Shares of financial technology firm SoFi Technologies (SOFI) received a major boost on Wednesday, surging nearly 14% in a day. The surge followed the news that it had gained approval from the Federal Reserve and the OCC (Comptroller of the Currency) for a bank charter, with the acquisition of community bank Golden Pacific Bancorp. Indeed, the big regulatory hurdle has been passed, and investors are undoubtedly excited, as SoFi stock lifted off during an ugly day on the Street for tech stocks.

With SoFi given the green light to become a U.S. bank, many windows of opportunity have been open for the personal finance firm to broaden its offerings and take its growth to the next level. Undoubtedly, SoFi has already become so much more than just a means to refinance student loans. After hitting a big spot with younger consumers, most notably millennials, the neobank is ready to push into new waters with a potential edge over its traditional peers in the banking space.

Although I’m no fan of buying into a stock after a double-digit percentage move higher, I can’t help but be anything but bullish on the stock, even in the face of further tech-targeted volatility.

SoFi: This Neobank Play Broadens its Focus; Sets Sights on the Bigger Fish

Indeed, there have been a lot of tech-savvy firms taking a step back to consider the bigger picture (think Meta Platforms (FB) and its focus on the metaverse rather than just social media, or Block (SQ) and its focus on broader opportunities in payments). SoFi looks to be doing the same thing, and with its major regulatory step forward, the company seems ready to take its growth to the next level.

Indeed, SoFi may have already been viewed as a worthy bank challenger with a tech focus. Now, the fintech up-and-comer seems poised to make its big bank rivals really sweat.

Last year, JPMorgan (JPM) CEO Jamie Dimon remarked on the “enormous competitive” threat fintech firms posed to the big banks. More recently, Dimon voiced his desire for greater regulation of the fast-rising disruptive fintech players. Undoubtedly, SoFi just passed a significant roadblock and looks more than willing to jump past any others, en route to becoming a greater force in the banking scene.

With its tech expertise and willingness to offer consumers an incredible experience and value proposition, the banking sector finally looks ready for a long-overdue transformation. Either the big banks will need to pivot accordingly, or they will run the risk of losing traction to hungry neobanks like SoFi.

Wall Street’s Take

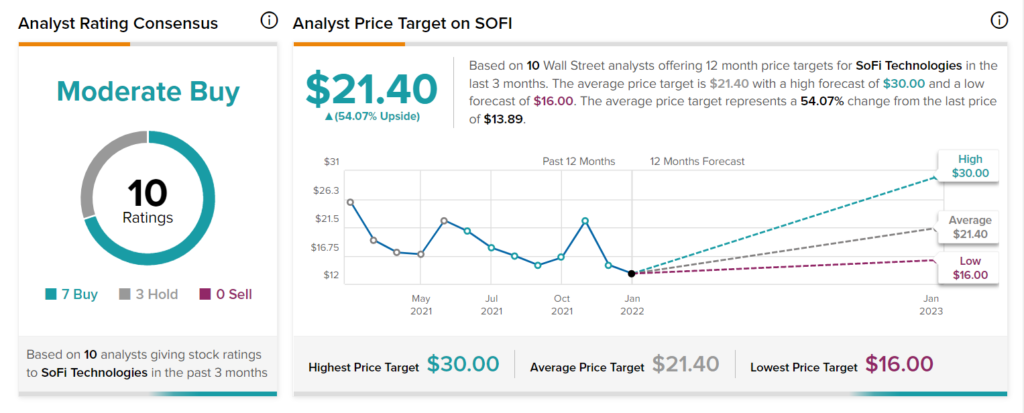

According to TipRanks’ consensus analyst rating, SOFI stock comes in as a Buy. Out of 10 analyst ratings, there are 7 Buy recommendations and 3 Hold recommendations.

As for price targets, the average SoFi price target is $21.40, implying an upside of 54%. Analyst price targets range from a low of $16.00 per share to a high of $30.00 per share.

The Bottom Line on SoFi Stock

Analysts applauded SoFi’s bank charter, enticing some to raise the bar on their price targets. Rosenblatt Securities increased its price target by $2 to $30 per share. With a consensus upside of above 50%, it’s hard not to be excited, even as tech falls further into its correction.

Amid such a tech-focused sell-off, the real question is whether SoFi can be an outlier that can outgrow its multiple in the face of potentially much higher rates. At over 11 times sales, SoFi stock isn’t cheap and sustained profitability could be a way off.

That said, the stock has already been cut in half from peak levels. Given the opportunity at hand and the presence of competent managers who are running the show, SoFi is definitely one of the more intriguing dip buys, following the fintech bloodbath.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure