It’s the sort of activity that takes place across every industry at the start of the year, be it entertainment, sports or indeed in the investment game: top pick lists. Everyone is looking for the next big thing and on Wall Street that involves pointing out the best stock investing opportunities for the year ahead.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

TC Cowen has been putting together just such a list, and one sector they focus on particularly is finance. The investment bank takes a broad view of the financial sector, and is looking at retail brokers, traditional asset managers, and alternative asset managers.

In a write-up of the firm’s coverage, describing its angle and outlook, 5-star analyst Bill Katz writes, “We are particularly bullish on companies with exposure to retail democratization, building capital markets upturn, upside earnings surprise, and special situations.”

But which stocks should those be? To shed light on this, we’ve closely examined his top stock picks for the year. With help from the TipRanks database, we can also find out what the rest of the Street makes of their prospects. Let’s delve into the specifics.

Stifel Financial Corporation (SF)

First up is Stifel Financial, an independent investment bank with a high reputation for the quality of its research work. Stifel operates as a retail broker, and also offers a full range of financial services, including wealth and asset management, and conducts its operations on the customer-facing end through a network of several subsidiary firms, each wholly-owned. The company boasts a market cap of ~$7.5 billion.

Stifel splits its financial services into several broad categories, including individual and family wealth management, institutional banking services, and commercial and retail lending services. Customers of all stripes can find the services they need here, everything from strategic planning for personal finances to institutional security brokerage services to small business loans and mortgages. The firm managed client assets totaling $412.5 billion at the end of 3Q23, the last reported, for a 13% year-over-year increase.

The company’s activities generate considerable revenue, which reached $1.05 billion as of September 30 last year. This figure was flat from the prior year, and came in $20 million below the estimates. Notable among the company’s quarterly statistics was the net interest income, which was up 17% y/y to $40.2 million.

Stifel’s bottom line earnings, the non-GAAP EPS, came to 60 cents per diluted share. This was a sharp drop from the prior-year quarter, when the equivalent figure was $1.29, and it missed the forecast by 69 cents as well. Management attributed the drop in earnings to a one-time legal accrual due to an industry-wide SEC review, and noted that, without those non-recurring charges, earnings were consistent with prior quarters.

Elsewhere, Stifel has been keeping up regular dividend payments since 2017, with the last declaration being for 36 cents per common share. The dividend was paid out on December 15; its annualized rate of $1.44 per common share gives a yield of 2.05%. The dividend is complemented by an active share repurchase program, under which the company bought back $118.8 million worth of common shares during 3Q23.

Ready access to capital and a solid return to shareholders form the center of analyst Bill Katz’s commentary on Stifel. He writes, “While not immune to Net Interest Margin (NIM) pressure due to declining interest rate expectations, we expect NII to remain relatively stable, with an upward bias. However, the more impactful story on SF will center on three key drivers, we believe: 1) we see SF well positioned to participate in upturn in capital markets, with high incremental margins; 2) we see several favorable capital deployment opportunities – notably elevated repurchase, potentially faster than modeled IEA upturn and eventually strategic M&A; and 3) tactically, we also think Street estimates may be increasingly undershooting on earnings power given shifting P&L drivers. SF is our favored retail B/D (broker-dealer) selection for ’24.”

Tracking forward from there, Katz rates SF shares as Outperform (Buy), and his $83 price target suggests an 18% gain in the next 12 months.

This multinational banking firm gets a Moderate Buy consensus rating from the Street, based on an even split in the 6 recent analyst reviews – 3 to Buy, 3 to Hold. The stock is priced at $70.14, and its $72.83 average price target points toward a modest 4% upside potential for the next year. (See SF stock forecast)

AllianceBernstein (AB)

The second stock we’ll turn to on our list of Cowen’s ‘top picks’ is AllianceBernstein, from Cowen’s coverage of traditional asset managers. AllianceBernstein provides a combination of research and management services for institutional and retail investors, as well as high-net-worth individuals. The company operates as three fully complementary businesses, each catering to a distinct client need: AllianceBernstein, the umbrella name and asset management service, Private Wealth Management, and Bernstein Research.

The company claims more than 4,600 employees in 54 locations across 27 separate countries and jurisdictions. Together, these people and offices manage a ~$3.5 billion firm with $696 billion in total assets under management as of November 30. That $696 billion in AUM was up from the $652 billion reported on October 31, an increase of 2.6% over one month.

Overall, AllianceBernstein’s activities generated $1.03 billion in total revenue during 3Q23, the last reported quarter, a total that was up 4.4% year-over-year and beat the forecast by $190.05 million. This revenue supported a non-GAAP income of 65 cents per diluted share, an EPS that was up 4 cents y/y and was 3 cents better than had been expected. The company’s EPS fully covered the regular share dividend, which was last declared in October for 65 cents per common share and paid out on November 22. The annualized payment of $2.60 per common share gives a solid yield of 8.36%.

