The stock market surged in 2023, and many investors are having difficulty finding value amid the myriad of stocks that are up significantly year-to-date. But there are still bargains to be had. If you’re looking for a steal, look no further than shares of Truist (NYSE:TFC), the U.S.’s seventh-largest bank.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Shares of Truist are down 11.4% year-to-date, during a time in which the S&P 500 (SPX) is up 24.8%, and the Nasdaq (NDX) is up 44.8%. Shares of Truist are also down about 30% from their 52-week high.

There is plenty of room for Truist to narrow the gap between its performance and that of the broader market in the year ahead. Based on its bargain valuation, substantial dividend yield, and diversified business model, I’m bullish on the stock, going forward.

Out of the Woods

Like many of its peers in the regional banking sector, Truist’s stock price slumped following the collapse of Silicon Valley Bank and several other regional banks.

However, we have emerged from the depths of the crisis without it spreading further, and many market observers believe that the Federal Reserve is finished with the interest rate hikes that have caught many regional banks offside. The Fed left interest rates unchanged at its most recent meeting, and many expect that they will remain unchanged after the January meeting. A few prognosticators even expect the Fed to pivot and cut rates in January, and 17 of 19 Fed policymakers see rates lower by the end of 2024.

Despite the banking crisis receding further into the rearview mirror and the likelihood that interest rates are stabilizing, these regional bank stocks have yet to recover fully, making Truist an intriguing value opportunity.

A Differentiated Regional Bank

Truist may be a regional bank, but this doesn’t mean it’s a sleepy, small-town bank. Truist was created when BB&T merged with SunTrust in 2019. This created a behemoth that is now the seventh-largest bank in the United States (by total assets). Truist offers various consumer and commercial banking services and has over 2,000 branches across 17 states, primarily in the eastern and southeastern U.S.

Aside from its scale, Truist is also differentiated in that it is engaged in various additional businesses outside the typical purview of regional banks, including investment banking, wealth and advisory services, and its digital lending platform (LightStream).

Truist is also involved in insurance and is the seventh-largest insurance broker in the world. Truist is in talks to sell this insurance business to a private equity company for $10 billion, a cash infusion that could bolster the bank’s balance sheet and lead to further returns to shareholders.

I like that its additional businesses give Truist additional ways to bring in revenue, diversify its business, and insulate it from some of the pressures facing the typical regional bank.

Inexpensive Valuation

Truist stock is remarkably cheap. The stock trades at just 0.9 times book value. This means that the stock trades at a 10% discount on what its net assets would be worth if it were to be liquidated today, giving investors a comfortable margin of safety when investing in the stock.

Furthermore, Truist looks cheap on a price-to-earnings basis, trading at just 9.7 times earnings, a significant discount to the broader market. For comparison, the S&P 500’s average valuation is currently 21.6 times earnings.

Reliable and Above-Average Dividend

In addition to this attractive valuation, Truist is also an attractive dividend stock. Shares currently yield 5.7%. This is a much higher yield than the broader market offers, as the S&P 500 currently yields 1.5%.

Furthermore, Truist has a proud history as a dividend stock. It has paid dividends to its shareholders for 26 straight years, and it has increased its payments for the last nine years in a row. Also, Truist’s payout ratio of roughly 50% implies that the dividend is safe for the time being.

Is TFC Stock a Buy, According to Analysts?

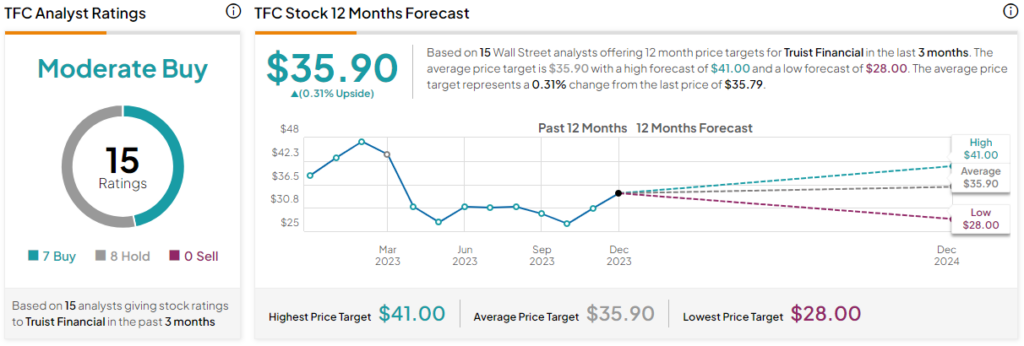

Meanwhile, analysts don’t see as much upside as I do. TFC earns a Moderate Buy consensus rating based on seven Buys, eight Holds, and zero Sell ratings assigned in the past three months. However, the average TFC stock price target of $35.90 implies just 0.3% upside potential.

Looking Ahead

The overall analyst community may not be enthused about Truist at the moment, but the stock has fans. Goldman Sachs (NYSE:GS) recently named Truist as one of its 2023 laggards that could lead the market higher during the first quarter of 2024. Odeon Capital recently upgraded Truist to Buy from Hold, while Bank of America (NYSE:BAC) maintained its Hold rating but increased its price target by $5 to $37.

Furthermore, legendary investor Bill Gross recently said that he believes the bottom is in for regional bank stocks and that those trading at discounts to book value and with high dividend yields, like Truist, are attractive. Gross said that he is buying shares of Truist as well as several other regional bank stocks like Citizens Financial (NYSE:CFG).

In conclusion, Truist stock is a bargain whether you are looking at it on a price-to-book basis or on a price-to-earnings basis. Add in the 5.7% dividend yield that pays investors as they wait for the stock to catch up with the broader market, and Truist looks like an attractive opportunity.