Space-related stocks like Virgin Galactic (NYSE:SPCE), Rocket Lab (NASDAQ:RKLB), and Planet Labs PBC (NYSE:PL) have lost substantial value and eroded shareholders’ wealth. While they have become penny stocks (learn more about penny stocks here), analysts see significant upside potential in PL and RKLB. However, the Street is bearish about SPCE’s prospects.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

With this backdrop, let’s delve deeper.

Is Virgin Galactic Buy, Hold, Sell?

Virgin Galactic stock has dropped by over 59% over the past year. Further, SPCE stock has lost over 37% of its value so far this year. Despite this notable drop in the share price of this aerospace and space travel company, analysts hold a pessimistic view of SPCE stock.

While Virgin Galactic has completed six human spaceflights in six months and is likely to benefit from its cost-saving initiatives, concerns about cash burn and profitability remain a drag. Moreover, the company confirmed that the production schedule for the Delta Class spaceships remains on track for revenue service in 2026. This adds uncertainty over the pricing and margins of the company over the next couple of years and could limit the recovery.

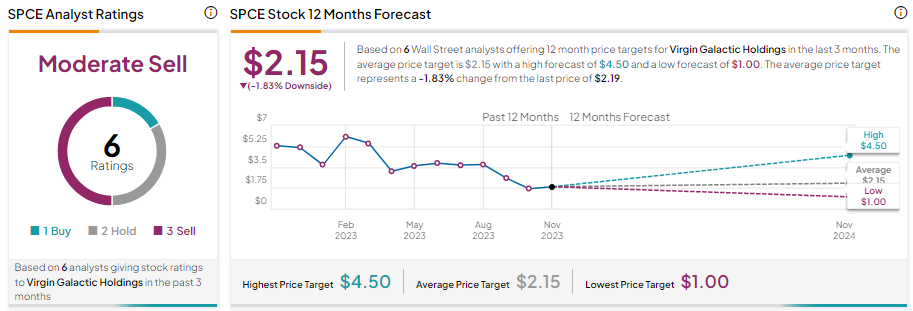

Given the pressure on earnings, Virgin Galactic stock has a Moderate Sell consensus rating on TipRanks, reflecting one Buy, two Hold, and three Sell recommendations. Further, the average SPCE stock price target of $2.15 implies a 1.83% downside potential from current levels.

Is Rocket Lab a Buy or Sell?

Rocket Lab stock has dropped quite a lot in the past three months. Nonetheless, its shares are still trading in the green year-to-date. The company, which specializes in rocket launch services, is under pressure due to postponing a previously scheduled Electron mission. The delay in launch adversely impacted its revenue and margins.

While the delay in the Electron mission poses short-term challenges, the company’s solid history of successful launches, increase in launch bookings, and ability to lower costs keep analysts cautiously optimistic about its prospects.

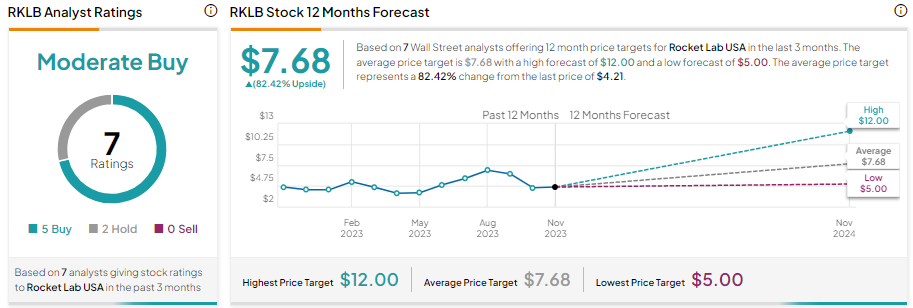

In summary, Rocket Lab stock has a Moderate Buy consensus rating based on five Buy and two Hold recommendations. Further, the analysts’ average RKLB stock price target of $7.68 suggests 82.42% upside potential from current levels.

What is the Forecast for PL Stock?

Planet Labs PBC stock has lost over 50% of its value over the past year. The company, which provides daily data and insights about Earth, is under pressure due to the elongated sales cycles amid macro uncertainty and tough year-over-year comparisons.

Nevertheless, the large addressable market, increase in remaining performance obligations (which indicates higher future revenue growth), and high-value contracts with government customers augur well for growth. Further, the company’s focus on driving durable revenue growth and building a high-margin business supports its bull case.

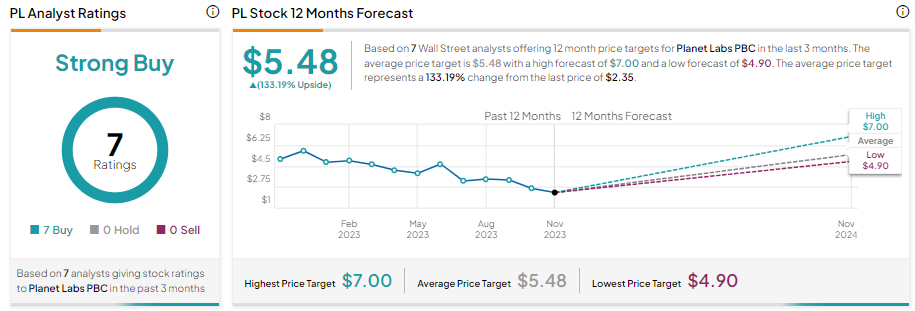

With seven unanimous Buy recommendations, Planet Labs stock has a Strong Buy consensus rating. Furthermore, the average PL stock price target of $5.48 suggests 133.19% upside potential from current levels.

Bottom Line

Though SPCE, RKLB, and PL have unique business models and could deliver strong returns in the long run, the near-term headwinds have weighed on their share prices. However, analysts are more bullish about Planet Labs stocks. Further, Planet Labs offers a higher upside potential (based on analysts’ average price target) compared to Virgin Galactic and Rocket Lab stocks from their current levels.