While streaming giant Netflix (NASDAQ:NFLX) boasts a vast library of original content, Walt Disney’s (NYSE:DIS) unparalleled legacy of beloved franchises, including Marvel, Star Wars, Pixar, and its classic animated films, remains unmatched. Netflix is already very profitable, but I believe Disney’s efforts to earn significant and sustained profits for its streaming business are being overlooked. Hence, I am bullish on DIS and neutral on NFLX.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Here, we have used TipRanks’ stock comparison tool to see how Wall Street perceives Disney and Netflix. Compared to the S&P 500’s (SPX) gain of 19%, Netflix stock has soared 62% YTD, while Disney has gained a mere 8%. Nevertheless, TipRanks has assigned Disney a Smart Score of 8 out of 10, indicating a high likelihood of DIS outperforming the broader market.

Netflix (NASDAQ:NFLX)

Founded in 1997, Netflix is not a very old player in the entertainment industry. Nonetheless, its strategy of heavily investing in diverse content has resulted in a massive subscriber base.

Netflix’s renowned original content, such as Stranger Things, The Crown, and House of Cards, among others, has aided it in achieving outstanding global recognition in a short period. Despite the challenges in the streaming industry this year with the writers’ and actors’ strike, the company’s ability to continue growing its subscribers and profits has left me neutral on the stock overall.

As of Q3, Netflix has managed a stronghold with 247.15 million paid members across the globe (up 10.8% year-over-year despite its decision to charge for paid sharing this year). Additionally, the streamer’s total revenue jumped 8% year-over-year to $8.5 billion, with a 20.3% uptick in earnings to $3.73 per share.

Furthermore, a Nielsen report cited in Netflix’s Q3 shareholder letter revealed it had “the most watched original series for 37 out of the first 38 weeks of 2023.”

As part of its strategy to deliver more value to members with fresh content, Netflix announced price changes in the quarter, particularly in the U.S., UK, and France. According to management, while revenue is expected to increase by 11% in Q4, global average revenue per membership (ARM) is forecast to be flat year-over-year, led by “limited price increases in the last 18 months.”

For 2023, analysts predict revenue to increase by 6% to $34 billion and earnings per share (EPS) to reach $12.21, up 23% from the prior year. 2024 earnings per share could come in at around $15.84, according to analysts, an increase of 30% year-over-year, meaning the stock is valued at 30 times forward 2024 earnings.

Is NFLX Stock a Buy, According to Analysts?

On November 10, JPMorgan (NYSE:JPM) raised its price target to $510 from $480, with a Buy rating on the stock. Netflix’s revenue growth in 2024 could be accelerated by strong subscriber growth and targeted price increases, according to JPMorgan.

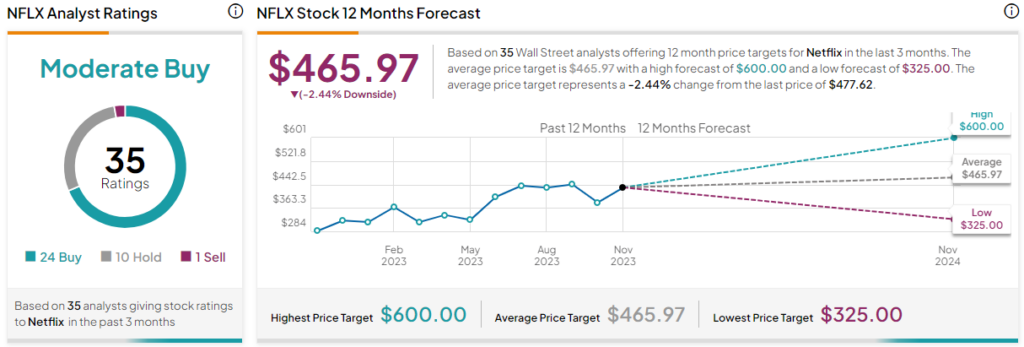

On TipRanks, the consensus rating for NFLX stock is a Moderate Buy, with 24 Buys, 10 Holds, and one Sell rating. The average NFLX stock price target stands at $465.97, implying downside potential of 2.4% from current levels.

Disney (NYSE:DIS)

Due to the high growth potential of the streaming industry, Disney quickly adapted to the change. What sets Disney apart from Netflix is its diverse business, which it ran for years before shifting its focus to online streaming. Its portfolio includes film and TV assets, Disney Experiences (theme parks and resorts), cruises, and a variety of consumer products.

Its diversified portfolio of successful businesses, along with its sharp focus on profitability, has me bullish on the stock.

Disney reported strong profit growth in its fourth quarter of Fiscal 2023. The company underwent a significant transformation in 2023 after CEO Robert A. Iger reclaimed control of the company in November 2022. These changes were aimed at reducing expenses for sustained growth and profitability.

Notably, in Q4, its net profits grew sharply by 173% year-over-year to $0.82 per share, while revenue increased 5% year-over-year to $21.2 billion. Fiscal 2023 EPS jumped 6.5% year-over-year, while revenue increased 7% from Fiscal 2022. On the streaming front, Disney added 7 million core subscribers in the quarter.

Disney expects to be profitable for its combined streaming businesses by Q4 Fiscal 2024, and its aggressive cost-cutting measures may assist it in meeting this goal. The CEO stated the company’s annualized cost reduction target is $7.5 billion now, up from the earlier target of $5.5 billion. Achieving this cost reduction target could help Disney break even in the next Fiscal Year.

For Fiscal 2024, analysts predict revenue growth of 4.6% to $93 billion, and earnings growth of 18% to $4.44 per share. Trading at 21 times forward earnings and 1.8 times forward sales, Disney’s valuation seems fairly reasonable for a growth stock.

Is DIS Stock a Buy, According to Analysts?

After its Q4 results, Deutsche Bank analyst Bryan Kraft reduced his price target to $115 from $120 but kept a “Buy” rating on DIS. The analyst is upbeat due to Disney’s improving fundamentals, which include strong growth from theme parks and improved streaming profitability.

Overall, Wall Street rates DIS stock as a Moderate Buy. Out of the 25 analysts covering Disney stock, there are 18 Buys and six Holds, along with one Sell rating. The average price target for DIS stock is $106.52, which is 13.5% above the current levels.

The Takeaway

The rivalry between Netflix and Disney ultimately benefits consumers, offering a plethora of choices and compelling content. However, from an investment perspective, their future trajectory will depend on how both players continue to tackle the streaming industry’s dynamics, such as high content creation costs and escalating competition, while finding a way to grow subscribers.

It’s a tough choice to pick one, as both look like good growth stocks for the long haul as the streaming industry expands. Nonetheless, I believe that for a reasonably valued stock poised for more growth, Disney’s efforts are being overlooked. Its diversified business and aggressive measures to sustain profitability make its risk-reward case stronger at current levels.