PayPal (NASDAQ:PYPL) stock is getting hammered, but I believe it’s now it’s trading at the right price for opportunistic investors. I am bullish on PYPL stock because the company’s quarterly results, while not perfect, were still pretty good, and the panic selling is unnecessary.

PayPal is a popular payments platform. Among other services, the company helps merchants provide point-of-sale payments. Generally, Wall Street’s experts are bullish on PYPL stock. For example, just a couple of weeks ago, BTIG analyst Lance Jessurun raised his price target on the stock from $85 to $90 and reiterated a Buy rating on PayPal shares.

However, the tide of sentiment can turn quickly in the financial markets. Now, all of a sudden, investors are overwhelmingly bearish about PayPal stock (though analysts might not be). Contrarian traders should consider whether the crowd is overreacting and whether now is the time to buy what others are selling.

PayPal Beats the Street, but the Stock Still Tanks

PayPal stock fell by over 12% today, the day after the company released its second-quarter 2023 earnings results. Does this mean that PayPal posted a slew of disappointing data points? Not at all – in actuality, the company beat analysts’ earnings expectations and provided plenty of fodder for the bulls.

For one thing, PayPal reported non-GAAP EPS of $1.16, while analysts had called for $1.15 per share. Furthermore, PayPal generated revenue of $7.3 billion, up 7% year-over-year and topping analysts’ call for $7.27 billion. In addition, the company’s total payment volume of $376.5 billion exceeded Wall Street’s consensus estimate of $368.87 billion.

As far as operating highlights go, PayPal increased its payment transactions by 10% to 6.1 billion and boosted its total payment volume (TPV) by 11% to the aforementioned $376.5 billion. With all of those positive data points in mind, we now have to figure out why traders would choose to sell their PayPal shares.

Why Did Traders Dump PayPal Stock?

Here’s the billion-dollar question: If PayPal delivered numerous positive data points in Q2, why did PYPL stock drop on high volume? The answer, for the most part, has to do with PayPal’s declining margins.

Profit margins have been a major concern of businesses generally, especially during the second quarter, when inflation was still elevated and reduced companies’ profits. PayPal has had to deal with this issue just like many other businesses, but somehow, the market isn’t willing to forgive PayPal for its declining margins.

Jessurun, the BTIG analyst I mentioned earlier, acknowledged that PayPal’s margins fell short of Wall Street’s expectations. At the same time, Jessurun hasn’t changed his Buy rating and his $90 price target on PYPL stock. Perhaps, that’s because PayPal’s margins aren’t really all that bad. As it turned out, PayPal reported a non-GAAP operating margin of 21.4% for the second quarter, up 228 basis points year-over-year. However, this result represents a decline from 22.7% in 2023’s first quarter.

To me, that doesn’t sound like a horrendous drop in PayPal’s profit margins, but evidently, the market is choosing to see the glass as half-empty. It’s also possible that investors are concerned about PayPal’s active accounts, which totaled 431 million in Q2 2023.

That’s higher than the 429 million active accounts that PayPal had in the year-earlier quarter, but it’s also lower than the 433 million active accounts the company reported in Q1 2023. Again, I don’t see anything terrible or unfixable happening here.

Is PYPL Stock a Buy, According to Analysts?

On TipRanks, PYPL is a Moderate Buy based on 20 Buys and 12 Hold ratings assigned by analysts in the past three months. The average PayPal stock price target is $88.56, implying 37.8% upside potential.

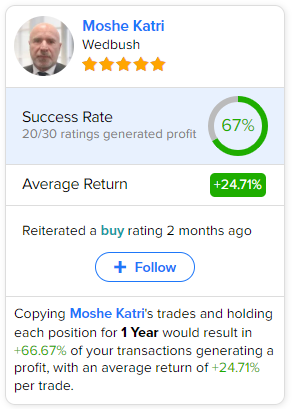

If you’re wondering which analyst you should follow if you want to buy and sell PYPL stock, the most accurate analyst covering the stock (on a one-year timeframe) is Moshe Katri of Wedbush, with an average return of 24.71% per rating and a 67% success rate. Click on the image below to learn more.

Conclusion: Should You Consider PYPL Stock?

PayPal delivered enough financial and operational highlights to support a bullish thesis. Yet, traders apparently chose to obsess over PayPal’s profit margins, which really aren’t too bad. In other words, PayPal appears to be on solid footing even if the market is in a sour mood. Therefore, I see a great opportunity with PYPL stock and would say it’s definitely one to consider now.