Growth stocks have displayed stunning year-to-date performances, as conveyed by the S&P 500 Growth index’s near 17% year-to-date surge. However, few analysts and retail investors alike have taken notice of the re-emergence of cyclical value stocks. Broad-based value securities are up by north of 7% since the start of 2023, and cyclical value securities have even more potential; here’s why.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Cyclical Value in Today’s Market Climate

Unlike defensive value stocks that pay high dividends and are not influenced by the economic cycle, cyclical value stocks are secured by risky businesses exposed to seasonal industries. Therefore, cyclical value stocks are suitable for “market timers” that seek alpha-rich returns.

The reason why cyclical value stocks are attractive in today’s market primarily pertains to macroeconomic factors. More particularly, a structural break is occurring in the bond market, driven by an expected change in the interest rate cycle.

Although yet to be consolidated, factors such as narrowing credit spreads, a recent rise in long-dated bond yields, and receding inflation all suggest that a macroeconomic shift is imminent, which can provide substantial support to cyclical value stocks.

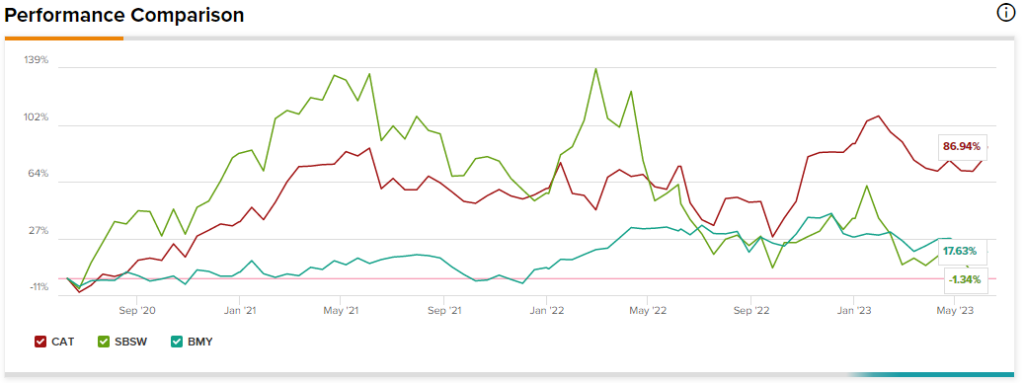

Three cyclical value stocks that I am bullish on are Caterpillar (NYSE:CAT), Sibanye-Stillwater (NYSE:SBSW), and Bristol-Myers Squibb (NYSE:BMY). If your outlook on the market concurs with mine, watch these three stocks closely, as they have the potential to skyrocket at any moment.

1. Caterpillar (NYSE:CAT)

Caterpillar is one of the first names that comes to mind when thinking about industrial equipment manufacturers. With a broad-based market share of more than 13%, the company possesses a market position allowing for price control over its consumers and input cost setting over its suppliers. Thus, Caterpillar operates at significant profit margins, helping it achieve a notable return on common equity figure of 40.4%.

In recent events, the company released its first-quarter earnings results, showcasing year-over-year sales growth of 17%, owing to an invigorating spending cycle within the construction industry. Moreover, the company streamlined its business model as it completed the divestment of its Longwall entity.

Despite the stock’s 8% month-over-month surge, its key valuation metrics imply that it remains in undervalued territory. For example, Caterpillar’s price-to-earnings ratio of 14.81 is at an 18% discount to its five-year average. In addition, Caterpillar’s EV/EBITDA multiple of 11.5 is lower than the sector average by about 3%.

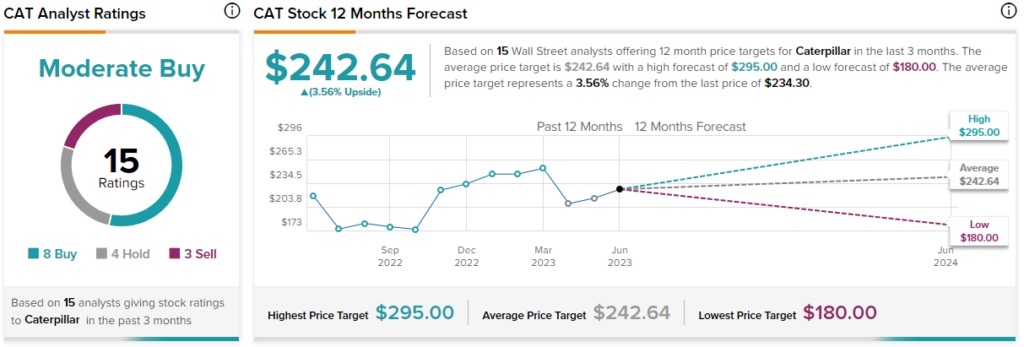

Is CAT Stock a Buy, According to Analysts?

