While the cryptocurrency market has been a positive revelation this year, everyone knows the space presents high risks. Therefore, if you’re only somewhat sure about cryptos and would like to exercise more caution, you may want to consider technology giant Nvidia (NASDAQ:NVDA). Thanks to its blockchain-mining friendly graphics processing units (GPUs), Nvidia offers indirect exposure to digital assets while aligning with other relevant sectors. Therefore, I am bullish on NVDA stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Cryptos Might Be a Buy, but Who Really Knows?

On the surface, cryptos appear to be a no-brainer proposition. Data from CoinMarketCap reveals that at the start of this year, the total market capitalization of all blockchain-derived assets measured just under $800 billion. At writing, the sector soared to just below $1.28 trillion. Hard-hit advocates now have serious momentum under their feet, bolstering enthusiasm. Still, some debts linger.

Recall that at the beginning of last year, the total market cap of all cryptos stood at over $2 trillion. So, with all the huffing and puffing, the market got back a little less than half of what it lost. That isn’t nothing, but investors must consider the broader context before forking over too many funds.

In addition, cryptos and the broader ecosystem can be unusually cruel. For example, crypto exchange FTX used to rank among the most popular platforms for investors and blockchain advocates. However, prosecutors later accused FTX founder Sam Bankman-Fried of “fraud of epic proportions.” More than likely, the bad taste left over from the fiasco will linger for years.

At the same time, this matter also presents NVDA stock in a rather positive light. Producing dedicated GPU processors for professional crypto-mining enterprises, Nvidia essentially offers the infrastructure to the burgeoning market.

The company might not know what coin or token might make it big. However, most crypto projects utilize the proof-of-work (PoW) consensus mechanism that allows the underlying blockchain to function. With PoW protocols being processor intensive, the company should enjoy ongoing demand if cryptos move higher. Thus, an investment in NVDA appears sensible.

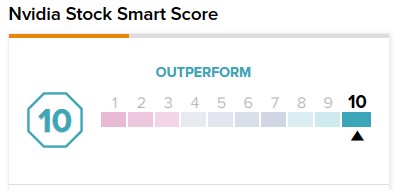

Bolstering the bull case, on TipRanks, NVDA stock has a ‘Perfect 10’ Smart Score rating. This indicates strong potential for the stock to outperform the broader market.

NVDA Stock Poised to Do Well Even If Cryptos Fail

Of course, with cryptos earning a reputation for volatility, it’s not out of the question for the sector to tumble. Indeed, prospective traders should probably gird themselves for volatility or at least have a backup plan should it materialize. However, the compelling factor for NVDA stock is that the underlying enterprise enjoys many other sectors it can address.

And to stress the point, investors should plan ahead for numerous outcomes if they choose to play in the crypto arena. While the banking sector crisis that dominated headlines last month doesn’t seem like much of a concern right now, it very much is. Let’s be real – bank runs don’t materialize because people have confidence in the financial system.

Moreover, the surprise production cut by the Organization of the Petroleum Exporting Countries and non-member oil-producing countries – an alliance known as OPEC+ – demonstrated that the Federal Reserve isn’t the only major influencer of the U.S. dollar’s trajectory. Given the many pressure points around, it’s no wonder that some experts still believe a recession might occur. If so, that wouldn’t be positive for cryptos.

On the other hand, Nvidia continues to develop solutions for burgeoning sectors such as artificial intelligence (AI) and machine learning. So, one sector collapsing probably won’t dent the entire narrative.

Nvidia is Overheated but Dependable

To be fair, one factor might connect cryptos and NVDA stock: both might be overheated. For the former asset category, investors may look at technical indicators for specific coins and tokens. Regarding the latter, NVDA trades at a forward multiple of nearly 64. That’s well above the sector median value of 21.8 times.

Nevertheless, because of Nvidia’s aforementioned relevancies, over the intermediate to long term, NVDA stock arguably commands more confidence. Further, the financials support the dependability angle. For example, Nvidia’s Altman Z-Score (a solvency metric) pings at 22.8, reflecting high fiscal stability and low bankruptcy risk.

Operationally, the company enjoys a three-year revenue-per-share growth rate of 34.5%, outpacing 87.8% of rivals listed in the semiconductor industry. Also, its net margin stands at 16.2%, above 69.5% of sector players.

Is NVDA Stock a Buy, According to Analysts?

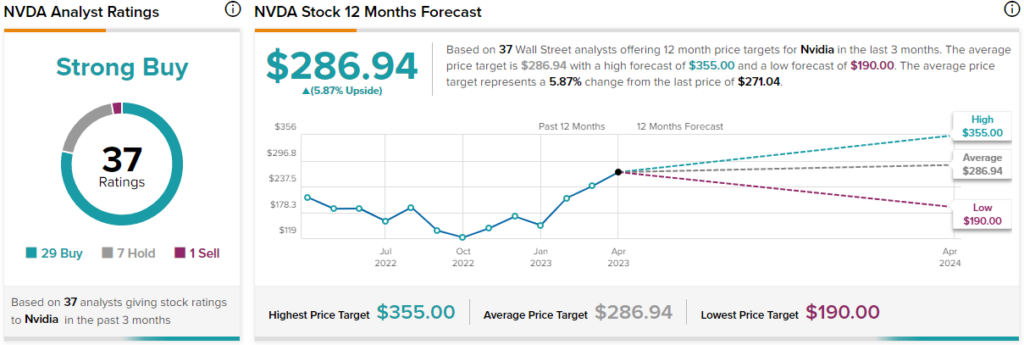

Turning to Wall Street, NVDA stock has a Strong Buy consensus rating based on 29 Buys, seven Holds, and one Sell rating. The average NVDA stock price target is $286.94, implying 5.9% upside potential.

The Takeaway: NVDA Stock Provides the Shotgun Approach

Overall, NVDA stock brings the shotgun to the duck hunt. Basically, Nvidia doesn’t need to aim for a direct hit. Rather, it just needs to move the barrel toward the general vicinity of compelling market opportunities. Once fired, its pellets of relevance should hit something. While this approach isn’t particularly exciting, it’s probably more effective in attaining some positive results.