Procter & Gamble (NYSE:PG) shares jumped by nearly 5% in the opening session today after the branded consumer packaged goods major announced its results for the second quarter. Despite clocking a 3.2% year-over-year increase, revenue of $21.44 billion missed estimates by a thin margin of $40 million. EPS of $1.84, on the other hand, fared better than expectations by $0.14.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

During the quarter, organic sales rose by 4%, and core net earnings trended higher by 16%. Impressively, adjusted free cash flow productivity during this period came in at 95%. Further, lower organic shipment volumes in Q2 were offset by gains in pricing, with marked sales growth across Grooming, Fabric & Home Care, and Health Care segments.

Additionally, the company’s gross margin expanded by 520 basis points on the back of productivity savings and favorable commodity costs. Buoyed by this performance, P&G has raised its core EPS outlook for the full year. The company expects all-in sales growth for Fiscal Year 2024 to be in the range of 2% to 4%. Core net earnings per share growth is now anticipated between 8% to 9% versus the prior outlook of 6% to 9%. This translates into an EPS of between $6.37 to $6.43. Notably, the company expects to dole out dividends of over $9 billion and repurchase $5 billion to $6 billion worth of shares in 2024.

Is PG Stock a Good Buy?

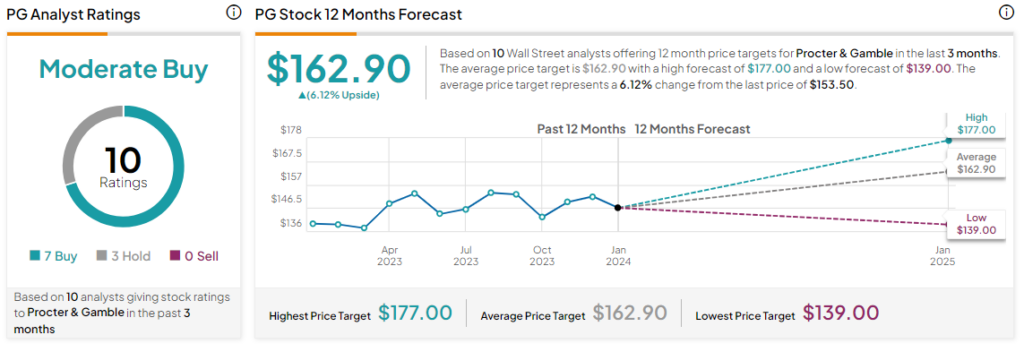

Overall, the Street has a Moderate Buy consensus rating on Procter & Gamble, and the average PG price target of $162.90 points to a 6.12% potential upside in the stock. That’s after a nearly 3.6% modest rise in the company’s share price over the past year.

Read full Disclosure