Shares of Disney (NYSE:DIS) gained in after-hours trading after the company reported earnings for its fourth quarter of Fiscal Year 2023. Earnings per share came in at $0.82, which beat analysts’ consensus estimate of $0.71 per share. In addition, total Disney+ subscribers stood at 150.2 million, higher than the forecast of 148.15 million.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Sales increased by 5.7% year-over-year, with revenue hitting $21.24 billion. However, this missed analysts’ expectations by $170 million.

The beat in earnings can be attributed to ESPN+ and theme park growth. On the other hand, a fall in ad revenue caused the revenue to come in soft.

What is the Target Price for DIS Stock?

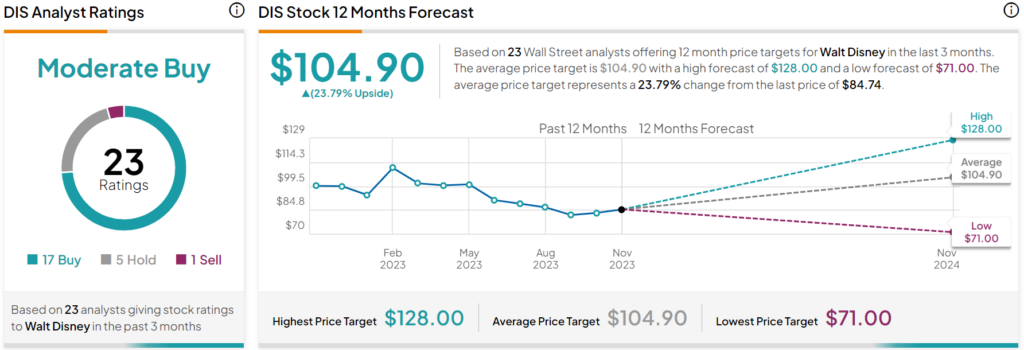

Turning to Wall Street, analysts have a Moderate Buy consensus rating on DIS stock based on 17 Buys, five Holds, and one Sell assigned in the past three months, as indicated by the graphic below. Furthermore, the average DIS price target of $104.90 per share implies 23.79% upside potential.