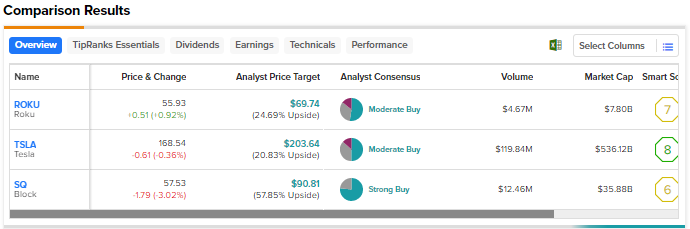

Several growth stocks have recovered this year despite continued macro uncertainty. Many investors are looking beyond near-term pressures to focus on long-term growth potential. Also, expectations about the federal reserve halting interest rate hikes going forward bode well for growth stocks. Bearing that in mind, we used TipRanks’ Stock Comparison Tool to place Roku (NASDAQ:ROKU), Tesla (NASDAQ:TSLA), and Block (NYSE:SQ) against each other to pick the most compelling growth stock as per Wall Street experts.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Roku (NASDAQ:ROKU)

Roku generates a significant portion of its revenue through advertising and content distribution services on its streaming platform. The company also sells streaming devices. Roku’s revenue grew 1% to $741 million in Q1 2023 and surpassed analysts’ estimates. It reported a lower-than-anticipated loss per share of $1.38, although losses widened considerably compared to $0.19 in the prior-year quarter.

The average revenue per user (ARPU) declined 5% year-over-year to $40.67. The company expects advertising spend to remain under pressure throughout this year due to macro challenges.

Is Roku a Good Stock to Buy?

Following the Q1 results in late April, Oppenheimer analyst Jason Helfstein maintained a Buy rating on Roku stock but lowered his price target to $75 from $85. Explaining his investment stance, the analyst stated that platform revenue has stabilized, with upcoming tailwinds from advertisers, agencies, retail media, and DSP integrations.

Given headwinds from slowing ad spend by subscription video on demand (SVOD) providers and higher “scatter market exposure,” Helfstein expects Roku to be one of the first beneficiaries of any recovery in the ad market.

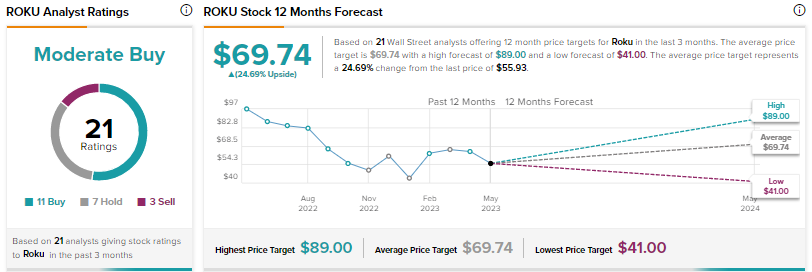

Wall Street’s Moderate Buy consensus rating on Roku is based on 11 Buys, seven Holds, and three Sells. The average price target of $69.74 implies about 25% upside.

Tesla (NASDAQ:TSLA)

Investors were unimpressed with Tesla’s first-quarter performance, as the company’s earnings declined due to the impact of price cuts on margins. The company also cited underutilization of new factories, higher raw material, commodity, logistics, and warranty costs, and lower revenue from environmental credits as the reasons for margin contraction.

During the Q1 earnings call, CEO Elon Musk justified the company’s pricing strategy, saying that a focus on higher volumes and a larger fleet is the “right choice” over lower volumes and higher margins. Musk expects Tesla’s vehicles to generate significant profit over time through its autonomy feature.

Following multiple price cuts, Tesla recently hiked the prices of several cars in the U.S., Canada, China, and Japan. Nonetheless, prices remain lower than the levels seen at the start of this year.

Is Tesla a Buy, Hold, or Sell?

Earlier this month, Piper Sandler analyst Alexander Potter lowered his price target to $280 from $300 but reiterated a Buy rating. The analyst reduced his 2023-2025 estimates to reflect price cuts and their impact on margins. While Potter agrees with management’s view that margins will eventually rise due to software, he contends that this won’t happen quickly enough to offset the near-term impact of lower prices, higher warranty costs, and slower inventory turnover.

On the positive side, Potter thinks that the global average selling price (ASP) could fall by ~$125 per unit every quarter for the next two years without hurting margins due to production credits under the Inflation Reduction Act.

Until margins and other fundamentals start improving, Potter believes that TSLA might struggle to “catch a bid.” Nevertheless, he remains bullish on the stock and expects investors to turn around in the second half of the year and beyond.

Wall Street’s Moderate Buy consensus rating on Tesla is based on 15 Buys, 12 Holds, and four Sells. The average price target of $202.15 suggests nearly 20% upside.

Block (NYSE:SQ)

Shares of fintech Block declined sharply in March after short-seller Hindenburg Research accused the company of inflating the number of users on its Cash App system. The company shook off these concerns by reporting better-than-expected Q1 2023 results last week.

Adjusted EPS jumped 122% to $0.40 in Q1 2023, driven by a 26% rise in revenue to about $5 billion and enhanced margins. Results gained from solid momentum in the company’s Cash App peer-to-peer ecosystem. Cash App’s gross profit increased 49% to $931 million. Meanwhile, Square, the company’s ecosystem focused on merchants, delivered a gross profit of $770 million, up 16% from the prior-year quarter.

Based on the gross profit momentum in Q1, the company increased its full-year adjusted EBITDA outlook to $1.36 billion from the previous guidance of $1.30 billion.

What is the Price Target for SQ Stock?

Following Block’s results, Needham analyst Mayank Tandon reiterated a Buy rating on the stock but lowered his price target to $80 from $95, given the lower market valuations for stocks in the payments space.

The analyst highlighted that Q1 results beat expectations because the robust momentum in the Cash App business offset softer seller trends as volumes faded during the quarter. Tandon remains positive on Block based on the company’s focus on driving profitable long-term growth and an expanding product suite as payments continue to shift to digital channels.

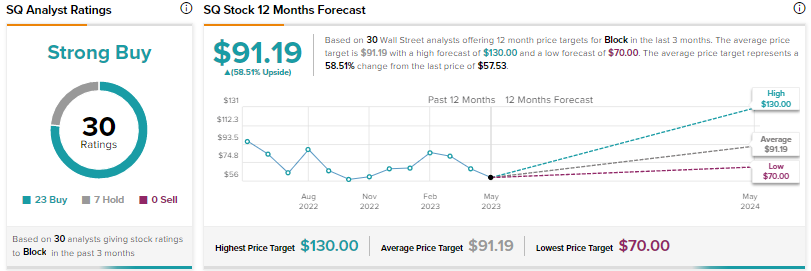

With 23 Buys and seven Holds, Square earns Wall Street’s Strong Buy consensus rating. At $91.19, the average price target suggests 58.5% upside.

Conclusion

Block shares have underperformed Tesla and Roku stocks so far this year. However, analysts are more bullish about Block and see higher upside potential in the stock compared to the other two growth stocks.