Is digital technology coming of age? Over the past several years, we have seen recurring demand waves for digital tech, all billed as transformative. A new one is starting now, a digital transformation that brings with it the promise of true change. Previous waves had been focused on company internals – but the current growing demand for digital transformation is occurring on the outside, facing the customers.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

This is a new development, and it brings with it potential for a lasting change in the way we interact with technology, especially digital technology. Watching these developments from Canaccord Genuity, Joseph Vafi, counted by TipRanks in the top 5% of Wall Street’s analysts, explains just what is going on, and why it is different from previous changes: “Today we are in the midst of what we view as the largest and most enduring IT services demand wave so far – and that is digital transformation,” the 5-star analyst said. “What distinguishes Digital Transformation from previous demand waves is that this time, technology is being used to drive revenue growth and enhance the customer experience directly. Instead of being an IT Services demand wave focused on cost takeout, this time it’s customer-facing.”

Vafi also sees a rich field of opportunity in this market, saying, “In a post-Covid world, technology, in the many forms that make up the broader concept of Digital Transformation is at the core of the competitive strategy playbook. Most all market research firms are in agreement, putting the TAM for enterprise and government transformation in the multiple $T range.”

In practical terms, this means that tech stocks can soar, but which ones offer the best potential? Vafi has an idea about that and sees 2 certain names as primed for gains of at least 40% over the coming year. We’ve drawn the details on them from the TipRanks database; here they are, with this top analyst’s comments.

Don’t miss

- These 2 MedTech Stocks Look Too Cheap to Ignore, Says Morgan Stanley

- Morgan Stanley Says These 3 Semiconductor Stocks Are Hot Buys Right Now

- ‘Time to Upgrade,’ Says J.P. Morgan About These 2 Energy Stocks

Alight, Inc. (ALIT)

The first stock we’ll look at here is Alight, a software company offering a line of business process products. Its Business-process-as-a-service (BPaaS) is designed to make it easy for client companies to adopt Alight’s software, which brings with it solutions for streamlining and automating business processes, data analytics, and human capital management. Alight is known for using AI technology in its software portfolio, allowing for improved automation and risk management features.

Alight bills its services as ‘mission-critical’ for its customers, and boasts that its BPaaS offering can smooth out all the processes of everyday business, in managing payroll and workforce; in managing health, wellbeing, and retirement benefits; in tracking employee leave; in streamlining professional services. The company markets its products as holistic solutions that will benefit whole companies.

The software platform, dubbed Worklife, has gained a level of popularity while the company has built up a globe-spanning international operation, boasting 4,300 clients, in more than 100 countries, and serving some 70 of the Fortune 100 list.

Alight reported its 3Q23 results this past November. The firm saw its BPaaS bookings increase by 26% year-over-year, and hit $262 million for the quarter. This brought the total bookings since the beginning of 2021 to nearly $2 billion, surpassing the company’s end-of-2023 $1.5 billion goal by a wide margin. Revenue in the quarter came to $813 million, up almost 8.5% y/y although some $16.5 million below the pre-release estimates. The bottom line earnings, by the non-GAAP measure, outperformed modestly. Adj. EPS came to 14 cents per share, beating the forecast by a penny and beating the prior-year Q3 value by two pennies.

For Canaccord’s Vafi, all of this adds up to a solid choice for investors. He outlines the company’s prospects for growth in a rich target market, writing, “We view Alight and its Worklife platform to be compelling and differentiated in the employee benefits management marketplace. Given the strong growth in as-a-service bookings and growth trajectory of revenue, we see Alight as exploiting better than anyone else the introduction of digital transformation offerings into the HR function of the enterprise. As such we believe there is an opportunity to see modest revenue acceleration even though the company is operating in a relatively mature segment and with substantial market share already. Margin expansion should follow, not only from higher mix of BPaaS revenue but also from internal efforts to more and more migrate the computing architecture to the cloud.”

Tracking forward from this, Vafi rates these shares as a Buy, and his $12 target price implies a robust one-year upside potential for the stock of 50.5%. (To watch Vafi’s track record, click here.)

ALIT shares have earned a unanimous Strong Buy consensus rating from the Street, based on 6 positive analyst reviews. The $12 average price target here is the same as Vafi’s objective. (See Alight’s stock forecast.)

