Shares of PayPal (NASDAQ:PYPL) lost nearly 4% in after-hours trading after the company reported earnings for its first quarter of Fiscal Year 2023. Earnings per share came in at $1.17, which beat analysts’ consensus estimate of $1.10 per share. Sales increased by 8.3% year-over-year, with revenue hitting $7.04 billion. This beat analysts’ expectations of $6.99 billion.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Most of PayPal’s segments saw growth to some degree. PayPal’s total payment volume, for example, came in at $323 billion this time last year. Now, it’s at $355 billion. Individual transactions, meanwhile, climbed to 5.8 billion, 13% higher than this time last year. Finally, transactions per active account were also up, adding an extra 13% to reach 53.1 per account

PayPal management also offered some forward projections. Previous guidance expected full-year 2023 EPS growth of around 18% to reach $4.87 per share. That’s been modified to now reach 20%, hitting $4.95. As for the second quarter, EPS is expected to rise between 24% and 26% to hit between $1.15 and $1.17. That’s effectively in line with analyst projections calling for $1.17.

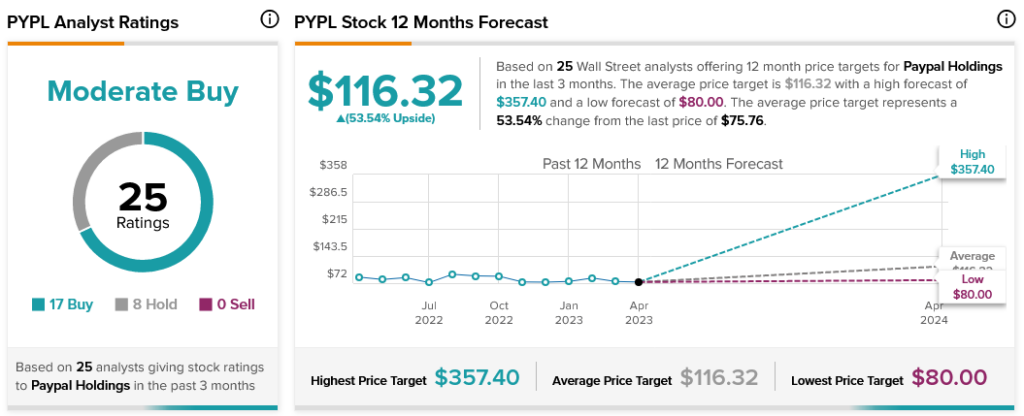

Overall, Wall Street has a consensus price target of $116.32 on PayPal stock, implying 53.54% upside potential, as indicated by the graphic above.