Undeniably, online used-car dealership Carvana (NYSE:CVNA) sparked an astonishing rally this year against wild odds. However, cracks are finally starting to appear in its seemingly impregnable armor. Amid recent analyst downgrades and unfavorable broader industry shifts, speculators need to be careful about excessive exposure. Therefore, I am bearish on CVNA stock.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Experts Weigh in on CVNA Stock

Since the start of the year, CVNA stock has managed to return 650%. Earlier this year, the financial narrative focused on its prolific cash burn as well as its massive debut accumulation. Therefore, bankruptcy hardly seemed a remote possibility. Still, speculation alone can’t sustain a fundamentally flawed enterprise, which is where the experts come in.

Late last week, Exane BNP Paribas analyst Chris Bottiglieri downgraded CVNA stock to Neutral from Outperform with a $37 price target. In particular, the market expert cited reduced confidence in unit growth. If so, Carvana shares will likely not be able to generate the robust returns that speculators have come to expect.

As anyone can see with the rise and fall of the original meme stocks, when sentiment fades for these high-risk wagers, the rush to the exits tends to be intense, and the main worry is that the dynamic will be permanent.

A little more than a week prior to Bottiglieri’s downgrade, JPMorgan analyst Rajat Gupta – while raising the price target on CVNA stock to $25 (from $20) – maintained an Underweight rating, the equivalent of a Sell. It’s also worth pointing out that the $25 target still represents 26% downside risk against last Friday’s closing price.

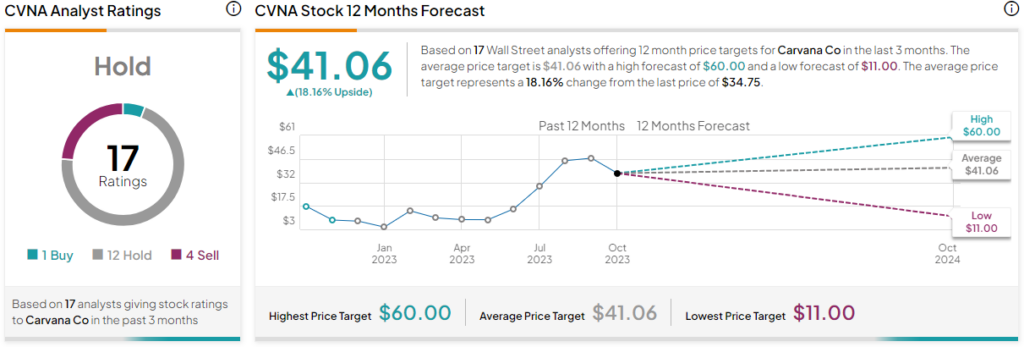

As well, within the past one-year period, only one analyst assigned a Buy rating for Carvana. Otherwise, the predominant sentiment – even with the skyrocketing of CVNA stock – has been the equivalent of a noncommittal Hold.

Fundamentals Cloud Carvana’s Narrative

In all fairness, while analysts’ opinions are important for their experience, acumen, and influence, they shouldn’t represent the sole catalyst for making an investment decision. They’re experts, but they’re also human. What truly makes CVNA stock a worrisome idea are the underlying fundamentals for the used-car retail segment. Basically, an influx of supply may put pressure on the industry.

According to a UBS report, analysts estimate that worldwide auto production may overtake sales in the sector by 6% this year. If so, that might yield an excess of five million vehicles that will probably require price cuts to avoid the prospect of sitting inventory. Further, the cuts may materialize in the back half of this year. What’s more, automakers are already preparing for a price war.

It’s not just empty speculation. Earlier this year, Tesla (NASDAQ:TSLA) began slashing prices on its popular EV models, leading to competitor responses. If such actions replicate themselves in the used-car market, only the stoutest enterprises will survive. That doesn’t describe Carvana, irrespective of its progress in the charts.

For example, in the second quarter of Fiscal 2023, Carvana posted total revenue of $1.96 billion, down heavily from the $3.88 billion posted in the year-ago quarter. However, when it came to the bottom line, it printed a net loss of $58 million.

Yes, the company sharply pared the net loss of $238 million from one year ago. Still, this is an enterprise that needs the winds to move with it, not against it. A price war that negatively affects industry profits simply isn’t what CVNA stock needs right now.

The Consumer Economy Doesn’t Help

Another factor that threatens the viability of CVNA stock is the underlying consumer economy. According to data from S&P Global Mobility, the average age of passenger vehicles on U.S. roadways hit 12.5 years this year, a new record. Further, the average age for sedans jumped to 13.6 years.

Facing a potential price war, Carvana must also manage a declining total addressable market. Due to broader economic pressures, people are determined to drive their cars until the wheels fall off. That mentality just won’t help CVNA stock.

Is CVNA Stock a Buy, According to Analysts?

Turning to Wall Street, CVNA stock has a Hold consensus rating based on one Buy, 12 Holds, and four Sell ratings. The average CVNA price target is $41.06, implying 18.2% upside potential.

The Takeaway: Time May Have Run Out for CVNA Stock

While Carvana’s stratospheric rise caught many observers by surprise, a flawed enterprise can only cheat gravity for so long. That seems to be the case with CVNA stock, which has seen its armor crack in recent sessions. Further, a potentially upcoming price war might put a cruel end to this automotive Cinderella tale.