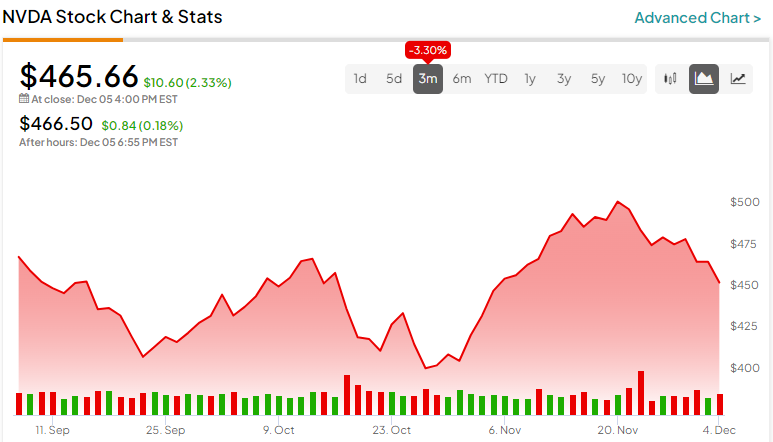

A few months ago, the sentiment toward shares of the semiconductor powerhouse Nvidia (NASDAQ:NVDA) was that it had peaked, prompting investors to consider booking profits. However, I retained my bullish stance on September 15. About two months later, NVDA stock reached an all-time high of $505.48. More recently, though, it dipped despite an impressive Q3 print, hovering around $466 due to concerns about export restrictions to China. Nevertheless, I’m sticking with my bullish stance.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

I believe NVDA is a long-term buy-and-hold position as it continues its unstoppable growth trajectory for years to come.

Stellar Q3 Earnings, Raised Q4 Outlook Despite China Concerns

On November 21, NVDA delivered yet another blowout quarterly result. Impressively, both revenue and earnings smashed analysts’ expectations as well as the company’s own revenue guidance. Revenues tripled to $18.1 billion, while GAAP net income jumped by over 13x to $9.2 billion. Q3 adjusted EPS of $4.02 handily beat estimates of $3.37 and was up almost 7x year-over-year.

The highlight of the quarter was NVDA’s relentless market leadership in AI chips, as Data Center revenues registered a growth of 279% year-over-year to $14.5 billion. Meanwhile, the firm’s adjusted gross margins remained strong at 75%, growing 380 bps year-over-year.

Despite reporting a massive beat, NVDA stock has not gained since then. One of the main reasons for share price weakness is the significant anticipated decline in revenues from China due to export restrictions imposed by the U.S. It is to be noted that China represents 20% to 25% of Data Centre revenues on an average basis over the last few quarters. The company is confident that the loss of revenues from China will be more than offset by growth in other regions.

Nonetheless, there was some reason to cheer, as management raised its Q4 outlook. Q4 revenues are expected to come in at $20 billion (+/-2%) versus prior expectations of $18 billion. This means that revenue may triple one more time on a year-over-year basis, reconfirming unwavering demand for all things AI. More positively, its adjusted gross margin is expected to hover around 75.5%.

An AI Leader

Having leaped into the AI bandwagon early, NVDA’s market leadership is indisputable. NVDA will continue to reign supreme in the AI semiconductor industry for years to come. It stands years ahead of its closest peers, serving as an all-comprehensive and one-stop solution for all AI needs, encompassing everything from chips and processors to complex software.

NVDA’s Data Center revenue continues to witness exponential growth each quarter. It has grown 5x in the three-year period from FY2020 ($3 billion) to FY2023 (estimated at $15 billion). Notably, Wall Street expects similar (if not more) growth momentum to continue in the next three years as well.

The company is reckoned to have a market share of over 80% in the AI chip market despite competition from rivals like Advanced Micro Devices (NASDAQ:AMD) and Intel (NASDAQ:INTC), who are quickly boosting their AI capabilities. NVDA made investments in AI years before its peers and is thereby reaping the rewards. Therefore, its peers lag behind despite making heavy investments in AI space aimed at capturing AI’s supernormal growth predictions.

NVDA is not resting on its laurels and continues to make newer innovations in the AI race. It has already started working on GH200, its next-generation Grace Hopper Superchip. GH200 combines its flagship H100 chip with an Arm CPU, leading to enhanced memory, technology, and performance. It is estimated to be another billion-dollar opportunity for the company.

Further, NVDA has reported impressive growth in the networking business, driven by InfiniBand technology. Quite impressively, the networking business has already grown by 10x since acquiring it. In addition, other products like the Bluefield DPU, AI Foundry business, and Ethernet are all projected to make substantial contributions to revenue in the foreseeable future.

It’s no wonder that the Q3 results prompted several upward revisions in revenue and EPS estimates across Wall Street. Some analysts expect 2025 EPS to touch as high as $20+ from the $12.30 expected in Fiscal 2024 (ending January 2024).

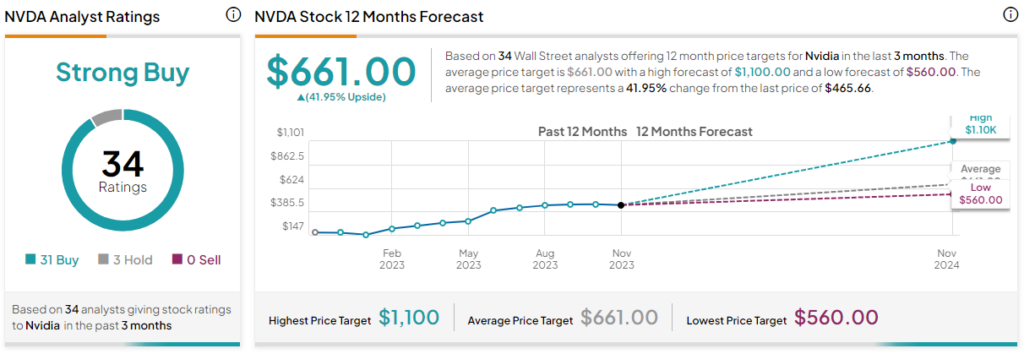

Is NVDA Stock a Buy, According to Analysts?

NVDA is that elusive beast — a widely covered stock that is expected to grow from strength to strength. Given that it has received 31 Buy ratings and three Hold from analysts in the last three months, it has a Strong Buy consensus rating. The average NVDA stock target price of $661 implies 41.95% upside potential.

Breaking the Myth Again: NVDA’s Valuation Isn’t Expensive

In terms of its valuation, NVDA is currently trading at a forward P/E multiple of 37x. At first, this may look expensive. However, this is a much lower level compared to the P/E of 135x it was trading less than a year ago. Further, its competitors Advanced Micro Devices and Intel are trading at much higher levels (44.5x forward P/E for AMD and 46x for INTC), even though they have just begun their mark in the AI world and remain far behind NVDA.

I believe an industry leader like NVDA with a $1 trillion+ market cap should trade at a much higher premium, given its favorable industry-leading position and larger total addressable market or TAM, leading to a supernatural growth outlook.

Conclusion: Consider Buying NVDA on Current Weakness

NVDA has surged a massive 218% year-to-date, driven by the AI boom. Many investors may contemplate booking profits. However, it is important to consider the following question: will the AI boom last only in 2023? The answer is obvious. The demand for AI chips and processors is insatiable and will see continuous expansion for years to come. As the market leader, NVDA will be the biggest beneficiary.

Given this perspective, I will continue to buy NVDA stock in the coming months, capitalizing on any share price weakness.