Block (NYSE:SQ) shares plunged about 15% on Thursday after short-seller Hindenburg Research made several allegations against the fintech giant. Hindenburg alleged that Block “highly” inflates Cash App’s transacting user base and the app grew by serving “unbanked” customers involved in criminal or illicit activity. Wall Street analysts gave mixed reactions, with some displaying complete faith in the Jack Dorsey-led company while others expressing certain concerns.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Block called Hindenburg’s report “factually inaccurate and misleading.” It intends to work with the Securities and Exchange Commission and explore legal action against Hindenburg.

Wall Street’s Reaction to Hindenburg Report

Bank of America analyst Jason Kupferberg feels that the short seller report on Block likely creates a “near-term overhang” on the stock. That said, he felt that shares are “likely oversold.” Kupferberg thinks that the allegations in the Hindenburg report do not suggest accounting fraud. Nonetheless, he acknowledges that like other peer-to-peer providers, Cash App continues to struggle in addressing illegal activities. Kupferberg reiterated a Buy rating on Block with a price target of $96.

Meanwhile, Atlantic Equities analyst Kunaal Malde downgraded Block to Hold from Buy, citing the growing uncertainty around Cash App. The analyst also expressed disappointment about the company’s initial response. “With valuation remaining high, we believe it is prudent to turn Neutral until we can get more comfort around sizing the exposure to these risk factors,” remarked Malde.

Citigroup analyst Peter Christiansen also felt that the company’s response should have been more detailed. Further, he believes that “exploring legal action” might not be enough to address investors’ concerns. Christiansen has a Buy rating and a price target of $90.

Wolfe Research analyst Darrin Peller, who has a Buy rating on Block, also opined that the company’s response to the Hindenburg report could have been more elaborate. The analyst understands that the company doesn’t want to give importance to short-seller reports. However, he feels that investors would welcome further details on monthly active users and the company’s know your customer (KYC) practices.

Robert W. Baird analyst David Koning stated that while he views Block shares as “good value,” he is concerned about the existence of any criminal activity and its potential impact on investor sentiment. Koning has a Buy rating on Block and a price target of $92.

Mizuho analyst Dan Dolev, who has a Buy rating on SQ, agrees that the short seller report did highlight some valid points, like the slowdown in inflows. However, certain other aspects like risks surrounding high, unregulated interchange fees are “well known” to investors.

Meanwhile, KeyBanc analyst Josh Beck supported Block, saying “In summary, we see no merit to the disparaging claims and rather view the report as observations from a relatively novice industry outsider who is not familiar with standard operating practices and principles within the FinTech industry or the broader regulatory construct.” Beck has a Buy rating on Block with a price target of $100.

Is Block a Buy Right Now?

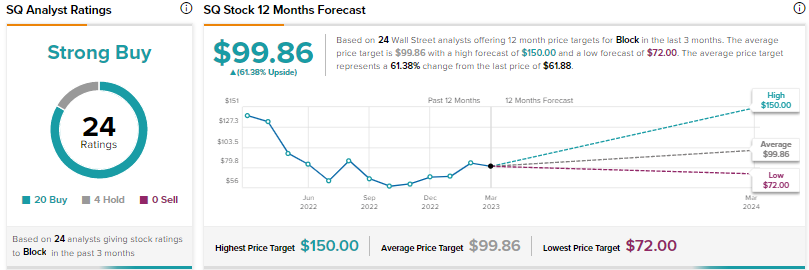

Overall, Wall Street has a Strong Buy consensus rating on Block based on 20 Buys and four Holds. The average SQ stock price target of $99.86 suggests 61.4% upside potential.

Conclusion

While several analysts reiterated a Buy rating on Block, many of them did express concerns about the aspects raised by Hindenburg regarding the Cash App. Moreover, some analysts felt that the company should have given a stronger response and addressed the allegations. Nevertheless, Hindenburg’s report might weigh on the shares over the near term.