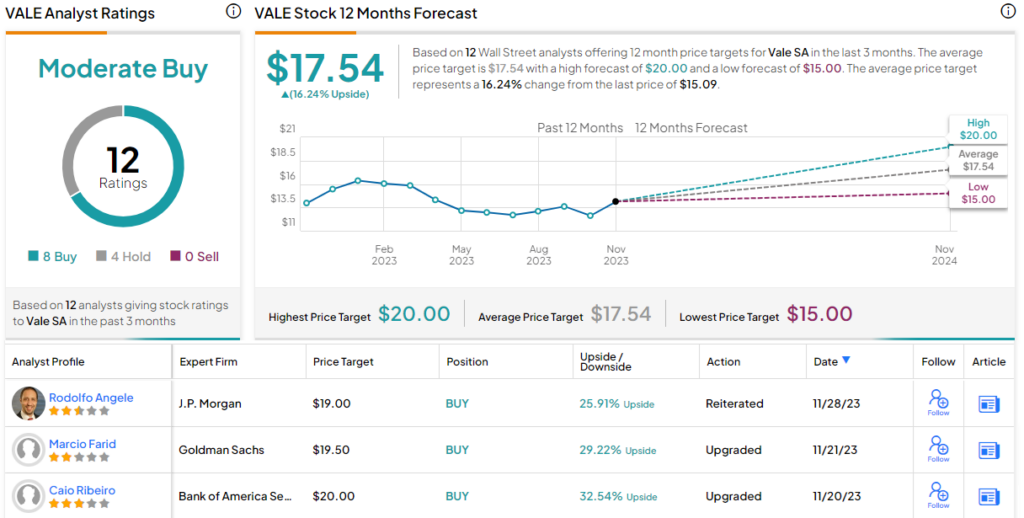

Summing up, the analyst puts a Buy rating on the stock, and his $19.50 price target implies an upside potential of 29% in the next 12 months. (To watch Farid’s track record, click here.)

Vale’s Moderate Buy consensus rating from the analysts is based on 12 recent reviews, including 8 Buys to 4 Holds. The shares have a current trading price of $15.09 and its average price target, at $17.54 implies a one-year upside of 16%. (See Vale’s stock forecast.)

Installed Building Products (IBP)

The second company on our list is one of the largest installers of building insulation products in the US construction industry. Installed Building Products, IBP, works mainly in the residential new construction market, and in addition to insulation the company also provides complementary products such as waterproofing, fire-stopping and fireproofing, garage doors, and rain gutters. For home interiors, IBP offers products such as closet shelving, shower doors, and mirrors.

From the customer’s perspective – that of the builder – IBP is a full-service provider, managing the full installation process. This includes sourcing and direct purchase of materials, supplying those materials to the job sites, and the final installation – especially important to get right for home insulation products. IBP’s service and product portfolio is available for both new and existing single- and multi-family residential projects, and for selected commercial builds.

IBP’s work adds direct value to the final products, the homes constructed, by increasing curb appeal – an important factor in real estate sales. Attractive houses are more likely to sell, and realtors and buyers both will pay close attention to details like rain gutters and garage doors. IBP’s focus on getting those details right helps ensure the homes will sell, a win-win situation for everyone from the builder to the contractors to the homeowners.

The real estate and construction markets have faced pressure recently, from high interest rates and high home prices combining to hurt sales. Against that background, IBP reported $706.5 million in revenue for 3Q23, a y/y decline of nearly 2% yet almost $1.1 million above the forecast. The company’s non-GAAP diluted EPS, however, rose 11% y/y and hit $2.79, described as a record. The non-GAAP EPS was 44 cents better than had been expected.

So, IBP beat the forecast in a tough environment, and Goldman analyst Susan Maklari took note. In addition, Maklari believes that the housing market will improve next year – and so she is upbeat on IBP. The analyst says of the company’s prospects, “As we estimate single-family starts will grow 8% YOY in 2024, we believe IBP will leverage its compelling value proposition to builders. With this, our 2024 Street-high EBITDA estimate is 8% ahead of consensus. We highlight the following as key to our bullish expectations: 1) normalization in build times allowing for greater efficiencies, 2) improving price/cost dynamics after two years of elevated inflation, 3) positive contribution from multi-family volumes, and 4) commercial margins that have shifted from head to a tailwind following weakness in 2022.”

With the supporting factors laid out, Maklari goes on to outline her bullish take on IBP, writing, “Given our optimistic outlook for residential construction along with company-specific efforts to drive further profitability as well as above average growth, we believe a re-rating of the multiple towards historical norms is warranted.”

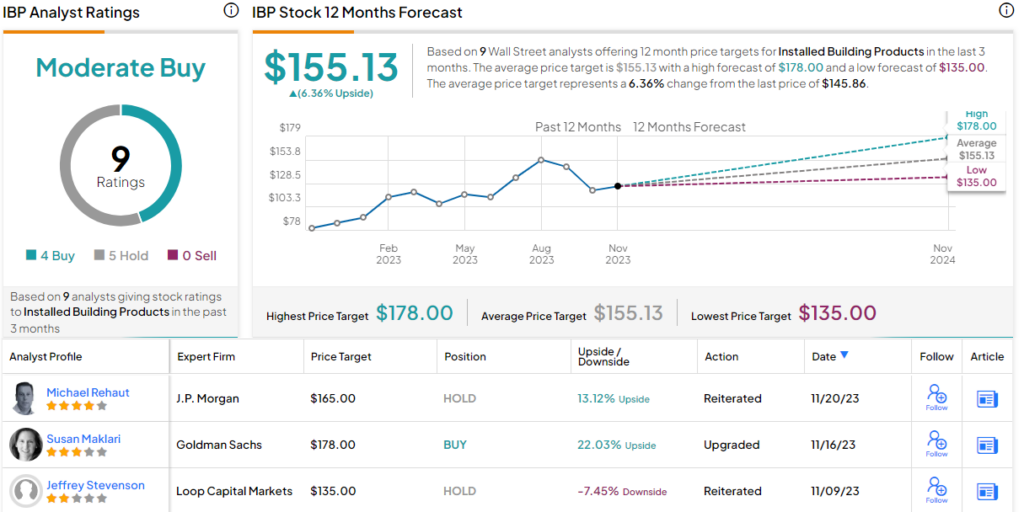

These comments combine to support her Buy rating, while her $178 price target points toward a 22% share appreciation on the one-year horizon. (To watch Maklari’s track record, click here.)

