Chip giant TSMC (NYSE:TSM) gained in pre-market trading after the company reported fourth-quarter earnings of $1.44 per ADR unit. Although this was a decline of 19.3% year-over-year, it still surpassed consensus estimates of $1.39 per share.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The company generated fourth-quarter revenues of $19.62 billion, a decline of 1.5% year-over-year. Analysts were expecting revenues of $19.68 billion.

In Q4, 3nm (nanometer) wafers made up 15% of the company’s total revenues, 5nm chips made up 35%, and 7nm comprised 17%. In total, these advanced technologies chips made up 67% of TSMC’s wafer revenue.

Looking forward, the company’s management expects the first quarter of 2024 to be affected by smartphone seasonality. TSMC expects to generate revenues between $18 billion and $18.8 billion in the first quarter of FY24, a projected growth rate of 20% year-over-year. TSMC expects its capital expenditure in FY24 to be in the range of $28 billion to $32 billion.

TSM also plans to expand its global footprint with the construction of its fab in Germany, which is projected to begin in the fourth quarter of this year. However, the company has delayed volume production at its Arizona facility in the U.S. to 2027 or 2028.

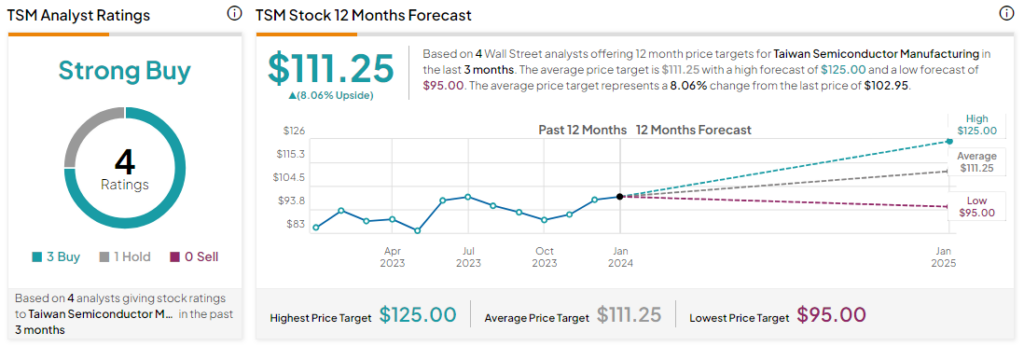

Is TSM a Buy or Sell?

Analysts remain bullish about TSM stock with a Strong Buy consensus rating based on three Buys and one Hold. Over the past year, TSM stock has gained by more than 15%, and the average TSM price target of $111.25 implies an upside potential of 8.1% at current levels.