Are you worried about a stock market pullback and want to put a safe haven in your portfolio? Maybe you also like to collect quarterly dividend payments. Procter & Gamble (NYSE:PG) stock checks these boxes without sacrificing growth prospects for 2024. Without a doubt, I am bullish on PG stock and feel that it’s appropriate for any safety-minded investor.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

From toothpaste to laundry detergent and pain relief to skin care, Procter & Gamble provides a wide variety of personal goods. The brand names Tide, Pampers, Pepto-Bismol, and Old Spice all belong to Procter & Gamble.

Procter & Gamble stock is a sensible pick, but there will always be issues in the world to consider. For example, there were problems in Asia that Procter & Gamble encountered last quarter. Still, investors can be aware of these issues while also appreciating the growth, recession-resistance, and dividends that Procter & Gamble can offer.

Procter & Gamble: First, the Bad News

To be fair and balanced, I feel obligated to first present the challenges that Procter & Gamble faced in the company’s second quarter of Fiscal Year 2024, which ended on December 31. These issues are worth considering but still shouldn’t be deal-breakers, even if you’re a highly cautious investor.

First, Procter & Gamble wrote down (i.e., adjusted lower) the value of Gillette, the company’s razor brand, by $1.3 billion. That’s notable, but it shouldn’t be a huge shock to anyone who’s been following the news related to Procter & Gamble. In early December, Procter & Gamble warned that it would write down as much as $2.5 billion over two fiscal years, including the value of the company’s Gillette business.

Second, Procter & Gamble had some issues in Asia. According to a CNBC report, Japan “started releasing treated radioactive water into the Pacific Ocean” last year. Consequently, Chinese consumers boycotted some Japanese brands, including Procter & Gamble’s Japanese-produced SK-II skin-care product line.

This, I imagine, will be a temporary problem. Procter & Gamble CFO Andre Schulten assured, “Our consumer research indicates SK-II brand sentiment is improving, and we expect to see sequential improvement in the back half.” Hopefully, he’ll be right about that.

Why Procter & Gamble Stock Rallied Today

Now, you have a general idea of Procter & Gamble’s main issues, which may be temporary. So, let’s move on to the good news and why PG stock rallied 4.1% today.

It seems that the market was willing to look beyond Procter & Gamble’s aforementioned challenges and focus on the company’s impressive Fiscal Q2-2024 earnings performance. As it turned out, Procter & Gamble posted a quarterly EPS beat, reporting earnings of $1.83 per share, while Wall Street had only expected $1.72 per share. This was the company’s third consecutive earnings beat.

Turning to PG’s top-line results, one might complain that Procter & Gamble’s quarterly revenue of $21.44 billion missed the consensus forecast of $21.48 billion. However, that’s nitpicking, and I’d just say that this was basically an in-line result for Procter & Gamble.

I suspect that Procter & Gamble’s top-line performance would have been better if it weren’t for the company’s issues in Asia. Procter & Gamble’s CFO Andre Schulten seemed to acknowledge this, stating, “What we saw this quarter is very weak volumes in China driven by what we said all along, a bumpy recovery.”

Again, one might hope that Procter & Gamble’s problems in Asia will subside in the coming quarters. Referring to China’s market, Schulten predicted, “We expect volumes will continue to accelerate across the second half. We’re making progress.”

In the final analysis, you’ll want to think globally if you plan to invest in Procter & Gamble. To quote S&P Global Ratings analyst Amanda O’Neill, Procter & Gamble’s quarterly earnings were a “tale of two regional stories.” Procter & Gamble had issues in Asia but fared comparatively well elsewhere. Perhaps China’s “bumpy recovery” will smooth out in 2024.

Is PG Stock a Buy, According to Analysts?

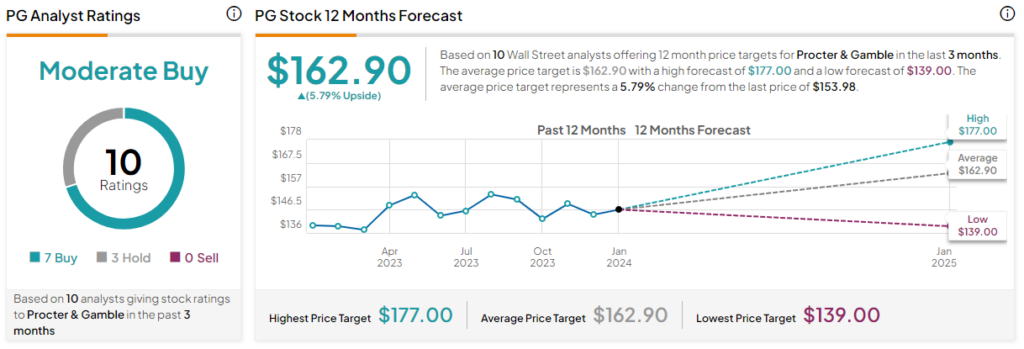

On TipRanks, PG comes in as a Moderate Buy based on seven Buys and three Hold ratings assigned by analysts in the past three months. The average Procter & Gamble price target is $162.90, implying 5.8% upside potential.

Conclusion: Should You Consider PG Stock?

Procter & Gamble, like all other global companies, will have to deal with problems on more than one continent. Nevertheless, Procter & Gamble stock remains a safe haven because its brands are famous and are generally considered necessities.

So, while Procter & Gamble addresses its issues abroad, investors can collect dividend payments from the company each and every quarter. Ultimately, I’m not too bothered by the challenges that Procter & Gamble will have to face as a global company, and I’m definitely considering PG stock for this year.