This asset manager’s combination of a sound business plan and profitable capital returns caught analyst Katz’s attention. In the Cowen paper, Katz writes of AB, “Like many peers, AB is navigating several strategic changes to reposition into faster growth, higher margin outcomes though we believe management is further along in such repositioning, with superior execution to date. We see sustained pathway to above trend NNA (net new assets), improving base fee rate(s), improving business mix and step up in profitability – all of which should pace further P/U multiple expansion, in our view.”

The analyst sums up by laying out a clear path forward for the stock: “No question, AB’s MLP structure – and high inside ownership – likely reduces institutional investor interest, though quickly shifting interest rates backdrop may enhance high distribution yield relative appeal. We see clear, identifiable milestones over the next six to 18 months that should help AB outperform the sector.”

Altogether, this stance comes down to an Outperform (Buy) rating, while Katz’s price target, which he has set at $36, implies the stock will appreciate by 16% on the one-year horizon.

The 5 recent analyst reviews on AllianceBernstein include 4 to Buy against just 1 to Hold, for a Strong Buy consensus rating. The shares have a $31.10 current trading price and the $35.50 average price target points toward a 14% gain from that level. (See AllianceBernstein’s stock forecast)

Apollo Global Management LLC (APO)

The last stock we’ll look at is the alternative asset manager in Cowen’s coverage universe, Apollo Global Management. This is a large-cap stock, with a market cap value of almost $54 billion. The company invests in multiple assets classes, including credit, equity, and real estate, and gives especial focus to the private investment grade and fixed income markets. Apollo has set itself a goal of becoming a leading provider of capital solutions for its client companies.

Strategy-wise, Apollo has made private equity its cornerstone approach for over 30 years. The company’s basic strategy is designed to be flexible, on the idea that no one size will fit all clients. The company’s private equity segment includes investments in over 190 client firms, and totals $76.8 billion in assets under management. Overall, Apollo has invested in more than 300 companies since its 1990 founding, and currently holds some $631 billion in total assets under management.

Looking at Apollo’s financial results, we find that the company reported $2.59 billion in revenues for 3Q23. This was down almost 13% y/y, but was also an impressive $1.78 billion better than the forecast. The company’s GAAP earnings per share came to $1.10.

Of particular note in Apollo’s earnings results, the fee related earnings (FRE) came to $472 million, boosted by a combination of management fee growth and record fees in quarterly capital solutions. This was complemented by $873 million spread related earnings (SRE), which found support in organic growth and new business profitability. Between them, the FRE and SRE came to more than $1.3 billion.

When we turn to the Cowen view, we find analyst Katz upbeat on Apollo’s potential to goose gains going forward. He writes of the company, “Cognizant of strong stock price appreciation off 2023 lows, we see further room for appreciation reflecting strong fundamentals, upside to ’26 key financial metrics, capital return optionality and potential SPX inclusion. We also see opportunity for further modest P/DE revaluation given strong execution and relative multiples elsewhere among large(r) cap Alternatives – though underlying earnings mix may cap expansion.”

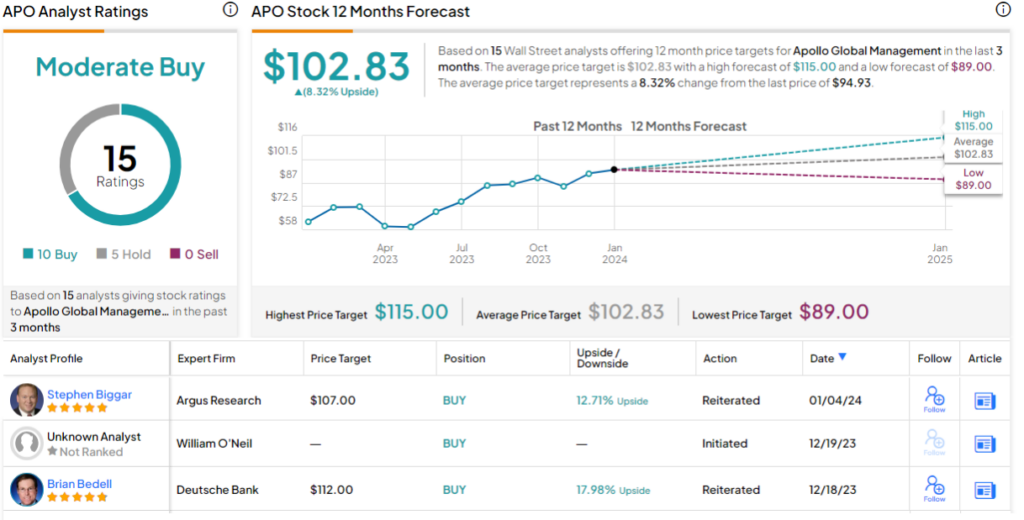

Katz goes on to put an Outperform (Buy) rating on APO, while giving the stock a $115 price target that shows his confidence in a 21% one-year upside potential.

These shares have 15 recent analyst reviews, and the 10 to 5 breakdown favors Buys over Holds for a Moderate Buy consensus rating. The shares are trading for $94.93 and the average price target, at $102.83, implies an upside of 8% for the next year. (See APO stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.