After a year of headwinds buffeting the markets, we’re heading into 2024 and things are looking up. Market strategists are debating just how much they’re looking up. The consensus is that the Federal Reserve will start cutting interest rates, but the question is, ‘How much?’

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The conventional wisdom is pointing toward as many as three cuts, starting in Q3, and totaling 25 to 75 basis points. But the strategy team from investment banking giant UBS has a different view, and is predicting a much more hawkish Fed – and rate cuts next year that may total as much as 275 basis points.

“Inflation is normalizing quickly and by the time we get to March, the Fed will be looking at real rates which are very high,” the UBS team wrote.

For investors, the key point here is the magnitude of the cuts that UBS foresees; 275 basis points will bring the Fed’s key rate down by approximately half – and that’s likely to boost stocks.

With that in mind, the UBS stock analysts have been picking out beaten-down stocks they see as potential winners in next year’s changing environment. Let’s take a closer look at two of them, using the comments from UBS’s analysts and the latest details drawn from the TipRanks database.

Don’t miss

- Morgan Stanley Says These 3 Stocks Are Top Picks for 2024

- RBC Sees S&P 500 Reaching 5,000 in 2024; Here Are 2 Stocks to Play the Bounce

- TipRanks’ ‘Perfect 10’ List: These 3 Top-Rated Stocks Hit All the Right Marks

JD.com, Inc. (JD)

We’ll start in the online world, with a spotlight on JD.com, the Chinese e-commerce behemoth. JD holds a leading position in supply chain-based technology and services in its home country, providing a top-of-the-line retail infrastructure and logistics system designed to facilitate customer purchases – the company aims to help its customers buy what they want, when they want it, and have it delivered where they want it.

JD.com has more than 580 million active customers and supports their purchases with a logistics network that includes more than 1,600 warehouses. These can provide small, medium, and oversized warehousing, support chilled and frozen products, and facilitate cold chain deliveries, backing up the delivery network that provides the leading e-commerce industry shipping service in China. JD claims that it can deliver up to 90% of all orders the next day.

The company’s sales ops are mainly in the B2C segment, offering a huge range of products – pretty much anything that any customer could want. Site users can find apparel, cosmetics, electronics, and even groceries, all available through the firm’s Chinese-language website.

Despite the size and scope of JD’s business, the company’s stock has fallen 49% so far this year. JD shares have faced headwinds in the form of broad-based concerns about China’s economy this year. The world’s second-largest economy has shown signs of sputtering in 2023: consumer spending has flattened out from Q2 to Q3 as the Chinese government and economy deal with serious issues in the credit and real estate sectors.

Nevertheless, JD’s revenue in the last reported quarter, 3Q23, came to US$34 billion. This was up a modest 1.7% year-over-year, and it beat the forecast by some US$60 million. The company’s third-quarter non-GAAP diluted EPS was reported as 92 cents US per American Depositary Share, a figure that was 11 cents above the estimates.

For UBS analyst Kenneth Fong, the real story is JD’s move to improve and streamline its business model. Fong writes, “JD is in a year of transition with a new strategy based on: 1) cultivating a vibrant third-party (3P) ecosystem by expanding long-tail SKUs; 2) building low-price mind share; and 3) streamlining its corporate structure to be more responsive to market change. We view its business recalibration as necessary in this dynamic and competitive market, but the process is unlikely to be smooth amid peaking internet user growth, a slowing economy and rising competition.”

Getting to the details, and to JD’s results, Fong goes on to add, “While margins continue to improve, muted top-line growth (at a low-single digit for H223E, by our estimate) and uncertainty over the business transition have hurt the shares. JD may underperform its peers until there is more visibility on the business transition, but we view its valuation as attractive at 8x 2024E PE with net cash roughly equal to 50% of its market cap.”

These comments support Fong’s Buy rating on the stock, while his $39 price target implies a 36% gain for the shares in the coming year. (To watch Fong’s track record, click here)

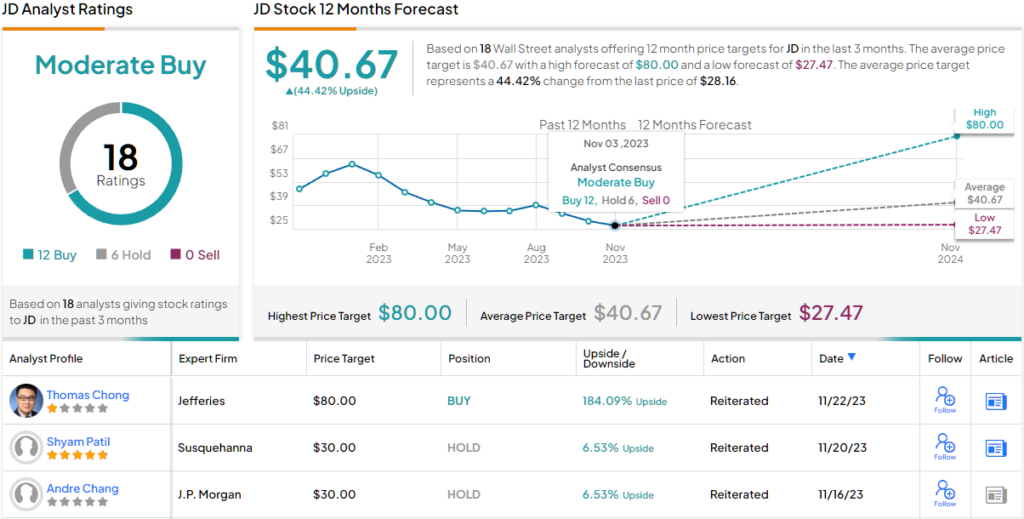

Overall, this Chinese retailer gets a Moderate Buy consensus rating from the Street, based on 18 analyst reviews that include 12 Buys to 6 Holds. The shares have a 44% average upside potential, based on a current trading price of $28.16 and a consensus price target of $40.67. (See JD stock forecast)

Noah Holdings (NOAH)

For the second stock on our list of UBS picks, we’ll stick with China – and look at the wealth management sector. China’s economy, which for much of the 2000s has been a fast-revving growth engine, has generated a large number of wealthy entrepreneurs and tycoons who need places to put their money to work. Noah Holdings operates in that environment and is one of China’s largest independent wealth and asset managers.

Noah offers its customers a comprehensive range of services on global investments and asset allocation. The firm caters to high-net-worth individuals, and as of June 30 this year, counted some 445,557 customers in its network. Customers can access a range of investment products in multiple currencies – primarily China’s RMB but also the US dollar and other commonly traded currencies. Noah maintains offices in 63 Chinese cities, as well as in international locations in Singapore, Silicon Valley, and New York.

Looking at some basic numbers, we find that Noah has a market cap of US$892.4 million. At the end of Q2 this year, the company’s assets under management totaled US$21.6 billion. This AUM has been remarkably stable over the past year – it is within 1% of its 2Q22 and its 1Q23 values. Shares in NOAH reached a recent peak in February of this year and are down approximately 36% from that value.

This company has not yet released its 3Q23 numbers, so the most recent data is from the second quarter of this year. That release showed a top line of US$129.9 million, up more than 27% from the prior-year period – and up 17% quarter-over-quarter. Management attributed the revenue gain to an increased distribution of insurance products. At Noah’s bottom line, the firm reported a non-GAAP earning per American Depositary Share of 62 cents US; this was down 14% year-over-year.

So Noah shows an increase in revenue and a slide in earnings – but UBS analyst Helen Li is bullish, seeing the company as a relatively safe and conservative bet for investors. She sets out the case clearly, and her notes describe why this stock should be an easy buy: “The stock has de-rated by 38% (in PE terms) from the peak level in February 2023 after a short rally boosted by China’s reopening. We think risk is tilted more to the upside than downside. Several catalysts could likely drive the stock’s re-rating: 1) limited impact on Noah’s business operations from the Zhongzhi default, and the overdone stock sell-off; 2) potentially increased shareholder return through possibly higher payout ratio or even share buybacks; and 3) strong distribution capability and stable revenue & earnings growth outlook. Also, the current market cap is almost on a par with the company’s liquid assets, which provides a safety margin for the investment, in our view.”

For Li, this adds up to a Buy rating, and she puts an $18 price target here to point toward a 33% upside potential in the next 12 months.

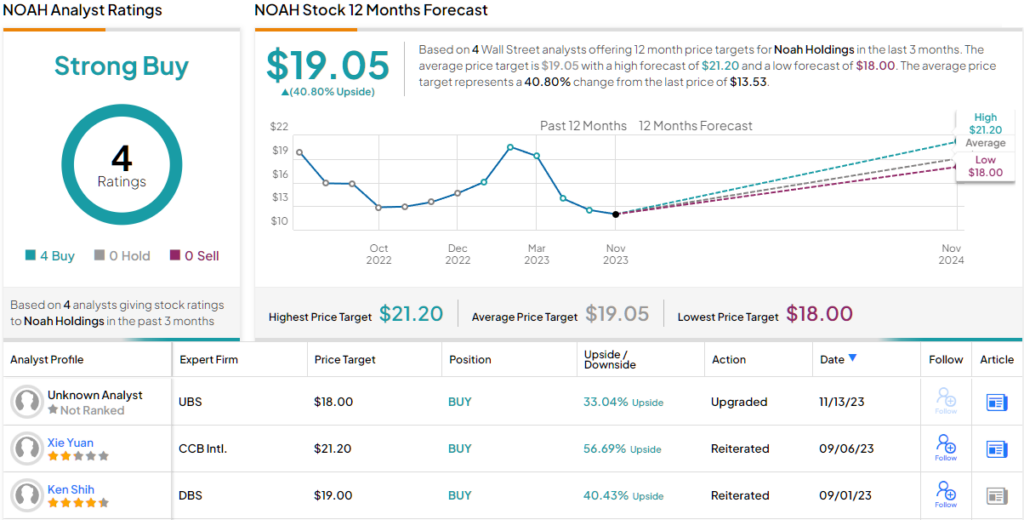

Overall, NOAH stock gets a unanimous Strong Buy consensus rating, based on 4 recent reviews – all positive. Shares are trading for $13.53 on Wall Street, and their $19.05 average price target suggests a gain of ~41% on the one-year time frame. (See NOAH stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.