Rocket Lab (NASDAQ:RKLB) has adjusted its Q3 revenue forecast downward following a failed Electron mission on September 19. The space company, specializing in launch services, spacecraft components, and various space-related solutions, announced that it has postponed a previously scheduled Electron mission, initially slated for launch by the end of the third quarter.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

These Electron missions are designed to deliver small satellites to precise and unique orbits.

The company now expects its Launch Services revenue to be in the range of $66 million to $68 million, down from its earlier forecast of $73 million to $77 million. Furthermore, Space Systems revenue is now projected to be $22 million, down from the previous guidance of $30 million for Q3.

The downward revision in revenue is likely to weigh on its margins. Rocket Lab expects its adjusted gross margin to be 26-28%, about 200 basis points lower than its previous outlook.

Nonetheless, the company has a proven track record with 37 successful Electron missions under its belt and has successfully deployed 171 satellites into orbit. With several Electron launch vehicles currently in production, Rocket Lab is well-positioned to resume operations once investigations are concluded. With this backdrop, let’s look at what the Street recommends for RKLB stock.

What is the Future of RKLB?

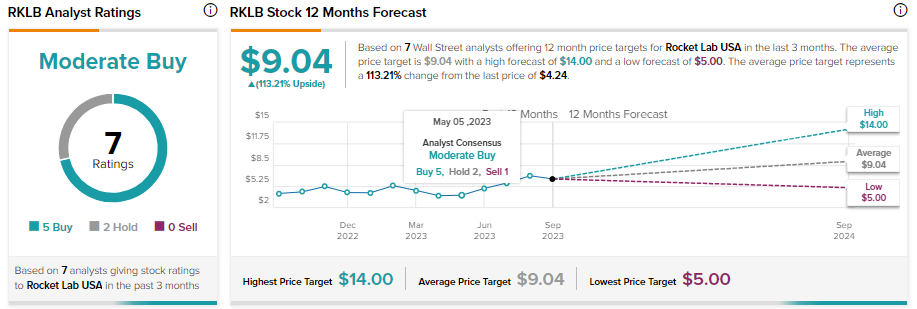

Wall Street analysts are cautiously optimistic about Rocket Lab stock. However, Wells Fargo analyst Matthew Akers and Citi analyst Jason Gursky lowered the price target on RKLB stock following the failure of the Electron mission.

Further, Rocket Lab stock has been trending lower since its founder and CEO, Peter Beck, sold 3.6 million shares (worth $22.3 million) earlier this month.

With five Buy and two Hold recommendations, RKLB stock has a Moderate Buy consensus rating. Further, due to the recent pullback, analysts’ average price target of $9.04 implies 113.21% upside potential from current levels.