Following a strong earnings report – such as the one that chip contract manufacturing and design specialist Taiwan Semiconductor (NYSE:TSM) delivered last week – it’s not unusual to see a pullback. Call it the buy-the-rumor, sell-the-news effect. Basically, investors ought to capitalize on the hype rather than the underlying substance. However, because of the rising importance of generative AI, this aphorism might not hold for TSM stock. Instead, I’m bullish on TSM as the AI hype train continues to steam ahead.

TSM Stock May Prove to be Too Important to Sell

At first glance, the idea of selling TSM stock is tempting, not because of deep-seated fundamental concerns but rather the ebb and flow of the post-pandemic market. Last year, investors avoided a much-dreaded recession. With TSM popping up over 12% last week, it seems appropriate to rotate into a fresh opportunity.

After all, its 52-week gain of 20% is largely due to the strong earnings print. With questions about what may happen in 2024, TSM stock might be overstretched. Then again, a new AI-based framework suggests sticking with Taiwan Semiconductor may be a prudent idea.

First, the earnings print itself was credible. In the company’s fourth quarter, the semiconductor specialist posted earnings per share of $1.44. While this figure represented a 19.3% year-over-year decline, it beat the consensus estimate of $1.39 per share. On the top line, TSMC posted sales of $19.62 billion, down 1.5% year-over-year but quite close to the $19.68 billion target.

Second, and more importantly, the details of the earnings print facilitate confidence in TSM stock. According to TipRanks reporter Shrilekha Pethe, “In Q4, 3nm (nanometer) wafers made up 15% of the company’s total revenues, 5nm chips made up 35%, and 7nm comprised 17%. In total, these advanced technologies chips made up 67% of TSMC’s wafer revenue.”

Of course, the critical takeaway here is that these represent the processor categories that power intensive generative-AI-focused applications. According to Bloomberg, generative AI could become a $1.3 trillion market by 2032. If so, that would represent a trailing-10-year compound annual growth rate (CAGR) of 42% from the 2022 starting period.

Because digital intelligence is in such high demand, TSMC’s leadership team is confident that it can meet its ambitious first-quarter financial targets. Thus, simply avoiding TSM stock on the basis of its market success leading to a potential correction may not be the most well-reasoned thesis.

Curious Options Trades Warrant a Closer Look

According to TipRanks’ unusual options activity screener, on January 18, it recorded 50 unusual transactions. Most remarkably, all 50 of them featured bullish sentiment — either bought calls or sold puts. With everyone on that particular day placing optimistic bets on TSM stock, contrarians may be tempted to consider the other side of the wager.

In many ways, the long-side wager is the favorite to win the upcoming game. However, oddsmakers or bookies need people to take the other side of the bet to balance the books. Therefore, bookies can sweeten the deal through spreads that favor the underdog.

A similar thought process goes on in the capital markets. Sometimes, it’s just not advantageous to bet alongside everyone else. Sure enough, traders prior to and after TSMC’s earnings report went against the grain, betting against TSM stock.

Perhaps the one trade that stood out was the TSM Apr 19 ’24 105.00 put. On January 19, a major trader (or traders) bought 2,097 contracts of this put option, paying a premium of $524,000. To quickly recap, put options give holders the right (but not the obligation) to sell the underlying security at the listed strike price.

True, TSM stock would only need to fall 8% from where it stands now for the put option to be at the money. However, the half-a-million dollars used to initiate this transaction could evaporate if shares stay elevated. And that’s not an unrealistic proposition.

According to McKinsey & Company, generative AI’s impact on productivity could add trillions of dollars in value to the global economy – perhaps the equivalent of $2.6 trillion to $4.4 trillion worth. By comparison, the U.K.’s entire GDP in 2021 was $3.1 trillion.

With AI-focused demand set to skyrocket, betting against TSM stock is risky.

Attractive Multiple Also Supports the Bullish Cause

Another factor that could help TSM stock overcome the naysayers is the attractive multiple. Despite a relatively strong earnings print, shares trade at a trailing-year earnings multiple of 22.3x. That’s below the semiconductor sector’s average multiple of 30.6x. Further, the stock’s forward earnings multiple sits at 18.4x.

It’s also important to note that the low valuation isn’t just an arithmetic trick. Rather, it’s backed by solid metrics. For instance, TSMC’s return on invested capital (ROIC) stands at 21.04% on a trailing-12-month (TTM) basis. That’s significantly higher than the 2.6% average ROIC for the semiconductor market. Thus, TSM’s discount is a credible one.

Is TSM Stock a Buy, According to Analysts?

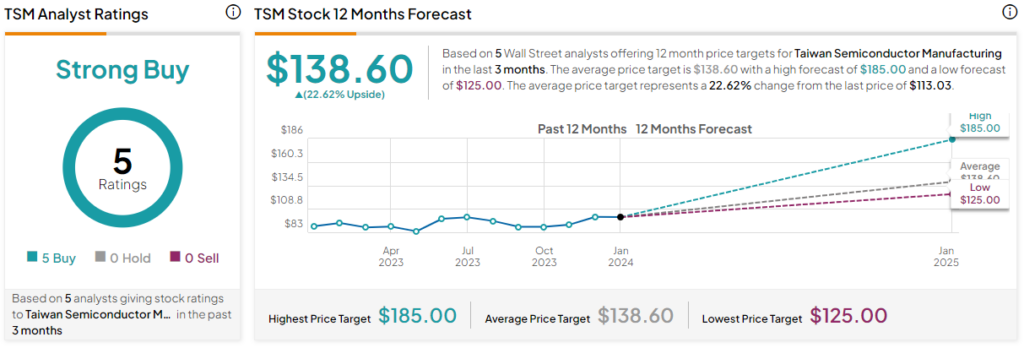

Turning to Wall Street, TSM stock has a Strong Buy consensus rating based on five Buys, no Holds, and zero Sell ratings. The average TSM stock price target is $138.60, implying 22.6% upside potential.

The Takeaway: Don’t Jump Ship from TSM Stock Just Yet

Given TSM stock’s strong performance following the company’s earnings report, it’s tempting to pocket the profits and rotate into another compelling opportunity. Even options traders have taken large bearish bets on TSM stock. However, because of the tremendous demand for generative AI applications, advanced semiconductor products will likely rise in prominence. Adding to this, TSM stock trades at a reasonable valuation. All things considered, investors shouldn’t feel pressured to abandon TSM.