SoftBank’s (SFTBY) Vision Fund, launched in 2016, is by far one of the biggest funds when one considers its size of $100 billion. With market gyrations, the fund’s fortunes have been on a rollercoaster.

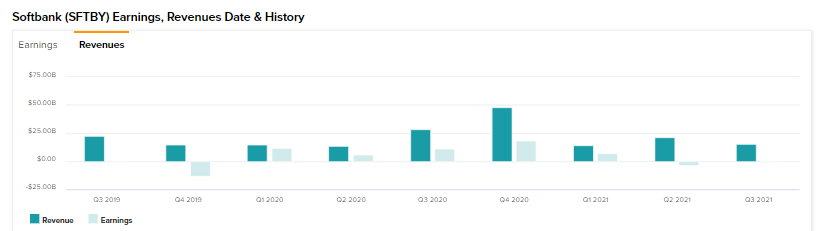

On May 12, amid the present turmoil in the broader markets, the Street estimates the company will post a net income of $181.72 million on revenue of $15.04 billion. In the comparable year-ago period, the company delivered a net income of $11.15 billion on revenue of $28.29 billion.

Bets That Did Not Deliver

As the Vision Fund rode the bubbling markets in the past years, it has been facing the brunt as companies’ valuations get marked down. Let us have a look at some of the major investments made by the fund and how they panned out.

In 2020, Softbank lost $17.7 billion owing to write downs on its investments in WeWork and Uber. Since then, Uber shares have nosedived from $63.18 in February 2021 to the current $23.29 levels.

The next major name is ride-hailing company DiDi, in which Masayoshi Son has picked up a 20% stake. Owing to regulatory actions in China, the company is delisting from the NYSE and listing in Hong Kong. From being listed at $15.53 in June 2021, DiDI shares now trade at $1.59. That’s a decline of 89.8%.

The other two major listed names in the portfolio, DoorDash and Coupang, are both down 44.8% and 71.3% in the past year as well. In contrast, in May 2021, SoftBank posted the biggest profit for a Japanese company of $45.9 billion in the fourth quarter.

Moreover, how valuations in the fund’s investments in the private space pan out, such as India’s Grofers, Oyo Rooms, and One97 Communications, also remains to be seen in the coming periods.

Earlier this year, in January, Rajeev Misra, SoftBank Vision fund CEO, had cautioned that private markets were getting frothier and should “rebalance” and that the “Gap between public and private markets is going to tighten over the next six months.“

Over the past 12 months, the market cap of SoftBank has dropped 59.5% to $63.09 billion!

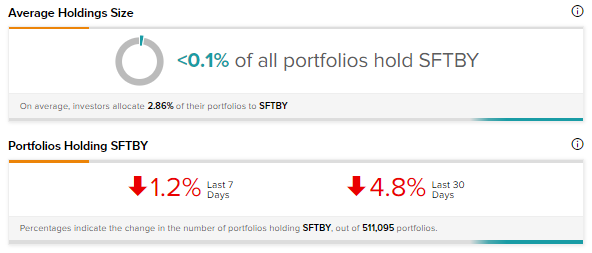

Investors Turn Cautious

TipRanks data indicates investor sentiment in the stock remains very negative. The number of portfolios holding SoftBank has decreased by 4.8% in the past 30 days alone.

Closing Note

The Vision Fund has taken massive bets in both private and public space. All eyes will be on tomorrow’s results to see how these bets pan out.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure

Related News:

Lemonade’s Q1 Results Were Sweet, but Outlook Leaves a Sour Taste

Why Did Palantir Stock Lose 21% on Monday?

Musk’s Twitter Offer is Risky, Says Activist Short-Seller