Top-rated Needham analyst Rajvindra Gill was left disappointed recently by the U.S. Government’s hardened stance on chip exports to China and Russia, terming it a “significant headwind” to Nvidia (NASDAQ:NVDA).

Shares of the company have been in a free fall the past month, dropping 28.1%, amid concerns that the new licensing requirements from the U.S. Government could adversely impact its sales to China by around $400 million in Q3 of FY23.

The analyst estimates that the U.S. Government is unlikely to soften its position anytime soon and has lowered his estimates for the U.S. chipmaker.

Data Center Sales Likely to Take a Hit

Analyst Gill believes that this stance is most likely to impact the sales of the A100 Data Centers, which contribute the most in terms of revenues to the Data Center business. He also pointed out that China now represents around 25% of NVDA’s overall data center revenues.

As a result, Gill remains concerned with the slowdown in the spending on data center buildouts by Chinese companies like Alibaba (BABA) and Baidu (BIDU). Moreover, he believes that the Chinese economy is in deterioration and expects this to continue for the rest of this year.

The analyst is of the view that while data center business is NVDA’s growth engine over the long term, competition in the business “will exert pressure on the company’s long-term positioning; however, we believe several industries will transition to AI [artificial intelligence]-based systems faster than before.”

Is NVDA a Buy, Sell or Hold?

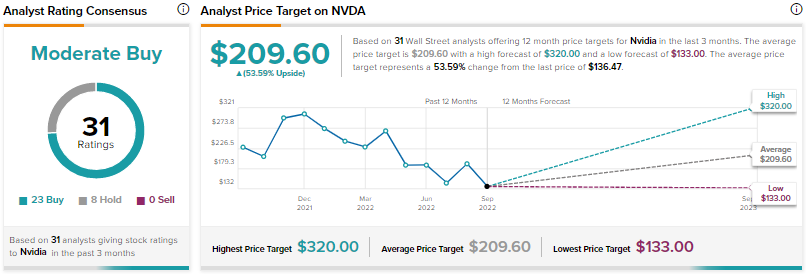

The analyst remains bullish on the stock with a Buy rating but has lowered the price target from $185 to $170, implying an upside potential of 24.6% at current levels. However, other analysts on the Street remain cautiously optimistic about NVDA with a Moderate Buy consensus rating based on 23 Buys and eight Holds.

NVDA’s average price prediction of $209.60 implies 53.6% upside potential.

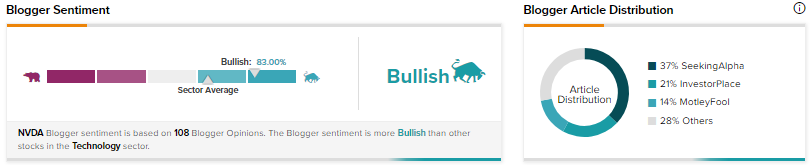

Similarly, financial bloggers are 83% Bullish on NVDA stock, compared to the sector average of 64%.

Concluding Remarks

Analysts are broadly expecting NVDA to take a hit in terms of revenues due to the tough stance of the U.S. Government. However, over the long term, the stock seems poised well and could even ride out this storm.

Read full Disclosure