Turning to Wall Street, Caterpillar earns a Moderate Buy consensus rating based on eight Buys, four Holds, and three Sells assigned in the past three months. CAT stock’s average price target of $242.64 implies 3.6% upside potential.

2. Sibanye-Stillwater (NYSE:SBSW)

Most modern resource investors are lithium-seeking. However, few consider the application of platinum group metals (PGMs) for industrial purposes, especially regarding renewable product development.

Sibanye-Stillwater is a South African PGM miner with a global presence. The company mines a quarter of its PGM basket in Yellowstone (in the U.S.) and the rest in Sub-Saharan Africa. Additionally, Sibanye has interests in other materials such as lithium, gold, and copper.

Perhaps more importantly, Sibanye Stillwater is dubbed to reach carbon neutrality sooner than its sector peers, which is forecasted to widen its existing operating profit margin of 23.5% even further. As a matter of fact, the company agreed to acquire South Africa’s largest private wind farm a week ago, illustrating the seriousness of the company’s strive toward self-sustaining energy.

A more holistic overview of the company shows just why it is widely touted to succeed in the coming years. Sibanye has grown its revenue at a 10-year compound annual growth rate of 23.65% while operating as one of the world’s top five value-based platinum producers. Some of the world’s leading investors are taking note of the firm’s stunning growth, with legendary investor Dr. Michael Burry adding 800,000 shares to his portfolio earlier this year.

Despite Sibanye’s impressive headline features, its stock has sustained a drawdown of approximately 38% in the past year after a flood stalled its Stillwater mine in Montana and labor union strikes derailed many of its South African operations. However, both issues have been resolved, presenting investors with the opportunity to snap up a stock trading below its 50-, 100-, and 200-day moving averages.

Is SBSW Stock a Buy, According to Analysts?

Turning to Wall Street, Sibanye-Stillwater earns a Moderate Buy consensus rating based on two Buys assigned in the past three months. SBSW stock’s average price target of $14.50 implies 100.4% upside potential.

3. Bristol-Myers Squibb (NYSE:BMY)

As per its industry classification, American pharmaceutical maker Bristol-Myers Squibb is a defensive value stock. However, the stock’s return distribution suggests otherwise, as it possesses a positive correlation to the economic cycle. Therefore, the stock is deemed a cyclical value play for the purposes of this article.

Bristol-Myers Squibb’s stock has drawn down by roughly 10% since the turn of the year, underperforming the S&P 500 (SPX) by approximately 22%. Nevertheless, a suppressed valuation and a few cataclysmic short-term events mean the stock is likely due for a sharp recovery.

In a recent occurrence, Bristol-Myers Squibb accepted its New Drug Application for repotrectinib, a tyrosine kinase inhibitor for lung cancer. The agency has assigned a Prescription Drug User Free Act to be reviewed on 27 November 2023. The event occurred a few weeks after Bristol-Myers Squibb received fast-track approval for its Milvexian, which is an oral factor XIa inhibitor being studied to prevent and treat major thrombotic conditions.

In other words, Bristol-Myers Squibb’s stock is receiving support from short-term events while the company is operating with a levered free cash flow margin of 27.49%, meaning that it is a robust company set for sustained growth.

Lastly, Bristol-Myers Squib is theoretically undervalued, with its price-to-earnings ratio of 8.36, sitting at a discount worth 25.36% compared to its five-year average. Moreover, its stock is trading below its 50-, 100-, and 200-day moving averages.

Is BMY Stock a Buy, According to Analysts?

Turning to Wall Street, Bristol-Myers Squibb earns a Moderate Buy consensus rating based on three Buys, three Holds, and one Sell assigned in the past three months. BMY stock’s average price target of $76.71 implies 18.4% upside potential.

Concluding Thoughts

Cyclical value stocks are back in play, as salient macroeconomic indicators indicate that a structural break is about to occur, which may give rise to cyclical stocks with suppressed valuations.

Based on TipRanks’ data and recent market events, Caterpillar, Sibanye-Stillwater, and Bristol-Myers Squibb might be among the primary breadwinners in the cyclical value space.