It was expected that UBS’s (NYSE: UBS) takeover of Credit Suisse (CS) for more than $3 billion would stem the banking crisis and instill investors’ confidence in the banking sector. On the contrary, investors’ optimism about this deal seemed to fade quickly as banking stocks, including these two, tumbled in pre-market trading on Monday.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Instead, the focus has shifted to Credit Suisse’s additional tier-1 (AT1) bondholders. As a part of this deal, the Swiss banking regulator has decided that these bonds with a notional value of $17 billion will be valued at zero. This has angered some of the AT1 bondholders who were under the assumption that they would be better protected than the CS shareholders.

Moreover, CS’s national shareholder, Saudi National Bank also suffered massive losses due to the failure of Credit Suisse – suffering around a loss of 80% on its investment.

As Mike O’Rourke, chief market strategist, Jones Trading told Reuters, “It should be clear that after more than a week into the banking panic, and two interventions organised by the authorities, this problem is not going away. Quite the contrary, it has gone global.”

Meanwhile, First Republic (FRC) shares continued their downslide hit by downgrades from credit agencies. This is even after the bank received major help from a consortium of eleven big banks in the form of uninsured deposits worth $30 billion.

Major bank stocks including JP Morgan (JPM), Wells Fargo (WFC), and Citigroup (C) all ticked lower in pre-market trading on Monday.

In other news, the U.S. Fed has joined hands with central banks including the Bank of Canada, Bank of England, Bank of Japan, the European Central Bank, and the Swiss National Bank to stem any liquidity concerns by improving the provision of liquidity and preventing the collapse of the global banking system.

The consortium of central banks intends to do this through U.S. dollar swap line arrangements. The Fed elaborated further on this arrangement and told CNBC, “To improve the swap lines’ effectiveness in providing U.S. dollar funding, the central banks currently offering U.S. dollar operations have agreed to increase the frequency of seven-day maturity operations from weekly to daily.”

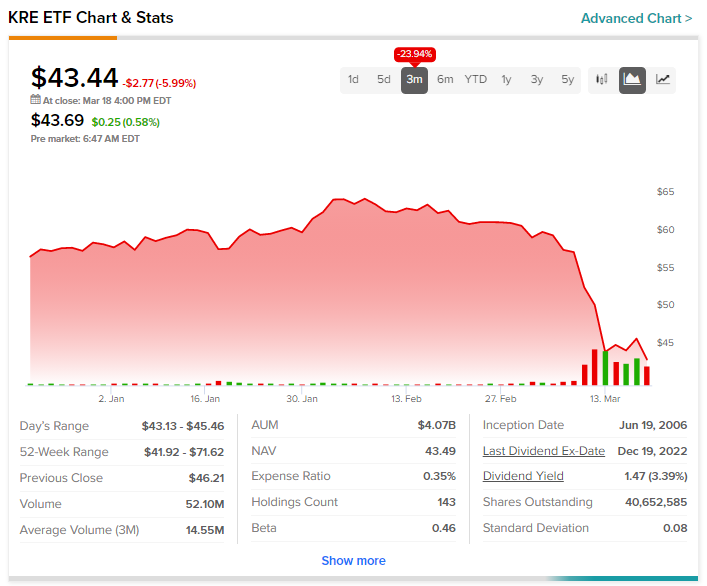

The turmoil in the banking sector has resulted in the SPDR S&P Regional Banking ETF (KRE) sliding by more than 22% in the past three months.