Shares of Rivian Automotive (NASDAQ: RIVN), the new electric vehicle (EV) player on the block that was listed on the Nasdaq earlier this year tanked 17.4% in the past five days, following its Q3 results. The company’s third-quarter loss widened from $288 million to $1.2 billion, reflecting a loss per share of $12.21.

However, the EV maker generated total revenues of $1 million through its first customer deliveries of 11 R1Ts. R1T is the company’s two-row five-passenger pickup truck.

Retail investors remained bearish about the stock as Rivian also scaled down its production outlook for this year. As of December 15, the company had produced 652 R1 vehicles and delivered 386 of these vehicles. However, the company’s management stated on its Q3 earnings call that for 2021, it expects to fall short of its initial production target of 1,200.

Rivian’s management also stated that the rise in the production of three different vehicles is proving to be a challenge due to supply chain constraints, the COVID-19 pandemic, and a difficult labor market.

While Wells Fargo analyst Colin Langan was disappointed with the production delay, he said it was “hardly a surprise for a startup & does not change our long term view.”

The analyst remained neutral, with a price target of $110 (13.6% upside) on the stock.

But the company’s order pipeline remained robust and as of December 15, Rivian had 71,000 R1 preorders in the U.S. and Canada. The company is also targeting the commercial EV segment with its Electric Delivery Van (EDV) and also plans to launch its Commercial Van platform.

Amazon (AMZN) has proved to be Rivian’s first commercial customer, with an initial 100,000 orders for RIVN’s Electric Delivery Van (EDV) with an option to expand the agreement. Amazon is also a stakeholder in Rivian, with a 20.2% stake.

Considering this order pipeline, the company is in the process of scaling up its business and is in the process of establishing a second manufacturing plant in Georgia at an investment of $5 billion. RIVN anticipates manufacturing 400,000 vehicles every year at this facility. While construction of the facility is expected to start next year, production is expected to begin in 2024.

Rivian is also planning to scale up its manufacturing capacity at its existing plant in Normal, Illinois.

Analyst Langan slightly lowered his earnings estimate for 2021 from a negative $3.30 per share to a negative $3.45 per share “to reflect the Q3 miss vs. our estimate as well as a higher LCNRV [lower of cost or net realizable value] adjustment.”

LCNRV adjustment refers to the Generally Accepted Accounting Principles (GAAP) rule that inventory should be valued at its laid down cost or the amount at which the inventory can be sold, whichever is lesser.

The analyst also lowered the delivery forecast for Q4 from 1,010 vehicles to 851 vehicles due to the production delays.

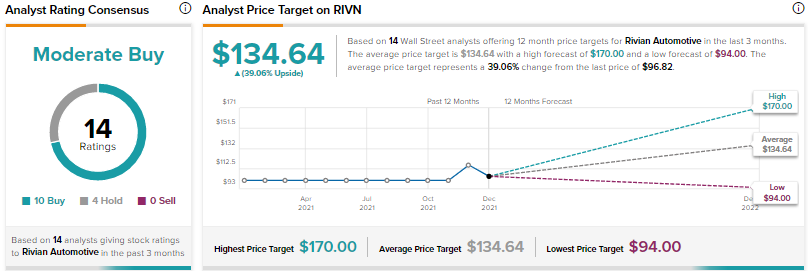

When it comes to analyst ratings, other analysts on the Street are cautiously optimistic about the stock, with a Moderate Buy consensus rating based on 10 Buys and 4 Holds. The average Rivian stock prediction of $134.64 implies upside potential of 39.1% to current levels.

Disclosure: At the time of publication, Shrilekha Pethe did not have a position in any of the securities mentioned in this article.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates. Read full disclaimer >