With most precious metals rebounding late in 2023, South African gold miner Sibanye Stillwater (NYSE:SBSW) seemingly offered a viable upside opportunity. After all, the company doesn’t just focus on gold but other critical resources, including palladium. However, outside factors such as labor strikes have long dragged on the company. Also, palladium prices have dropped significantly in the past two years. Still, for speculators, the metal’s relevance could lead to an upswing in SBSW stock, making me bullish.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

SBSW Stock Struggles amid Steep Challenges

For those anticipating a recovery in precious metals in 2024, numerous other mining enterprises offer a more secure profile. To be 100% clear, SBSW stock belongs in the high-risk, high-reward category. Most notably, shares lost almost 50% of their equity value last year. That said, in the trailing month, Sibanye returned beleaguered stakeholders by nearly 22%. So, patience could turn out to be a virtue.

Still, prospective market participants must acknowledge the steep challenges impacting the business. As TipRanks contributor Steve Gray Booyens stated in June last year, the mining firm suffered from a flood, which stalled its Stillwater mine in Montana. As well, labor union strikes derailed many of the enterprise’s South African operations.

At the time, Booyens argued that because these headwinds faded, SBSW stock should start rallying. Unfortunately, investors continued to dump shares. Adding insult to injury, palladium prices dropped sharply late in 2023 due to prospects of a surplus in the new year. Unrelenting in bearishness, several experts warned that the rise of EVs could contribute to the supply glut.

Fundamentally, automotive demand makes up about 80% of total palladium demand. Specifically, automakers incorporate the metal into the manufacturing of catalytic converters (for combustion-powered vehicles). Of course, the problem is that EVs are rapidly becoming more popular. As sales of electric-powered cars rise, demand for new combustion cars fades. Understandably, then, this framework casts a dark cloud over SBSW stock.

Still, it’s important to note that the average age of passenger vehicles on U.S. roadways hit a record 12.5 years in 2023. In other words, economic woes continue to affect household demand for big-ticket items like EVs. Also, not everyone has access to convenient home-charging solutions. Therefore, the argument that EVs will soon dominate the roads isn’t clear-cut.

Geopolitics Could Favor Sibanye Stillwater

On another note, investors should realize that the EV transition isn’t a one-way street. According to one study, 26.3% of EV drivers went back to a gasoline-powered vehicle. To be fair, as battery technologies improve range, this reversion should decline. Still, the dynamic also demonstrates the hidden potential behind SBSW stock. Further, the EV rollout poses geopolitical nuances that could favor Sibanye.

Basically, EVs are easier to commoditize. Manufacturers don’t have to deal with the complexities associated with combustion engines. Frankly, that’s part of the reason why the Chinese dominate the EV market. Should the mobility medium become mainstream across the world, it’s doubtful that Western companies can keep up. China already has a sizable lead in production capacities and battery technologies.

When push comes to shove, it will be difficult for developed nations to beat Chinese labor costs. So, the more the world goes electric, the more China comes out ahead. That’s a geopolitical angle that international policymakers must consider, possibly extending a lifeline to the traditional auto industry.

Even if EVs continue to steamroll ahead, an alternative bullish argument for SBSW stock centers on clean energy solutions. Because palladium’s unique properties enable a strong affinity to hydrogen, the commodity may play a major role in practically every aspect of the projected hydrogen economy.

Here, too, geopolitics could favor SBSW stock for the long haul. With Russia showing no sign of slowing its invasion of Ukraine, it has effectively ostracized itself from Western economic partners. That automatically off-lines a huge chunk of the palladium supply. In turn, the more politically stable and palatable South Africa could step into Russia’s palladium role, possibly lifting Sibanye.

Valuation Presents a Vexing Profile

As stated earlier, SBSW stock represents a speculative investment – high risk in exchange for the possibility of high reward. Perhaps no other metric demonstrates this framework more than its valuation (on paper).

Currently, shares trade at a lowly trailing-year earnings multiple of 5.18x. In contrast, the gold-mining sector runs an average multiple of 31.53x. The sector for other industrial metals and mining comes in a bit lower at 24.23x. Either way, SBSW stock has these metrics “beat.”

Of course, the concern here is that Sibanye could be a value trap. Essentially, you’d be gambling on two narratives: first, that the EV market will slow down (which is not an entirely unrealistic proposition), and second, that other palladium-consuming industries will rise. Again, it’s risky, but the rewards could be gargantuan.

Is SBSW Stock a Buy, According to Analysts?

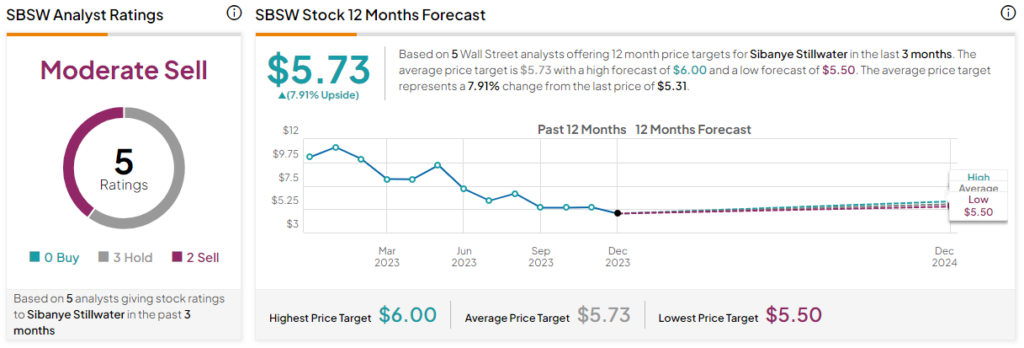

Turning to Wall Street, SBSW stock has a Moderate Sell consensus rating based on zero Buys, three Holds, and two Sell ratings. The average SBSW stock price target is $5.73, implying 7.9% upside potential.

The Takeaway: SBSW Stock is a High-Risk Contrarian Opportunity

Without question, Sibanye Stillwater presents a high-risk idea, but it’s also compelling. Should combustion-powered cars remain relevant for longer, and if green energy usage starts to consume more palladium, the current geopolitical environment could end up benefiting SBSW stock.