Once again, we’re looking at a stock with a Moderate Buy consensus rating. IBP has 9 recent analyst reviews, that include 4 Buys and 5 Holds. Shares are trading for $145.86, and their $155.13 average price target suggests a modest gain of 6% is in store next year. (See IBP’s stock forecast.)

Legend Biotech Corporation (LEGN)

Last up on our list of Goldman picks, is Legend Biotech. This firm is both a clinical stage and early commercial stage biopharma, with an active pipeline featuring drug candidates at preclinical, early clinical, and late clinical study phases, and a new drug, carvykti, approved for use in the US in the treatment of multiple myeloma. The company receives backing, and has partnership agreements with, the Big Pharma stalwart Johnson & Johnson.

The biggest story for Legend right now, however, is the ongoing commercialization effort to promote carvykti. Multiple myeloma is a dangerous cancer, with few effective treatments; carvykti showed in clinical trials a high potential in the treatment of the disease. The drug, a chimeric antigen receptor T cell therapy, or CAR-T, is designed to recognize and attack multiple myeloma cancer cells after a single infusion treatment. It received approval from the FDA in February 2022, and conditional marketing authorization by the European Commission in May of that same year. Since then, Legend, which developed the drug in partnership with the JNJ subsidiary Janssen, has been vigorously promoting it.

Those efforts have shown success. Legend reported its 3Q23 results on November 20, and those results included $152 million in net trade sales during the quarter. This represented a 30% increase quarter-over-quarter. According to the company, the gains were driven by ‘ongoing market launches, expanding market share and capacity improvements.’

Leveraging partnership agreements for licensing and collaboration payments, the company generated a total of $96 million in revenue during 3Q23. This was up a whopping 250% y/y, although it did come in $3.5 million below expectations. At the bottom line, the company, like many biotech peers, runs a net loss; but the 17-cent EPS loss in Q3 represented a strong improvement from the 26-cent loss reported in 3Q22 – and beat the forecast by 14 cents per share.

Legend’s strong position – its growing revenue stream and its solid backing – attracted analyst Ziyi Chen, who wrote in the Goldman note on the stock, “We believe Legend has the potential to grow into a leading global cell therapy company with: 1) strong backing of JNJ as global partner to leverage JNJ’s resources in R&D and CGT manufacturing with potential commercial synergies in multiple myeloma; 2) Carvykti as best-in-class BCMA CAR-T with $6.8bn global peak sales, given the BIC profile and the expected capacity ramp-up globally, while viewing the front-line treatment as upside potential; and 3) early-stage CGT R&D services from Genscript ProBio to support Legend’s integrated cell therapy platform. We consider Legend as undervalued at current levels given the limited reflection on 1L MM and the relatively conservative market view on the capacity ramp-up vs our view.”

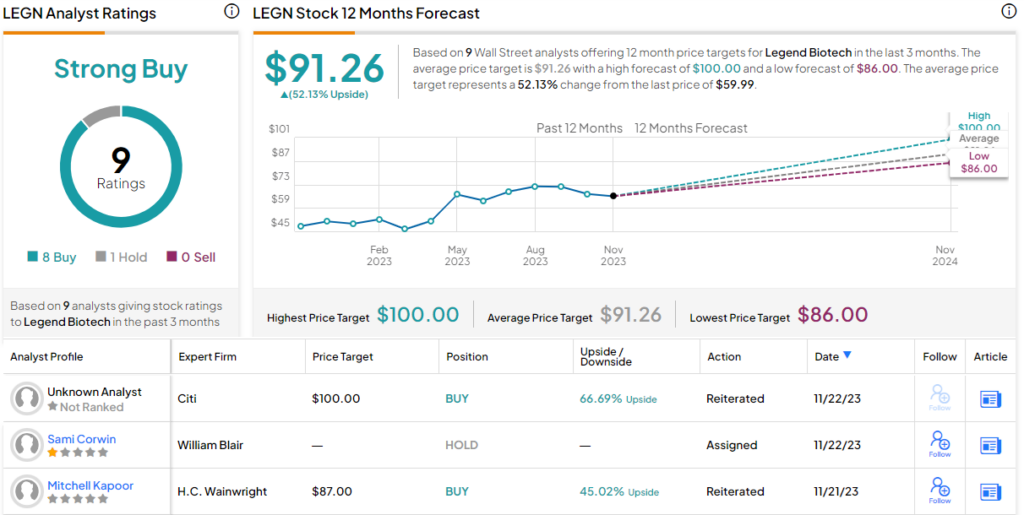

Chen puts a Buy rating here, along with a price target of $90.09 to imply an upside potential of 50% over the coming 12 months. (To watch Chen’s track record, click here.)

There are 9 recent analyst reviews on this stock, and the 8 to 1 breakdown, favoring the Buys over the Holds, indicates that Wall Street is bullish – and gives the shares a Strong Buy consensus rating. The stock is selling for $59.99 and its $91.26 average price target indicates a possible gain of 52% for the shares over the coming year. (See Legend Biotech’s stock forecast.)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.