Shares of Roku (NASDAQ:ROKU) surged in after-hours trading after the company reported earnings for its first quarter of Fiscal Year 2023. Earnings per share came in at -$1.38, which beat analysts’ consensus estimate of -$1.47 per share. Sales increased by 1% year-over-year, with revenue hitting $740.99 million. This beat analysts’ expectations of $707.59 million.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Roku’s segment data, meanwhile, offered up a mix of high and low points. For instance, platform revenue dropped 1% against this time last year, coming in at $635 million. Meanwhile, gross profit came in at $338 million, which was down 7% in that same time frame. Roku gained in active accounts, however, reaching 71.6 million. That increased by 1.6 million quarter-over-quarter. Total hours spent streaming were also up, reaching 25.1 billion versus 21.9 billion last year. Despite this, average revenue per user was $40.67, down 5% year-over-year and likely indicative of an advertiser pullback.

Ultimately, however, the Roku system proved to be the leading smart TV system in the United States, landing 43% of the market by itself. Management offered some future projections, looking for net revenue of around $770 million and a total gross profit of $335 million. It also looks for the second quarter advertising market to be about the same as the first.

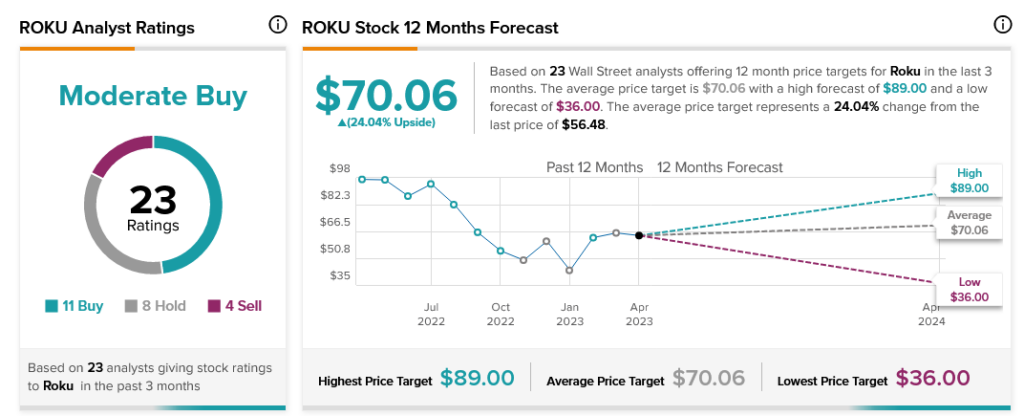

Overall, Wall Street has a consensus price target of $70.06 on Roku, implying 24.04% upside potential, as indicated by the graphic above.