Shares of Netflix (NASDAQ:NFLX) surged 11% in after-hours trading after the company reported earnings for its third quarter of Fiscal Year 2023. Earnings per share came in at $3.73, which beat analysts’ consensus estimate of $3.49 per share.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Sales increased by 7.7% year-over-year, with revenue hitting $8.54B, in line with analysts’ expectations. The company said its global streaming paid membership grew by 8.76 million to 247.15 million subscribers amid what it called a “challenging” six-month strike.

Looking forward, management now expects revenue and earnings per share for Q4 2023 to be $8.69 billion and $2.15, respectively. For reference, analysts were expecting $8.54 billion in revenue along with an adjusted EPS of $2.20.

What is the Prediction for Netflix Stock?

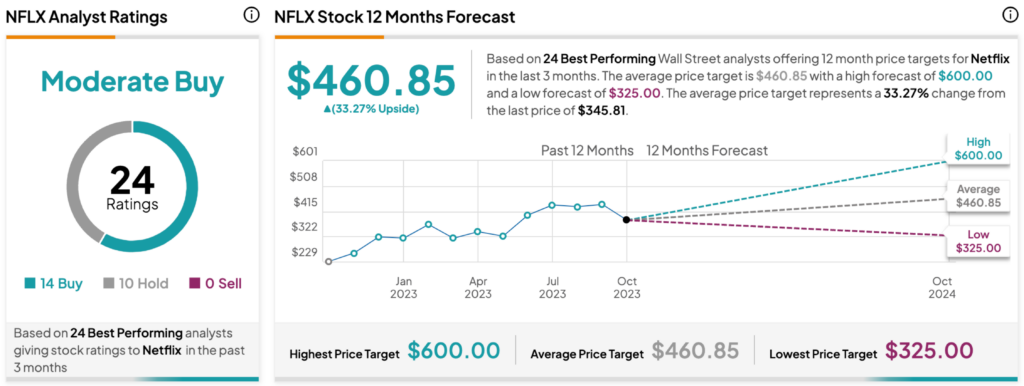

Turning to Wall Street, analysts have a Moderate Buy consensus rating on NFLX stock based on 14 Buys, 10 Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average NFLX price target of $460.85 per share implies 33.27% upside potential.