Akin to a rags-to-riches-back-to-rags tale, media company stocks incurred a wild ride throughout the post-pandemic new normal. Initially benefiting from a hostage audience, the at-home news and entertainment catalyst gave way to the “revenge travel” phenomenon. Now, with a potential global recession on the horizon, investors carry deep concerns about the tickers WBD, DIS, and CMCSA.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

When COVID-19 started, most publicly-traded companies suffered catastrophic damages. However, media company stocks quickly gained their footing.

Still, following roughly two years of various mitigation protocols, the collective cabin fever sparked a desire for normalization. Armed with cash savings from working at home along with government-issued stimulus checks, consumers stood poised to spend on experiences previously denied them because of the pandemic.

Then, to be sure, as savings dried up and prices skyrocketed, many households reduced their discretionary expenditures. In theory, this dynamic should have benefited media company stocks as providers of cheaper entertainment. Unfortunately, macroeconomic pressures also caused digital advertising dollars to dry up, impacting the broader media ecosystem.

Facing a dwindling total addressable market, sector players had little choice but to initiate mass layoffs. Still, as the Wharton School of the University of Pennsylvania warned, reducing headcount doesn’t always produce meaningfully positive results in the long run. With this assessment in mind, below are three media company stocks to watch following their layoff announcements.

Warner Bros Discovery (NASDAQ:WBD)

A multinational mass media and entertainment conglomerate, Warner Bros Discovery materialized off a recent spinoff and merger. Although the company generates the most attention for its namesake film and television studio, the enterprise ultimately features nine business units. Under one of them stands the news network CNN.

Per the Washington Post, the agency laid off hundreds of employees in an effort to reduce overhead. According to an internal memo obtained by Yahoo! Finance, CNN CEO Chris Licht described the cuts as a “gut punch.” Down the leadership chain, Rachel Metz, a senior technology writer, stated that she was “devastated” to be let go.

In all likelihood, Warner Bros’ cuts represented a matter of necessity. There are some red flags in the media firm’s financials. Among them, poor financial strength and higher-than-average bankruptcy risk (due to a low Altman Z-Score reading) ranked among the most worrying details.

Still, following a severe erosion of market value this year, in the trailing month, WBD gained nearly 7%. It could be the start of a recovery effort, though investors must be cautious.

Is WBD Stock a Buy, According to Analysts?

Turning to Wall Street, WBD stock has a Moderate Buy consensus rating based on four Buys, five Holds, and one Sell rating. The average WBD price target is $18.75, implying 74.3% upside potential.

Walt Disney (NYSE:DIS)

Although commanding a global entertainment empire, Walt Disney did not receive an exemption from the fallout impacting media company stocks. Since the January opener, DIS stumbled more than 41%, sending jitters throughout the equities arena. Not only that, the Magic Kingdom became a not-so-happy place, distributing pink slips to disappointed workers.

In November, an internal memo revealed that Disney planned to institute a hiring freeze, along with some job cuts. “We are limiting headcount additions through a targeted hiring freeze,” CEO Bob Chapek stated in the document. “Hiring for the small subset of the most critical, business-driving positions will continue, but all other roles are on hold.”

Part of the motivation for the layoffs center on reducing costs associated with its streaming service Disney+. However, those with a long-term view on media company stocks may want to give DIS another look. As the trade-down effect materializes in the entertainment arena, Disney might benefit as the low-cost alternative.

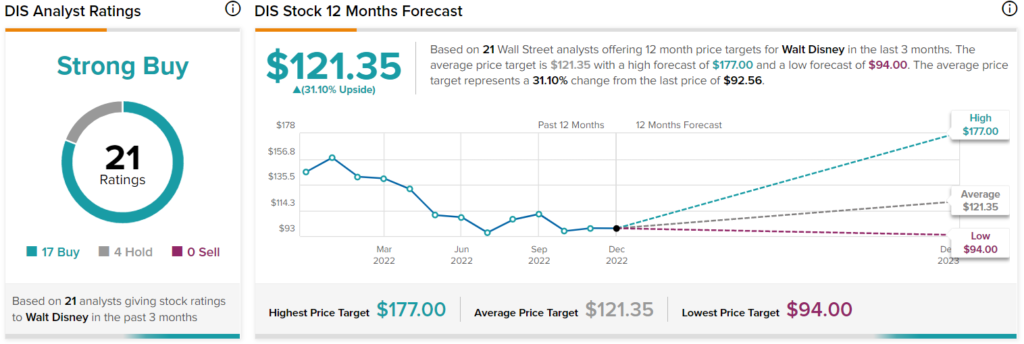

Is DIS Stock a Buy, According to Analysts?

Turning to Wall Street, DIS stock has a Strong Buy consensus rating based on 17 Buys, four Holds, and zero Sell ratings. The average DIS price target is $121.35, implying 31.1% upside potential.

Comcast (NASDAQ:CMCSA)

Finally, Comcast – which long featured a rivalry with Disney – likewise succumbed to the pressures affecting media company stocks. Since the start of this year, CMCSA has fallen by about 30%. With the underlying entity struggling to hold onto its subscribers, many analysts simply gave up on the business.

According to Fierce Telecom last month, Comcast’s cable unit “terminated an unspecified number of employees [in the first week of November].” Further, management hinted at additional layoffs. Moreover, the company’s entertainment arm NBCUniversal also anticipates a swinging axe. Additionally, Hurricane Ian in Florida sparked broadband subscriber losses, creating an ominous cloud for the upcoming fourth-quarter report.

Fundamentally, Comcast probably had little choice but to initiate the cuts. Along with a debt-laden balance sheet, CMCSA may represent a possible value trap. Indeed, with revenue declining and net income falling into negative territory in Q3 2022, circumstances appear very questionable for Comcast.

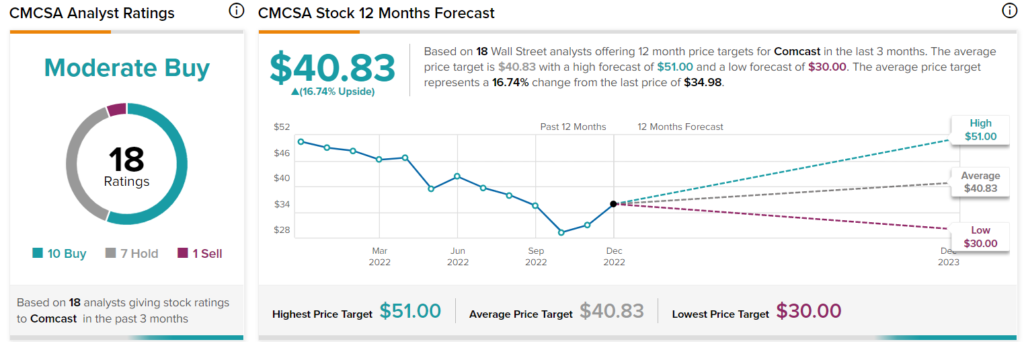

Is CMCSA Stock a Buy, According to Analysts?

Turning to Wall Street, CMCSA stock has a Moderate Buy consensus rating based on 10 Buys, seven Holds, and one Sell rating. The average CMCSA price target is $40.83, implying 16.7% upside potential.

Takeaway: Media Company Stocks Under Fire

With subscribers rushing for the exits and digital advertising dollars drying up, media company stocks face unprecedented pressure. Fundamentally, Disney might have a chance to redeem itself because of its powerful empire and burgeoning streaming unit. Secondarily, Warner Bros appears to show signs of stabilization. However, Comcast could be a tricky beast, particularly in the months ahead.