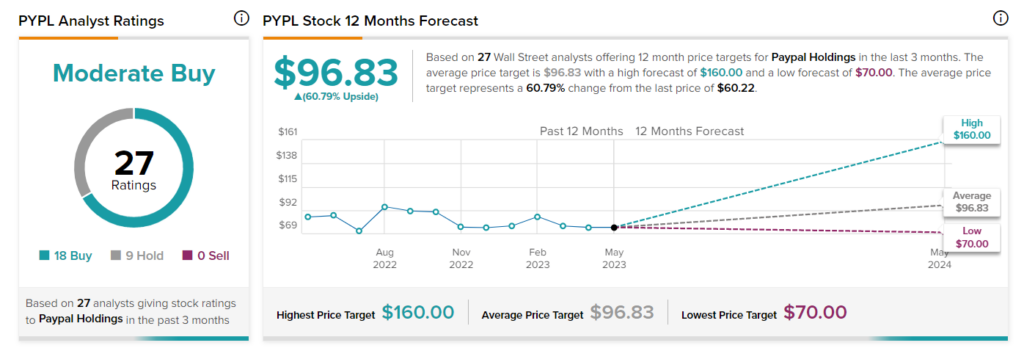

Shares of the fintech company PayPal (NASDAQ:PYPL) are currently trading near the 52-week low and are down 19% year-to-date. The fall can be attributed to concerns over rising competition in the payments industry and slowing cross-border payments due to economic uncertainty. Nevertheless, Wall Street analysts see about 61% upside potential in PYPL stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Additionally, PYPL currently looks undervalued. The stock is trading at a P/E ratio of 25.5, reflecting a 54.5% discount from its five-year average of 56.07x. This makes PayPal an attractive buying opportunity.

PYPL’s Surprisingly Positive Q1 Performance

On May 8, PayPal reported better-than-expected results for the first quarter. The company reported a strong payment volume of about $355 billion, compared with $323 billion in the last year’s quarter. Further, transactions per active account also increased by 13% to 53.1 per account.

Based on this upbeat performance, PayPal raised its guidance for full-year 2023 adjusted earnings to $4.95 per share from $4.87 per share. The revised outlook reflects a 20% growth rate. Moreover, it generates strong free cash flow and returns considerable amounts of cash to shareholders.

Analyst Dan Dolev of Mizuho Securities is bullish about PayPal’s prospects and sees about 53% upside potential from the current level. The analyst believes that 75% of the decline in Q1 net transactions was due to a “mix shift to Braintree.” Also, the analyst is of the opinion that investors’ concerns about pricing compression are “largely overblown.”

Is PYPL Stock a Buy or a Sell?

The company’s strong financial profile, attractive valuation, and future earnings growth potential make PYPL stock lucrative. However, persistent macroeconomic headwinds are slowing e-commerce business and have kept international payments under pressure.

Overall, Wall Street is cautiously optimistic about PayPal stock, with a Moderate Buy consensus rating based on 18 Buys and nine Holds. The average price target of $96.83 suggests 60.8% upside potential.