TTEC Holdings (TTEC)

No matter what the business, managing customer experience, or CX, is vital – if the customers and end users don’t like the product or can’t interact with the business, then the company will fail. TTEC Holdings, the next stock on our Canaccord-backed list, realized this fact decades ago, and has built itself to be an industry leader in CX technology and services. The Colorado-based firm got its start in 1982, and today employs over 64,000 people, working in more than 50 languages on six continents.

TTEC offers its enterprise clients a mix of technology, consulting, and analytical services, centered around improving the client company’s overall customer experience. This naturally requires a ‘whole system’ approach, optimizing the customer facing parts of the business, including customer service, tech support, and trust and safety solutions. TTEC is known for its use of AI operations, which are streamlined to maximize efficiency – but also to truly mimic online human interactions. The company describes its goal as creating ‘customer experiences that feel human even when they are not.’

These goals make a high bar, and TTEC clears it with a variety of tools, including solutions for contact center technology and operations, intelligent automation, data analytics, and revenue generation – with the whole adding up to a solid customer experience strategy.

As we take a look at TTEC’s recent financial performance, we find the company showed only modest y/y top-line growth, but revenue and earnings were ahead of expectations. The last quarterly release, for 3Q23, showed sales of $603 million, up only 1.8% from the prior year period – but coming in just above consensus, by a modest $680,000. The company’s non-GAAP EPS figure was 48 cents per share; this was 4 cents per share better than had been anticipated.

Now we can look at Vafi’s recent comments, and see why he believes this stock makes a solid portfolio addition for tech investors. “While enterprises remain in caution mode given the macro, the customer service function remains strategic, and with cuts already made to these budgets in 2023, we don’t see much more potential downside in 2024,” the analyst explained. “With this backdrop in mind, we cannot help but remain encouraged by TTEC’s value proposition. Coming out of the pandemic, the massive shift to e-commerce underscored the imminency of virtual customer care. This, combined with enterprises ‘raising the white flag’ on their own captive efforts here, has held to a TAM shift to service providers that has not been at this magnitude for at least several decades, in our view. And as a higher value, versus cost-leading player, we think TTEC is set to capture more than its share, especially with newer, higher-growth brands.”

The 5-star analyst quantifies his stance with a Buy rating and a $30 price target. His price target shows his confidence in a ~47% upside on the one-year time horizon.

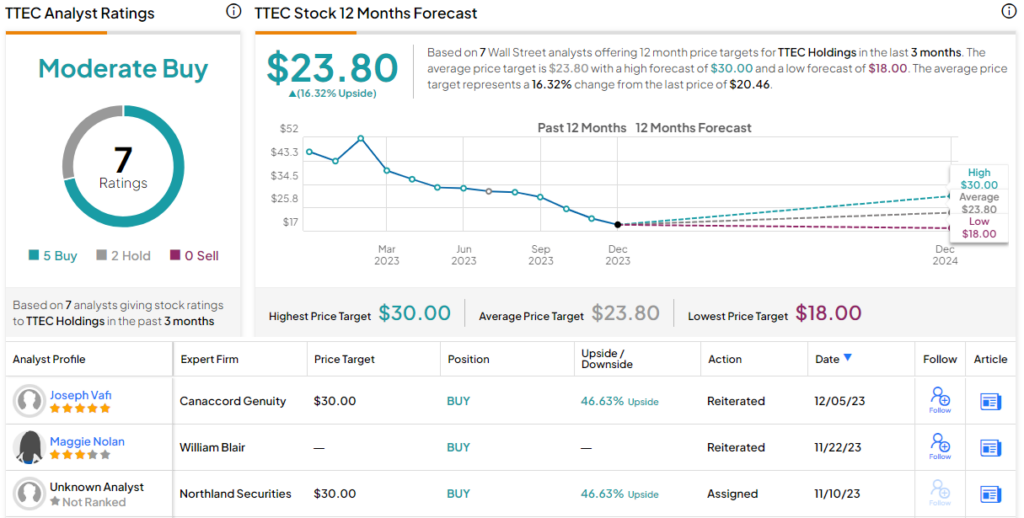

With 5 Buy ratings and 2 Holds on record, TTEC shares have a Moderate Buy consensus rating from the Street’s analysts. The current trading price here is $20.46, and the average target price of $23.80 suggests the stock will gain 16% in the next 12 months. (See TTEC Holdings’ stock forecast.)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.